Entering the European market for coconut milk

To succeed in Europe, coconut milk must meet strict food safety standards and have consistent quality. Buyers often expect suppliers to be certified for food safety and social responsibility. Halal certification is important for European markets with significant Muslim populations. Sri Lanka, Indonesia, Thailand and the Philippines are strong competitors. There is also a growing focus on ethical sourcing and transparent supply chains.

Contents of this page

1. What requirements and certifications must coconut milk meet to be allowed on the European market?

Our study on buyer requirements in the European processed fruit and vegetable market provides general information. The section below deals with the specifics related to coconut milk.

What are mandatory requirements?

Coconut milk sold in Europe must be safe for consumption. There are maximum levels for harmful contaminants. Whether it contains allergens should also be obvious from the labelling.

Additives and allergens

Additives should comply with the specifications outlined in Regulation (EU) No 231/2012. The list of approved food additives can be found in Annex II of Regulation (EC) No 1333/2008.

Between 2019 and 2024, the European Rapid Alert System for Food and Feed (RASFF) reported seven coconut milk-related notifications and two coconut cream notifications. There are few border rejections or market withdrawals of coconut milk. In 2024, the Netherlands notified the presence of undeclared allergen sulphite (sulfur dioxide; E220) in light coconut milk from Thailand.

Pesticide residues

European countries have strict controls on the presence of pesticides in imported foods. Be sure to check whether coconut producers in your supply chain use pesticides that are approved in Europe. The list of permitted pesticides and their allowed content can be found in Regulation (EU) 2023/915.

The EU has set maximum residue levels (MRLs) for pesticides in and on food products. The EU regularly publishes a list of approved pesticides. This list is frequently updated. In 2024, the European Commission approved 24 new regulations in the form of new approvals, extensions, renewals, amendments and restrictions. Products that contain more pesticides than the limit or which contain unapproved pesticides will be withdrawn from the market.

Still, excessive pesticide residues in coconut milk are uncommon. Pesticides are applied to the palm tree leaves and the outer husk of the coconuts, so only small quantities can penetrate into the edible part.

Product composition

Many European buyers check for the presence of edible oil contaminants that can harm human health. Two important ones are Mineral Oil Saturated Hydrocarbons (MOSH) and Mineral Oil Aromatic Hydrocarbons (MOAH). Official limits have not been set yet, but are expected soon. MOSH and MOAH were detected in coconut milk powder imported by the Netherlands from Thailand in 2022.

Suppliers should be aware that unauthorised processing methods could lead to the appearance of unauthorised substances. In 2021, Poland detected 2-chloroethanol and unauthorised ethylene oxide in coconut milk powder from Vietnam. The detection of 2-chloroethanol and ethylene oxide may be caused by using ethylene oxide as a sterilising agent.

What additional requirements and certifications do buyers often have?

For manufacturers who are just starting out, it is important to focus primarily on food standards certification.

Quality requirements

There are no specific European quality standards for coconut milk. However, the basic quality requirements for coconut milk are contained in the Codex Alimentarius Codes of Practices and Codex Alimentarius Standards. For coconut milk powder, consult the code of hygienic practice for low-moisture foods. For liquid coconut milk and cream, consult the standard for aqueous coconut products .

Table 1: Essential composition factors for coconut milk and cream

| Product | Total solids (% m/m) | Non-fat solids (% m/m) | Fat (% m/m) | Moisture (% m/m) | pH |

|---|---|---|---|---|---|

| min-max | min | min | max | min | |

| Light coconut milk | 6.6-12.6 | 1.6 | 5.0 | 93.4 | 5.9 |

| Coconut milk | 12.7-25.3 | 2.7 | 10.0 | 87.3 | 5.9 |

| Coconut cream | 25.4-37.3 | 5.4 | 20.0 | 74.6 | 5.9 |

| Coconut cream concentrate | 37.4 min | 8.4 | 29.0 | 62.6 | 5.9 |

Source: Autentika Global, Codex Alimentarius standard for aqueous coconut products, 2025

European buyers prefer additive-free, unadulterated products. Liquid coconut milk is basically coconut fat and water combined. Like other emulsions, these two components easily separate during the product’s shelf life.

Coconut milk is manufactured in the tropics at 30°C or higher temperatures. Coconut fat has a melting point of 22°C. In tropical climates the product is liquid. However, when the product is transferred to Europe temperatures in storage facilities can reach below 22°C. Because of this, the liquid product tends to separate into solid fat and water. As this is difficult to manage for food manufacturers and for consumers, some suppliers may be tempted to dilute their product with additives to keep it homogenous.

