The European market potential for coconut milk

Europe is an important importer of coconut milk in liquid and powder form. The European coconut milk market is expected to grow by around 5% annually in the next five years. This forecast is based on current trends and the various applications of the product. Coconut milk is a popular dairy substitute with a tropical flavour. The main market segments are Asian cuisine and plant-based foods and beverages. The confectionery and dairy industries use coconut milk to create unique flavours and products.

Contents of this page

1. Product description: coconut milk

It should be noted that this study refers to different uses of coconut milk (e.g. in cooking, desserts, drinks), but specific data on the size or growth of each use segment across Europe is not available. The market is fragmented, and importers often serve only certain parts of the market. They usually have partial insight into how the products are finally used, as this can vary by buyer, country, and over time. Recipes can also be adjusted depending on price and availability. For these reasons, detailed breakdowns or forecasts by use segment could not be included in the present study.

Coconut milk is a liquid derived from the grated flesh of mature coconuts (Cocos nucifera). Coconuts are informally called fruits, nuts or seeds. Botanically, the coconut is a fibrous one-seeded drupe. A drupe is a type of fruit with a seed that has a hard outer layer. The white endosperm is the main part of the seed and contains the nutritious parts that consumers eat. Coconut is highly nutritious and contains water, fat, some carbohydrates and a very low amount of protein.

Figure 1: Open coconut showing white pulp

Source: Image by zibik from Pixabay, Pixabay content license

Coconut milk and coconut water are different products. Coconut milk is extracted from the coconut meat, or pulp. This separation can be performed with or without water. The coconut pulp separates into a thick, creamy layer and a more translucent liquid. Coconut cream is a more concentrated and thicker cream than coconut milk, with higher fat content (around 24%). Both products are popular non-dairy milk alternatives.

Coconuts can be harvested at various times during their maturation. This also influences the products that can be obtained. During the middle stage of coconut development, after six months, the coconut can be harvested for its water or juice. These coconuts are used to produce coconut water.

From around eight months onwards, the liquid volume gradually decreases as the coconut flesh develops inside the coconut. The coconut fully matures at around 10 to 13 months, when it is typically harvested to produce either coconut milk, coconut cream or desiccated coconut.

Coconut milk is offered in four product styles:

- Light coconut milk: A thinner version of coconut milk. Typically produced by diluting regular coconut milk further or using the lower-fat portion separated during centrifugation;

- Coconut milk: A water-based emulsion made by finely grinding coconut meat and mixing it with water. It contains both dissolved and suspended solids;

- Coconut cream: A rich, thick emulsion extracted from mature coconut meat, sometimes with added water or coconut water;

- Coconut cream concentrate: A denser product made by partially removing water from coconut cream.

Other closely related varieties are:

- Cream of coconut: A sweetened and processed version of coconut cream. It contains added sugar and is not to be confused with unsweetened coconut cream;

- Condensed coconut milk: Thick and sweet, made by removing water and adding sugar to coconut milk. It is often used as a dairy-free substitute for sweetened condensed milk;

- Evaporated coconut milk: Unsweetened and concentrated version of coconut milk made through water removal. Evaporated coconut milk, coconut cream and coconut cream concentrate differ mainly in their water content, resulting in varying consistencies and flavours. Evaporated coconut milk is the least concentrated, with a thinner, creamier texture than coconut cream.

Europe is a major importer of coconut and coconut products, but there are no precise European trade codes for coconut milk alone. In the European Union’s tariff and statistical nomenclature (Council Regulation No 2658/87), coconut milk and cream are generally found under subheadings 2008.19 and 2106.90. The precise eight-digit code depends on pack size, the addition of sugar/spirit, and whether it is in liquid or powder form. These 8-digit codes are not used exclusively for coconut milk and cream, so precise trade statistics for coconut milk are not available.

Figure 2: Coconut milk powder

Source: Leche de coco en polvo by kiliweb for Open Food Facts, licensed under CC BY-SA 3.0

Subheading 2008.19 refers to ‘tropical nut’ preserves or preparations. Council Regulation No 2658/87 explains that this means coconuts and other tropical nut preparations. Two frequently used 8‑digit codes under this subheading are:

- 2008.19.12 for coconut milk and cream in immediate packings of a net content ≤ 1 kg;

- 2008.19.91 for coconut milk and cream in immediate packings of a net content > 1 kg.

Both codes are for milk and cream not containing added sugar or spirit.

Powdered coconut milk or cream may fall under 2106.90.92 or 2106.90.98, depending on sugar content, fat content and whether it includes other ingredients.