Sourcing of good and consistent raw material is critical. Mixing some bad coconuts with good ones results in off-flavours and a bad-tasting product. Raw material quality is a critical issue for buyers that are focused on ensuring a fresh coconut taste.

For powdered coconut milk, sodium caseinate is used as an emulsifier. In that case, be aware that the product is no longer vegan, it is vegetarian. Sodium caseinate is manufactured using cow’s milk.

Food safety certification

Most coconut milk suppliers will need certification recognised by the Global Food Safety Initiative (GFSI). Food safety certification is not obligatory. However, it is a requirement that is imposed and expected by most buyers and importers.

For coconut milk, the most popular GFSI-recognised certification programmes are:

- Brand Reputation through Compliance Global Standards (BRCGS);

- Food Safety System Certification 22000 (FSSC 22000);

- International Featured Standards (IFS).

Make sure to check which certifications are currently recognised by the latest version of the GFSI benchmarking requirements. Certain retailers may prefer one certification over another or demand additional ones. Major buyers will also usually visit and/or audit production facilities before starting a business relationship.

Sri Lanka’s Jaindi Export provides a page showcasing different certifications for its products, including coconut milk.

Corporate social responsibility (CSR) certification

To reach the big retailers, suppliers will need CSR certification. There are legal requirements to take care of the supply chain in terms of social responsibility. Importers may ask coconut milk suppliers to follow a specific CSR Code of Conduct.

Most European retailers have their own Codes of Conduct. Examples are Lidl and Kaufland (part of Schwarz Group), Jumbo, Rewe, Carrefour, Tesco and Ahold Delhaize.

Other companies may insist on common standards such as the Sedex Members Ethical Trade Audit (SMETA) standard. SEDEX membership alone (without an audit) is not very complicated or expensive. Other CSR alternatives are ETI, the amfori BSCI Code of Conduct and BCorp certification.

Packaging requirements

Liquid coconut milk and cream are transported in aseptic packaging to ensure sterility and extended shelf life. Bulk packaging options include 20-litre bags in boxes, 200-litre bags in drums and 1000-litre bag in totes. Retail packaging includes easy-open cans in 200-400 ml sizes and cartons. Food service packaging can be in larger cans. Metal cans have to be BPA-free.

Coconut milk powder is packaged in multi-layered kraft bags. These often weigh between 20 and 25 kg. The key is to protect the product from moisture. For retail, smaller, consumer-friendly packages are preferred, like individual sachets and larger pouches.

Labelling requirements

The EU has a general prohibition on using ‘milk’ and other dairy terms for plant‐based products. Coconut milk is an exception; the term coconut milk can be used owing to a legal exemption. This exemption is provided to coconut milk and cream in the European Commission Decision 2010/791/EU.

The term ‘coconut milk’ is more of a culinary/traditional expression than a modern branding choice trying to copy a dairy product. A 2017 EU Court of Justice ruling (the ‘TofuTown’ case) that banned names like ‘oat milk’ or ‘soy yoghurt’ did not require producers to rename ‘coconut milk’.

Coconut milk and coconut cream prepared by reconstituting coconut cream powder or the finely comminuted dehydrated coconut endosperm must be labelled to indicate that these are reconstituted products.

For retail packaging, product labelling must comply with EU Regulation 1169/2011 on the provision of food information to consumers. Food businesses must label foods with the country of origin or place of provenance of primary ingredients. These requirements are set out in Regulation (EU) 2018/775.

Tips:

- Perform laboratory tests in ISO/IEC 17025:2017 accredited laboratories;

- Consult the useful EU-wide uniform food labelling page provided by the German Ministry of Food and Agriculture. Keep an eye on the food labelling page from the European Commission. If you export to the UK, consult official UK labelling guidance;

- Refer to industry examples of product technical sheets and catalogues. For example, check this product specification sheet for organic coconut milk produced by Waguruwela in Sri Lanka. Consult this Navik Mills coconut product catalogue for product presentations of coconut milk, cream and powder.

What are the requirements for niche markets?

European importers and retailers may require more from their suppliers in niche markets.

Sustainability certification

For business relationships with leading manufacturers and buyers, suppliers might need sustainability certification. Fairtrade certification is used for the sustainability certification of coconut. Fairtrade International has developed a specific standard for oleaginous fruit. Fair trade certification is a premium and is usually not required.