Table 1: Frequently used trade codes for coconut milk

| HS Code | Brief description |

|---|---|

| 2008.19 (and corresponding 8-digit codes) | Coconut milk and cream |

| 2106.90 (and corresponding 8-digit codes) | Coconut milk and cream in powder form |

Source: Autentika Global, TARIC, 2025

Wherever this study refers to coconut milk, it includes the products specified in Table 1. Note that coconut milk with added sugar and spirit is not included in the analysis. Some countries, like Thailand, have their own national codes to track national trade, which are usually very useful for companies that are exporting or importing to that specific market.

While the liquid coconut milk version is the largest market, powdered coconut milk has certain specific uses. The main use of powdered coconut milk is to enhance the taste of various desserts, beverages and other sweets.

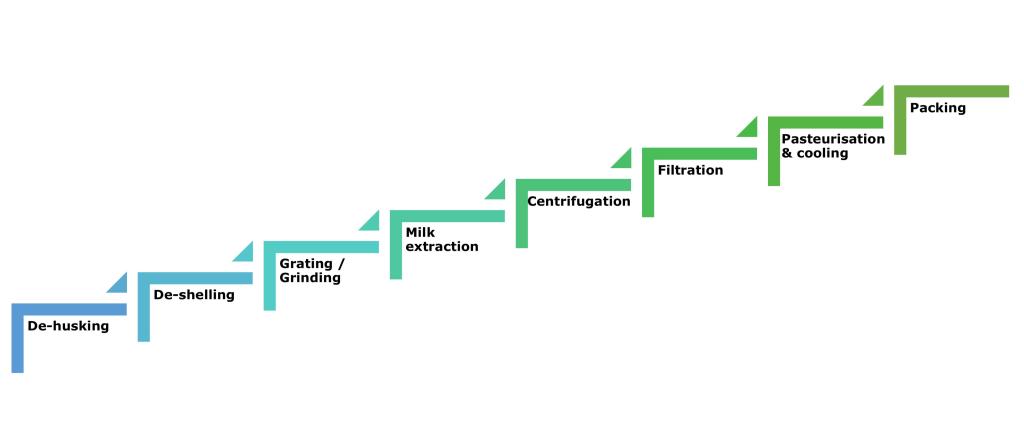

Figure 3: Major stages in the production process for coconut milk

Source: Autentika Global, 2025

Figure 3 shows the major stages of coconut milk processing. A more detailed breakdown includes:

- De-husking – removing the husk from the coconut. The process is now often done with husk peeler machines that use sharp tools to remove the husk;

- De-shelling – cracking the outer coconut shell of the fruit. The brown shell is removed using a de-shelling machine;

- Paring – often performed by machine. After the kernel is cut into pieces, the brown skin is removed;

- Blanching – the pared coconuts are briefly covered with boiling water in a tank;

- Grinding – the white coconut kernel pieces are ground to a smooth paste using a machine;

- Milk extraction – the ground coconut is squeezed by machine to extract the milk;

- Centrifugation – an optional process used to divide coconut cream from coconut milk. If coconut cream is produced, the remaining milk is low-fat;

- Filtration – the extracted coconut milk is filtered. This can be done with a vibro screen and a stainless 100 mesh filter or smaller;

- Pasteurisation – depends on the processing lines. Can be performed by double boiling at 70°C for 15 minutes;

- Packing – liquid products are packaged in aseptic packaging. This allows producers to distribute and store these goods without refrigeration. Non-aseptically packed liquid coconut milk requires chilled storage.

For a good visualisation of coconut milk processing, watch a video of an industrial line. This video is from India’s National Institute of Food Technology, Entrepreneurship and Management, Thanjavur (NIFTEM-T). For more information on how to set up a coconut milk processing unit, consult a report by Udyami. Udyami is an entrepreneurship training portal for India’s Prime Minister’s PMEGP programme.

In Europe, coconut milk is mainly used as a dairy alternative and as a cooking ingredient. It is common in sauces, soups and desserts. Coconut milk is an important ingredient in Asian, East-African, Caribbean and northern South-American cuisines. It is also widely used for making beverages. Market prospects are likewise good in countries where the popularity of vegan or vegetarian diets is increasing.

Coconut milk might be marketed as ‘coconut milk’, ‘coconut cream’, or ‘cooking coconut milk’.

Tips:

- Read our studies on coconut water, desiccated coconuts and coconut oil to learn more about European markets for processed coconut products;

- Read more about ultra-high temperature (UHT) skim coconut milk production from a Katesart University research paper;

- Consult coconut milk equipment manufacturers for equipment decisions. An online directory of manufacturers is free to access by persons from member countries of the International Coconut Community (ICC).

This study covers general information regarding the overall market for coconut milk in Europe that is of interest to producers in developing countries. The term ‘Europe’ in this study refers to the 27 Member States of the European Union (EU), plus the United Kingdom (UK) and EFTA countries (Iceland, Liechtenstein, Norway and Switzerland). The term ‘developing countries’ is used for countries that are listed on the OECD-DAC list of ODA recipients for 2024 and 2025 flows.

2. What makes Europe an interesting market for coconut milk?

The European market has over 500 million consumers with significant purchasing power. Coconut milk, coconut cream (the richer, higher-fat portion) and powdered coconut milk/cream are used as dairy alternatives. They are also cooking ingredients in curries and desserts, and are used for food and beverage manufacturing.

Europe is an attractive market for exporters from developing countries because it relies entirely on coconut milk imports and does not produce its own coconuts.

Coconut milk consumption in Europe has been growing recently. However, industry sources indicate that 2023 was a difficult year for coconut milk because it was still recovering from the COVID pandemic. A lot of volume was sold during COVID and many buyers overbought in 2022 because consumers spent more time cooking at home. This resulted in a temporary slump in European imports in 2023. Demand from manufacturers recovered in 2024. In 2025 and the following two years, coconut milk is expected to experience growth of around 5-6%.

In the retail segment, demand for coconut milk powder is not as strong as it is for aseptic coconut milks and creams. Supermarkets for private label products are trying to move away from additives and starches. As an exporter of coconut milk powder, it is best to focus on the confectionery industry, the wider food industry and food service as your primary customers.

The manufacture of coconut powder often requires the use of additives like maltodextrin and sodium caseinate. Maltodextrin is usually added from tapioca or maize and is used as a carrier. Sodium caseinate is a dairy protein with an allergen warning and is used as an emulsifier.

Since there are no precise data available on European imports of coconut milk, the market situation can be estimated based on information from industry experts and analysts. As the weight differences between powdered and liquid coconut milk products are significant, most estimates of coconut milk trade are still value-based.

One industry analysis valued the European coconut milk market at €432.6 million in 2023. The report projected the market would reach €816.80 million by 2030. The compound annual growth rate (CAGR) was estimated at 9.5% between 2024 and 2030. Another industry forecast valued the market at €538 million in 2024. The analysis expects the market to grow to €759.5 million by 2029, with a CAGR of 6.9%. These are overall estimations for the retail and ingredients segments.

The growth of the European coconut milk market is highly dependent on inflation, macroeconomic trends and global supply chain pressures. Volume growth is likely to remain low, especially if prices stay high.

When it comes to the organic coconut milk market in Europe, after a drop in 2022, the overall EU organic market began to recover in 2023. France and Germany still have the largest organic markets in the EU. The USDA estimates a modest upward trend in EU organic sales for 2024 and 2025, but at a slower pace than before 2022.

Industry sources indicated that 2023 was a tougher year for organic coconut milk, with improvement seen in 2024. Expectations from manufacturers indicate that 2025 could be a better year. Around 5-10% of the canned coconut milk market is organic, the rest is conventional. The organic market for bulk coconut milk is very small.

Bulk coconut milk is used in Europe for ice cream, sweets and beverages, but there are other industrial uses. Coconut milk imports in retail packaging are difficult to estimate because they go through more importers and channels. Canned coconut milk is mostly used for cooking by end-consumers.

Due to the very different uses of coconut milk, it is hard to collect precise statistical data. The consumption purposes and usages of coconut milk are so different that it is difficult to sum them up. Partial export data from four leading Asian origins (the Philippines, Thailand, Sri Lanka and Indonesia) to Europe indicate that Europe imports over 20,000 tonnes of coconut milk powder and over 80,000 tonnes of liquid coconut milk. Export data from four leading European coconut suppliers is available in our report Entering the European market for coconut milk.

Key drivers for growth for coconut milk in the short term include the popularity of plant-based diets, new product launches, and post-COVID health consciousness. For example, even traditionally dairy-heavy markets like Germany are embracing dairy alternatives. Some recent surveys suggest that 54% of European consumers now say they prefer plant-based beverages over animal milk.

Tip:

- Read CBI’s demand study for a broader view of the processed fruit and vegetables market in Europe.