In 2024, PETA Asia reported that trained monkeys were still being used in Thailand to pick coconuts. The Thai coconut industry and government have denied widespread use of monkey labour. In 2025, major retailers like Morrisons, Tesco and Aldi took further steps to remove implicated suppliers.

Nestlé publishes its responsible sourcing core requirements. In it you can find the Nestlé Policy on Environmental Sustainability and the company’s rules of sustainable packaging.

Organic coconut milk

Organic coconut milk has certain limitations in terms of additives for powdered versions. Manufacturers should ensure that all ingredients used are certified organic. The market for organic coconut milk powder is small. Organic certification may be an interesting way to market liquid coconut milk, as there is higher demand in this segment.

Figure 1: Canned organic coconut milk sold by German retailer dm-drogerie markt

Source: Autentika Global

To sell organic coconut milk in Europe, it must be obtained using organic production methods that conform to European legislation. Growing and processing facilities must be audited by an accredited certifier before you can put the EU’s organic logo or the logo of the standard holder on your products (e.g. Soil Association in the UK, Naturland in Germany and Agriculture biologique in France).

Organic products imported into the EU must be accompanied by an electronic certificate of inspection (e‑COI). The e-COI is defined in the Commission Regulation that defines imports of organic products from third countries.

Ethnic certification

Halal certification is almost a must for coconut milk in Europe, industry sources stated. Halal certification ensures that the product complies with Islamic dietary laws, while Kosher certification ensures compliance with Jewish dietary laws. It is not very difficult to obtain. Kosher certification is less important in Europe and is not requested as often. The Kosher London Beth Din (KLBD) provides guidelines on how to obtain Kosher certification. Halal certification in Europe can be obtained through certifying bodies like Halal Certification Services (HCS).

Tip:

- Consult a 2025 USDA report on the fall and recovery of the EU market for organic products.

2. Through which channels can you get coconut milk on the European market?

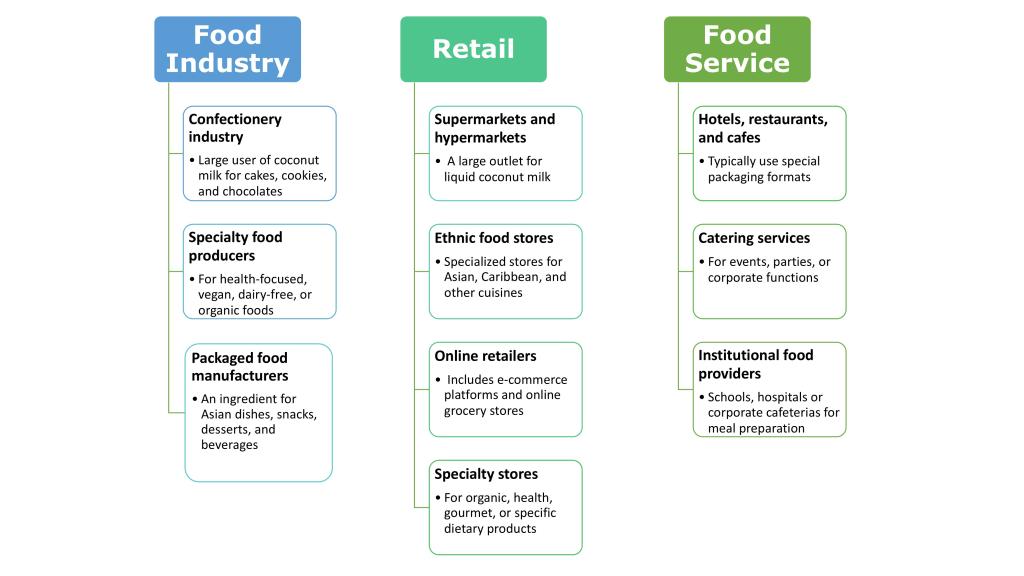

There is a good demand for coconut milk across all channels of the European market. The main channels are retail, food industry and food service.

How is the end market segmented?

There is no firm data confirming which market segment is the largest in terms of volume. This is also difficult to determine due to the weight difference between liquid and powdered milk. Although food service demand is smaller than that of the retail and food industry segments, according to consulted industry sources it is growing.

Figure 2: End-market segments for coconut milk in Europe

Source: Autentika Global

Retail segment

Canned liquid coconut milk is mostly sold in the retail sector. Most of it tends to be used for Thai and other Asian recipes. Retailers tend not to import coconut milk directly from developing countries, they are usually supplied via intermediaries.

Figure 3: Thai-style coconut milk beverage sold by German retailer Lidl under its Vitasia private label

Source: Autentika Global

Heuschen & Schrouff Foods Group is a leading supplier of Asian supermarkets in Western Europe. The company has six decades of experience in the European market, with dozens of brands in its portfolio. Their assortment includes all Asian kitchens. Kreyenhop & Kluge is an important supplier of wholesale and retail coconut milk from Thailand, Sri Lanka and Vietnam. These companies offer both cans for retail and 1-litre packages for food service.

Several retail alliances coordinate buying operations in Europe:

- AgeCore – Colruyt (cooperation on national brands and private labels), Conad, Eroski, Kaufland and Coop Switzerland;

- Carrefour World Trade or CWT – includes Carrefour, Système U, Match and Cora;

- Coopernic – includes E.Leclerc, REWE Group, Ahold Delhaize, Coop Italia and Colruyt Group;

- Epic Partners – Edeka, Aura Retail (Auchan, Casino and Intermarché), Picnic, Jumbo, Migros, Esselunga and Jerónimo Martins;

- Eurelec (from 2025) – Ahold Delhaize, REWE and E.Leclerc;

- European Marketing Distribution (EMD) – Colruyt (cooperation on private labels), Pfäffikon, Francap (10 retailers), Superunie, Countdown, Dagab/Axfood, Markant, Euromadi, RTG International and ESD Italia;

- Everest – Jumbo, Aura Retail (Auchan, Casino and Intermarché), Edeka and Picnic;

- Vasco International Trading (from 2025) – includes Colruyt Group, Coop Group and Superunie. Focuses on international A-brand suppliers.

Food industry

Packaged food manufacturers are large users of coconut milk as ingredients for confectionery products, cakes and chocolates. European bakeries are also users of coconut milk in products like pastries, biscuits and cakes. Some of the large bakery groups on the European market are Finsbury Food Group, Associated British Foods, Le Duff, Aryzta, Jab Holding, Kingsmill and Lantmännen Unibake.

Other large users of coconut milk include manufacturers of savoury Asian dishes, desserts and ice cream. There are specialised manufacturers of vegan coconut ice cream like De Jong’s IJs and Simply Ice Cream. Coconut milk powder is also present as an ingredient in the growing protein and lactose-free beverage and dessert market segment.

Figure 4: High-protein, lactose-free 'z bregov pudding with coconut milk, by Croatia’s Vindija dairy

Source: Autentika Global

The convenience food segment is a growing sector. This includes manufacturers of frozen foods and frozen meals. The frozen bakery market is another growing sector. European demand for frozen products is driven by the growing customer preference for ready-to-bake and ready-to-eat products.

Food service

The food service sector uses both liquid and powdered coconut milk. Typical consumers are gastronomy aficionados and canteens. Most of the sector is supplied by Asian food importers who deliver to Asia-related sources like Thai and Indian restaurants.

There are new opportunities emerging in Europe’s food service sector. For example, schools in Scandinavia are now offering vegan alternatives. One consulted industry source indicated that some Scandinavian countries are now purchasing significant coconut milk volumes for schools. This trend could likewise spread to mainland Europe, especially for children with lactose intolerance. Coconut milk is also commonly used for stews, soups and other dishes.

Tips:

- Read about the rise of European retail purchasing alliances. These alliances often negotiate large private label and branded purchases together, including coconut milk;

- Follow news from the Private Label Manufacturers Association. Many coconut milk products in Europe are sold under private label brands.

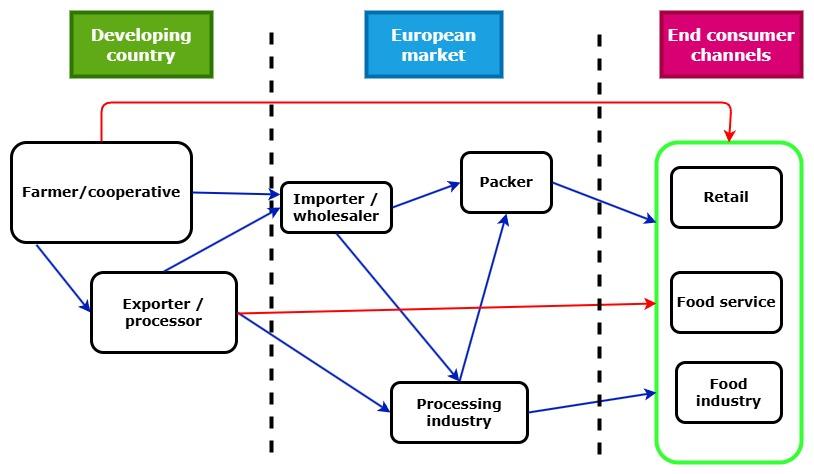

Through which channels does a product end up on the end market?