3. Which European countries offer the most opportunities for coconut milk?

The United Kingdom has traditionally led European demand for coconut milk, as Asian cuisine remains popular due to the UK’s large Asian population. Demand in continental Europe started to pick up less than 10 years ago. This was led by consumers’ increased demand for plant-based foods and yoghurts, as well as increased industrial demand.

Based on industry estimates, analytical reports and overall coconut product trade, Germany, France, Belgium and the UK are the largest European consumers of coconut milk. Continental Europe has some big contract manufacturers. Other important consumer markets and manufacturing centres are Spain and Italy. These consumer markets usually have a few large importing companies.

Dutch imports are overestimated because of the so-called ‘Rotterdam effect’, as the Port of Rotterdam is the largest seaport in Europe. Products arriving in Dutch ports include imports that are re-exported to other EU countries. Dutch demand is lower than the imported volume because large volumes are traded through the Netherlands. The Netherlands has some big importers of coconut milk. A major player is Catz International, part of the Acomo group of companies. It has a large tropical products portfolio.

Several large global multinational players are involved in the coconut milk market. Nestlé is one of them; it has a presence in several European markets with its MAGGI coconut milk powder. Nestlé manufactures its milk powder from Sri Lankan coconuts. France’s Danone has a global presence too.

In the pre-COVID years, Europe experienced a sudden growth in coconut milk imports. Volume growth has slowed sharply after the pandemic due to the negative effects of inflation. This was worsened by the rise in coconut raw material prices. However, imports in value terms continue to grow.

United Kingdom: Asian cuisine is a leading source of market demand

The UK is one of Europe’s largest consumers of coconut milk. It has a long familiarity with Indian and Thai cuisines. Because of the popularity of these Eastern cuisines, coconut milk is a common cooking ingredient. UK import volumes were growing fast pre-COVID but have stagnated since. Asian dishes like Thai green curry, Thai red curry and Indian chicken tikka masala are large sources of demand for coconut milk.

Coconut milk demand is driven partly by ethnic diversity and partly by the mainstream adoption of ethnic cuisines. The market for coconut milk powder in the UK is small. Industry sources estimate it at around a couple of hundred tonnes. The market for liquid aseptic coconut milk is much bigger by comparison and possibly several thousands of tonnes, including bulk and retail.

Vegan plant-based beverages and yoghurts are an important market segment. The UK’s plant-based market is also very developed – with about 4.7% of UK adults, around 2.5 million, adopting a vegan lifestyle in 2024. Younger generations are the largest consumer group following meatless diets or intending to stop eating meat. This is a strong consumer base for dairy alternatives.

A 2023 report by Straits Research found that the UK’s vegan food market was growing at a rate of 9.58% per year, with 40% of consumers saying they wanted more plant-based options. British supermarkets offer canned coconut milk and coconut cream, as well as coconut-based yoghurts and coconut milks for coffee.

The UK is a relatively open market and easy to enter for suppliers with the right certifications. Post-Brexit regulatory changes mean separate UK import compliance. JK Foods UK is one of Britain’s leading importers and distributors of authentic East Asian foods.

Some reports indicate the UK is the largest coconut milk market in Europe, holding approximately 22% of the European market share in 2024. A major player in the ingredients segment is First Grade International, a leading UK and European supplier of premium coconut-based ingredients. They recently launched two new international websites to meet the needs of the Spanish (FGI Spain) and Polish (FGI Poland) markets.

Other notable importers are TM Duché & Sons, Barnes Williams and G Bruce & Co (a division of the Brusco Food Group). Kiril Mischeff is a major coconut milk and coconut cream distributor and B2B supplier, together with Brusco.

The retail market is largely dominated by retail chains like Tesco, Sainsbury’s, ASDA, Morrisons and others. Most of them have their own private label brands for coconut milk. Some of the established independent brands are Coconut Merchant, Crazy Jack and Koko (a First Grade International brand). Innocent’s coconut milk blend was selected as one of the nine best vegan milks for coffees, cooking and pouring over cereal in the UK market in 2024.

Clearspring is a British brand known for its tinned organic coconut milk and coconut cream products. Biona Organic supplies organic condensed and regular coconut milk as well as coconut whipping cream.

A significant share is also traded by companies specialised in Asian food. AB World Foods owns the Blue Dragon brand of coconut milk. Tropical Sun, a specialist ingredients supplier for the UK’s ethnic communities, offers powdered and liquid coconut milk. Kingfisher Oriental and SOP International also import coconut milk.

Tips:

- Contact Plant-based Food Alliance UK to find out more about the UK coconut milk market;

- Follow the latest coconut-related market news from First Grade International;

- Seek out market intelligence from public annual reports published by British companies. Consult the full financial reports of First Grade International, Barnes Williams, G Bruce & Co, Kiril Mischeff and other players. Use webpage filters to narrow down your search.

Germany: A well-developed, mainstream market

Germany is the EU’s largest economy and has strong vegan and vegetarian movements. It leads Europe in plant-based food revenues. In Germany, around 40% of surveyed individuals identified as flexitarian.

In Germany, 93% of consumers regularly buy plant-based dairy alternatives, which is higher than in any of the other plant-based product categories. According to 2023 research by ProVeg International, 37% of surveyed consumers in Germany reportedly consume plant-based dairy alternatives at least once a week. In addition, 38% of surveyed German consumers said they plan to consume more plant-based dairy alternatives in the future. Import volumes of coconut milk have been increasing as both retail and foodservice use of coconut milk grows.

Figure 4: Regular and light canned private label coconut milk sold by Lidl

Source: Autentika Global

German supermarkets and drugstores (e.g. DM, Rossmann) sell coconut milk. It is used in everything from vegan baking to curries. Thai and Indian restaurants are common in German cities. The health aspect is a big driver. German consumers see coconut milk as a natural and wholesome ingredient because it is free from lactose and dairy additives.

Per capita consumption of dairy alternatives in Germany is among Europe’s highest, and is projected to reach 3.4 kg per person by 2028.

For exporters, Germany is an attractive yet highly competitive market. Products need to meet strict EU standards and preferably carry sustainability, organic or fair-trade labels to stand out. Price levels are moderate, and German retailers tend to be very price-sensitive. Consumers are willing to pay premium prices for organic or branded quality niche products like coconut milk. Distribution is often through importers or wholesalers who then supply supermarkets. The key to succeed on the German market is to have a German distributor partner.

Hafen-Mühlen-Werke, established in 1949, is a German import and trading company. They supply various sectors of the food industry with a diverse range of products, with a notable emphasis on coconut-based items. These products meet the growing demand for coconut-based ingredients, providing a wide range of options for manufacturers.

Coconut milk is used in small amounts by German chocolate manufacturers like Ritter Sport and in the smoothie industry.

Figure 5: Ritter Sport chocolate bar with coconut milk

Source: Kokos - Product by moon-rabbit for Open Food Facts, licensed under CC BY-SA 3.0.

For home consumption, coconut milk is sold under private labels like Freshona (by discounter chain Lidl), K Classic (by Kaufland), Back Family (by Aldi Süd and Aldi Nord), ja! (by REWE) and Edeka/Ediba Bio (by Edeka). Some independent brands are KoRo and Dr. Goerg.

Germany’s Dr. Goerg is a notable supplier of organic coconut milk and coconut products. Alnatura is a well-known brand of organic food products and coconut milk. Dr Antonio Martins is a leading German coconut products brand offering organic coconut milk for drinking and cooking. The brand is owned by Green Coco Europe.

Germany’s Rapunzel sources coconut products and coconut milk from various suppliers. It has its own fair trade programme, called HAND IN HAND. Pripa Exotic imports high-quality exotic organic products in bulk, including coconut milk, for further processing. The company also has its own brand of coconut products: BioLanka.

Heuschen & Schrouff Foods Group is a leading importer and supplier of Asian supermarkets in Western Europe. Similarly, Kreyenhop & Kluge is a key supplier of wholesale and retail coconut milk.

Tip:

- Search for German coconut milk buyers on the websites of the specialised trade promotion organisation Waren-Verein der Hamburger Börse and the German B2B platform Wer liefert was (wlw).

France: Coconut milk as a dairy-based alternative

According to some estimates, coconut milk sales in France are the fastest-growing in Europe and are expected to experience strong growth in the coming four years. This can be attributed to the various applications of coconut milk in French cuisine.

However, the past few years have been difficult for coconut milk sales in France. After COVID, the start of the war in Ukraine and food inflation, some coconut milk brands disappeared. Products made by Danone and other leading brands used to require several thousand tonnes of coconut cream. This has since dropped to less than one-third of peak volumes, according to several industry sources. The drop in vegan brands has also been noticeable.