Specialised importers, traders and agents dealing in food ingredients and Asian food are the best point of contact for exporting coconut milk to the European market. Some processing companies export their coconut products directly. Packaging for private labels and direct export to ingredient wholesalers can be an option for producers that are well-equipped and price-competitive. Broker-exporters are responsible for connecting processors with buyers and moving their products to export markets.

Figure 5: European market channels for coconut milk

Source: Autentika Global

Importer/Wholesaler

Germany’s Hafen-Mühlen-Werke is an importer and wholesaler known for its coconut milk powder, coconut milk and other coconut products. It imports many products through the port of Hamburg to supply the German and European markets. The company offers six different qualities of coconut milk powder, standard and high-fat varieties, as well as vegan and organic vegan coconut milk powder.

Catz International is a major Dutch trading house with a portfolio of coconut and other tropical products. Kiril Mischeff is one of the UK’s largest coconut milk and coconut cream distributors and B2B suppliers. A major player in the ingredients segment is First Grade International, a leading UK and European supplier of premium coconut-based ingredients.

Some coconut milk importers specialise in supplying to ethnic shops. Poland’s KK Polska imports coconut milk products in different versions for the European market. The large and formerly independent Dutch Thai Mas coconut milk importer is now integrated into the Asian Food Group, a large importer from 20 different Asian countries. Germany’s Kreyenhop & Kluge imports coconut milk and other Asian and Oriental food for professionals and aficionado chefs. Germany’s Feinkost Dittmann also imports coconut milk.

T&T Foods is a French wholesaler dedicated to Asian food products. It is a specialist in French retail and has very strong brands listed with Carrefour, Cora and Intermarché. Asia Express Food is a Dutch supplier of Asian and African foodstuffs, including coconut milk. Italy’s Blife is a wholesaler specialised in organic agrofood products, including untreated organic coconut milk powder. UK-based Brusco offers coconut milk and cream ingredients to food manufacturers and food service providers in the UK and Europe. Henry Lamotte Food and PRIPA Exotic Fruchtimport also have a presence in the market.

Broker/trader

The Coconut Company in the UK supplies bulk coconut milk powders, coconut milk and coconut cream. It trades coconut ingredients, plus holds an A-grade BRC Certification as a broker of coconut ingredients.

Maya Gold Trading is an Amsterdam-based leading international wholesaler, trader and importer of organic coconut milk and organic coconut milk powder for the food industry.

Food processor

Food processors are large buyers within the coconut milk market. Some buyers import ingredients directly, but most are supplied by importers and wholesalers.

Tips:

- Work to establish long-term cooperation with well-established wholesalers and importers;

- Consult reports on opportunities to export coconut products to individual European markets. Sri Lanka’s Department of Commerce periodically publishes such reports.

What is the most interesting channel for you?

Specialised importers are the best contact for exporting coconut milk to Europe. Importers usually have a good understanding of the market and its needs. They are your preferred contact. They also provide practical advice for exports to Europe. This is especially interesting for new suppliers.

In addition to specialised importers, food ingredient suppliers are another interesting channel to enter this sector.

What competition do you face on the European coconut milk market?

The key coconut milk suppliers to Europe are Indonesia, the Philippines, Sri Lanka and Thailand. There also smaller origins like India, Vietnam, China and Malaysia.

Which countries are you competing with?

It is still difficult to determine precise market shares because the European coconut milk market is very fragmented. Trade statistics for coconut milk started to emerge from key supplier countries only very recently. Figures 6 and 7 show trade data from supplier countries. More data has become available as of 2022. Figure 6 shows export data for coconut milk powder from the four largest suppliers. Figure 7 shows the volumes of coconut milk and coconut cream exports from Europe’s four largest suppliers.

Data only available for: *2022-2024, **2022-2023, ***2022-2024 for liquid and powder combined

Source: Autentika Global, BPS, PSA, Trade Statistic Report System, ITC Trademap, 2025

Data only available for: *2022-2024, **2022-2023, ***2022-2024 for liquid and powder combined

Source: Autentika Global, BPS, PSA, Trade Statistic Report System, ITC Trademap, 2025

Sri Lanka: A major supplier

Coconuts in Sri Lanka are harvested from 1.09 million acres of land. Most of the coconut production is concentrated in small holdings (917,307 acres). Annual production amounted to 3.4 billion coconuts in 2023. An estimated 1.3 billion coconuts are used for processing annually.

In 2023, Sri Lanka exported 16,800 tonnes of coconut milk powder, 44,600 tonnes of liquid coconut milk and 9,800 tonnes of coconut cream to Europe. Sri Lanka’s coconut product trade statistics are available from the country’s Coconut Development Authority (CDA).

Sri Lanka uses several domestic statistical trade codes for coconut products. The relevant codes are 2008.19.20 (sometimes also 2008.19.90) for liquid coconut milk, 2008.19.30 for coconut milk powder and 2008.19.40 for coconut cream.

There are several organisations that represent the interests of the sector, including the Ceylon Chamber of Coconut Industries (CCCI). The CCCI is the umbrella organisation for Sri Lanka's coconut industry. The CCCI has eight founding members, including the Coconut Milk Manufacturers Association. The sector is also supported by the country’s Coconut Research Institute.

Sri Lanka is often used as a supplier in Europe due to favourable labour regulations. The country does not have typhoons, hurricanes or earthquakes, which helps reduce the effects of natural disasters. Many big buyers are now diversifying their supply sources and seeking multi-origin supplies. Suppliers may seek to secure parallel supply from Indonesia and Sri Lanka, or from the Philippines and Sri Lanka. Including Sri Lanka as a sourcing origin allows buyers to reduce climate-related risks, as its location in South Asia places it outside the typhoon-prone zones of Southeast Asia.

In August 2024, Sri Lanka’s largest coconut milk exporter Renuka Group warned that its exports were being negatively affected by the situation in Europe. In its latest annual report the company said there is “a noticeable shift towards cost-effective options”.

Indonesia: Important coconut milk supplier

Indonesia’s coconut milk industry is represented by the Indonesian Coconut Processing Industry Association (HIPKI). The industry has recently been under pressure from a surge in fresh coconut exports. This has led to a shortage of domestic raw materials. Coconut-processing industries are reportedly working at one-third capacity.

Up until 2020, Indonesia was the world's largest coconut producer by volume. Since then, the Philippines has taken over. Indonesia has around 3.3 million hectares for coconut plantations. Coconut plantations are mostly smallholder farmers.

Some coconut plants operate for three months and then close temporarily. This is caused by a lack of raw material. European buyers who supply the industry need coconut milk supplies 12 months a year and do not wish to change suppliers frequently. Many Indonesian suppliers may struggle to meet this type of demand.

As part of its National Long-Term Development Plan (RPJPN) for 2025-2045, the Indonesian government has prepared a roadmap for downstreaming the processing of coconut products. Indonesian officials claim that there is growing demand from Europe for Indonesian coconut milk.

In 2022, Indonesia started using the new trade code HS 2106.90.93 to track trade in coconut milk, both powdered and liquid. Previously, coconut milk exports were lumped together with other food preparations under the codes 2106.90.55 and 2106.90.99. The new dedicated trade code was included by BPS Statistics Indonesia in its HS Code Master 2022 document.

According to the BPS trade database, in both 2023 and 2024 Indonesia exported 3,132 tonnes of coconut milk (powdered and liquid), and 1,139 tonnes in 2022. Trade data under these codes was available for 2022, 2023 and 2024. There is no separate trade code for coconut cream, which may be exported under a different umbrella code with other processed food products.

Thailand: A key supplier for the retail market

Thailand is a key canned coconut milk supplier for the retail market. However, the country’s foothold in this segment of the market seems to be weakening slightly. Thailand faces issues with supply because land used for coconut production is now being used for industrial purposes. Industry sources indicate that several Thai factories have moved processing to Indonesia.

Thailand’s Trade Statistic Report System has started tracking coconut milk trade in much more detail since the 2022 code revision. The country’s umbrella code used to track coconut milk exports is 2106.90.93. This code is subdivided into the following products:

- 2106.90.93.001: Coconut milk, in airtight containers

- 2106.90.93.002: Frozen coconut milk

- 2106.90.93.003: Powdered coconut milk

- 2106.90.93.501: Coconut milk (organic)

The Philippines: Rising producer of coconuts

According to the Philippine Statistics Authority (PSA), the country’s coconut production amounted to 14.89 million tonnes in 2023 from 3.66 million ha. According to a 2023 annual report published by the Philippine Coconut Authority (PCA), the number of bearing trees is around 345 million.

The impact of climate change is a concern for the country. In 2021, the Philippines was ranked fourth in the long-term climate risk index. Coconut production in the country is exposed to many risks, according to the Philippine coconut industry roadmap 2021-2040. These include strong and super typhoons, severe drought caused by El Niño, and the exotic pest Cocolisap.

European sources estimate the country’s bulk coconut milk exports to Europe at a few thousand tonnes. Large and traditional brokers have organised themselves as the Association of Coconut Brokers (ACBI).

The PSA recently introduced a new standard commodity classification PSSC 2022. The code covers the Filipino trade in coconut in powdered and liquid form and coconut cream from 2024 onwards. Earlier trade was covered by a set of different PSSC 2019 codes. Table 2 lists an overview of the codes.

Table 2: Philippine Standard Commodity Classification (PSCC) trade codes for coconut milk

| PSSC 2022 code | Former PSSC 2019 code | Description |

|---|---|---|

| 2106.90.93.001 | 2106.90.99.13 | Coconut milk in powdered form, whether skimmed or full fat |

| 2106.90.93.002 | 2106.90.99.14 | Coconut milk in liquid form, whether skimmed or full fat |

| 2106.90.99.018 | 2106.90.99.29 | Coconut cream and coconut cream concentrates (protein-oil-water emulsion with at least 20% fat and at least 25.4% total solids) |

Source: Autentika Global, PSA, 2025

Tips:

- Consult UNIDO’s Exporting to the European Union: a practical guide for Sri Lankan suppliers of agricultural products;

- Follow the latest coconut market news from the ACBI.

Which companies are you competing with?

Desiccated coconut-processing companies are often large players in the coconut milk industry. They are increasingly integrated producers that provide many products from a whole nut. These products include coconut cream/milk, coconut flour, coconut water, paring cakes, paring oil and virgin coconut oil.

While historically a secondary or side product, coconut milk and cream have seen increased popularity globally. This has led some companies to shift toward specialised production lines.

Indonesian companies

A major player in Indonesia is Pulau Sambu, part of Sambu Group. They produce coconut milk and cream plus other coconut products. With three coconut processing facilities and irrigated plantations, Sambu is the world’s largest integrated coconut industry. Pulau Sambu’s coconut milk and cream portfolios are available in a variety of retail and bulk packages.

PT Indo World is a significant coconut milk exporter. Pacific Eastern Coconut Utama (PECU) is Indonesia’s only Java-based integrated coconut products manufacturer.

Other notable exporters are CBL Global Foods, Cocomas (a brand of PT Bumi Sarimas), NDC Exports (with its Cocomate brand), Indo Thai Coco Investama, Union Coconut, Bentacoco, Unicoconut and Indo Pacific Coconut.

Sri Lankan companies

Renuka Group is a major producer of Sri Lankan coconut milk. It is also Sri Lanka’s leading exporter of coconut-based food and beverage products, with its own certified organic plantations. The company offers organic coconut milk and cream and coconut milk powder under its Cocomi brand. Products are exported through subsidiaries Renuka Agri Foods and Renuka Agri Organics.

Silvermill Group exports bulk coconut milk and cream for ingredients and coconut milk in retail packaging. Nestlé Lanka is the only manufacturer of coconut milk powder in the Nestlé Group and is among the largest exporters of coconut milk powder in the world. Nestlé Lanka has dedicated a facility at its Kurunegala factory exclusively to manufacturing the product.

Other notable players are Adamjee Lukmanjee and Sons, CBL Natural Foods, Jaindi Exports (with its Econutrena brand) and Navik Mills.

Filipino companies

In 2023, there were 15 coconut milk and 4 coconut cream concentrate manufacturers-exporters registered with the Philippine Coconut Authority (PCA).

Axelum Resources Corp is a leading manufacturer and exporter of premium coconut products. It offers coconut milk powder as well as pure coconut milk and cream. The company is co-owned by Metro Pacific Agro Ventures. Cardinal Agri is a key supplier of coconut milk and other products.

Other key players include Franklin Baker, with three manufacturing plants, the Primex Group of companies, Peter Paul Philippines Corp, Superstar Coconut Products (liquid and powdered) and Celebes Coconut Corporation.

Thai companies

Some of the prominent Thai coconut milk suppliers to Europe are Theppadungporn Coconut, First Canned Food, Thai Agri Foods and Erawan Food.

Tips:

- Explore Sri Lanka’s 2024 official list of coconut product exporters. Research the portfolio of PCA’s list of coconut milk and cream exporters;

- Consult freely available data on coconut milk and coconut milk powder exports from Sri Lanka and the domestic prices of fresh coconut published by the CDA;

- Monitor news from the coconut sector published by the PCA;

- Add your company details to the International Coconut Community’s (ICC) directory of coconut traders;

- Seek out market intelligence in Renuka’s annual reports.

Which products are you competing with?

Most consumers like the taste of coconut. Coconut milk has an exotic taste that stands out. It is a special product that is unique and difficult to replace. Asian cuisine and the sweets industry are the main market drivers. They want the specific qualities of coconut milk.

Several other products are produced from the white coconut kernel. As such, they can be considered competitors. The main coconut product competitor is probably desiccated coconut. Liquid coconut milk is thick, creamy and high in fat. This makes it more suited for cooking. Pure coconut milk is not used as a beverage but as an ingredient.

In the plant-based beverages market, soy milk holds a dominant position in the European non-dairy milk market. In 2024, soy milk accounted for a 43% market share of EU’s non-dairy milk market. The second and third place are held by oat and almond milk. In the vegan sector, oat milk has seen growth in demand. In Europe it is seen as a strong competitor for coconut milk.

Coconut milk has a major advantage compared to some alternatives, in the sense that it is nut-free. In some European countries many schools are nut-free, and coconut as an allergen-free ingredient has room to grow.

Tip:

- Read our study on desiccated coconut to understand fresh product competition.

What are the prices of coconut milk on the European market?

Coconut prices have seen significant fluctuations for many years. In December 2024, Jelfina Alouw, ICC’s director general, stated that extreme weather events and pest and disease outbreaks have disrupted production in key coconut-producing countries. In February 2025, the market situation for coconut raw material remained challenging, according to German importer Henry Lamotte Food.

Supply prices went up dramatically in early 2025, doubling coconut raw material costs. This has limited the growth perspectives in the short term. Pricing in 2025 is also affected by strong demand from China. Several coffee chains in China are heavily marketing coconut milk. This is bringing a lot of new demand to the market.

European buyers may push suppliers to agree on long-term pricing contracts of 12 months. Agreeing to fixed-price long-term contracts may be risky for developing-country suppliers. Industry sources say that the climate and the seasons are changing, and crop volumes can be roughly estimated up to half a year in advance. Committing to annual contracts for coconut milk supplies means a lot of financial risk for the supplier. For processors, coconut as raw material is the single biggest cost element.

Although coconut milk’s fat percentage varies slightly by supplier and specification, 17% fat is a common industrial standard for canned, full-fat coconut milk used in both retail and B2B trade. According to an industry source, FOB Sri Lanka, the price range for this product was around $1,800 to $2,000 per tonne in March 2025. This was up from $1,100/t in mid 2024. The price of the commodity was expected to return to lower levels in mid 2025.

The retail price of coconut milk includes a VAT rate. VAT rates on coconut milk as a foodstuff differ between European countries. They may go from 0% in some countries to more than 20% in other countries. Table 3 illustrates a rough price breakdown.

Table 3: Sample price breakdown for a 400ml can of coconut milk (retail price €1.49 incl. 19% VAT)

| Stage | % of retail price | Amount (€) |

|---|---|---|

| 1. Raw material | 10% | €0.15 |

| 2. Coconut milk producer | 35% | €0.52 |

| 3. Shipment | 5% | €0.07 |

| = Importer’s buying price | 50% | €0.74 |

| 4. Importer’s markup (20%) | 10% | €0.15 |

| = Importer’s selling price | 60% | €0.89 |

| 5. Retailer’s markup (40%) | 24% | €0.36 |

| = Retailer’s price excl. VAT | 84% | €1.25 |

| 6. VAT (19%) | 16% | €0.24 |

| Final retail price incl. VAT | 100.0% | €1.49 |

Source: Autentika Global based on input from industry sources, 2025

Note: This breakdown of the retail price is only intended for orientation purposes and cannot be used as a precise indicator. Retail and other margins can vary considerably.

Tips:

- Monitor weekly and monthly prices of coconut products from Indonesia, the Philippines and Sri Lanka on the website of the International Coconut Community;

- Keep an eye on market supply and demand with free market updates from traders. TM Duché & Sons offers free news updates.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research