France has several big importers of coconut milk. A key player is Loiret & Haëntjens. The company supplies aseptic coconut milk and cream in 200-litre drums and 20 kg bags in boxdrums. It also supplies coconut milk powder packaged in 15 kg boxes. In 2011, Loiret & Haëntjens bought competitor Navimpex. At that time, Navimpex was a leading importer of coconut and tropical fruit supplying European food producers. Another popular French importer is Odin, supplying the food industry with coconut milk and cream from the Philippines, Sri Lanka and Indonesia.

T&T Foods is a French wholesaler dedicated to Asian food products. It is a specialist in French retail and has very strong brands listed with supermarket chains like Carrefour, Cora and Intermarché. Asian foods supermarket chain Tang Frères imports coconut milk directly from developing countries.

Some of the coconut milk is supplied by other European importers, like Berlin-based natural food company KoRo. French multinational Ecotone has a focus on organic food and offers coconut milk for culinary use. The milk is packed in Bologna, Italy. The company was founded as Wessanen in the Netherlands and is headquartered in Lyon since 2020. La Maison du Coco offers organic and fair trade coconut-based products for food professionals.

Figure 6: Bjorg coconut cream for cooking

Source: Crème de coco légère by moon-rabbit for Open Food Facts, licensed under CC BY-SA 3.0.

Most of the market share for packed products is held by leading retail chains like Carrefour (Carrefour, Carrefour Bio and Petit Prix labels), Leclerc (Tablier Blanc label), Super U (U label), Intermarché (Chabrior label) and Auchan (Auchan label). French multinational food company Andros specialises in fruit and dairy products and offers several products with coconut milk.

Tips:

- Visit the French-language websites of the French Federation of Bakery Companies and the National Union of Manufacturers of Intermediate Products for Bakeries and Pastries to find users of coconut milk in the French bakery and pastry industry;

- If you are not from a French-speaking country, consider investing in French-speaking staff to facilitate entry to the French market.

Spain: Big on plant-based substitute products

Spain has many beverage companies and a big vegan market for non-dairy beverages. It is one of the major European markets for coconut milk and cream. Spaniards are consuming more plant-based dairy alternatives each year, including coconut milk. The Spanish market has many coconut milk suppliers from the Americas. A well-known brand is Goya (by Productos Goya Nativo), with coconut milk sourced from the Dominican Republic.

Fiesta Ingredients is a leading coconut importer in the food industry with years of experience in B2B solutions for the breakfast cereal, baking and ice cream industries.

Spanish company World’s Coconut Trading introduced easy-to-open Genuine Coconuts. They offer coconut milk and a line of other coconut products. Spanish retailer Mercadona sells coconut milk under its Hacendado brand. The product is created in cooperation with Thai company Theppadungporn Coconut.

Saludviva is a supplier of organic lyophilised coconut milk in powder form. Spain’s most important organic supermarket chain Veritas offers organic coconut milk under its own brand. Laboratorios Almond is a Spanish manufacturer and packer of plant-based products, including coconut milk. The company sells its coconut milk under the NaturGreen organic brand. It also offers coconut cream-based yoghurts and kefirs. Murcia-based supplier Nutriops serves the Spanish and European markets with its Ecomil brand.

Danone has invested €12 million in the Parets del Vallès plant in Catalonia. The plant is the first Danone centre in Europe to produce vegetable alternatives to yoghurt based on coconut and oats. It is also Danone’s first hybrid factory, which will produce both dairy and plant-based yoghurts under the brands ALPRO, Activia and Oikos. S.Colomer Casas and Iberochina Internacional are Spanish importers-wholesalers of coconut milk.

Spain’s import volumes have grown according to demand, with major retail chains now stocking coconut milk. The product is often in both the international aisle and the organic/health section. Key factors driving coconut milk imports into Spain include the popularity of smoothies and tropical flavours and the influence of Latin American and Asian fusion cuisine.

Price sensitivity can be a problem because Spanish consumers look for value. Competitively priced coconut milk (or larger can sizes for families) will potentially perform well.

Belgium: Important manufacturing base

Even though Belgium’s retail market is relatively modest due to its smaller population size, the industrial processing volume is considerable. Belgium is a large manufacturing base for plant-based beverages and other foods. Additionally, Belgium’s premium chocolatiers and biscuit makers source coconut milk or powder for fillings and mixes.

Belgium-based Alpro sells organic and non-organic plant-based products globally. Alpro is owned by Danone. It offers retail-packaged coconut milk-based drinks and cooking coconut milk. It also offers Alpro Barista coconut milk for the food service segment. In addition, Alpro uses coconut milk for yoghurts, desserts and ice creams. Alpro’s biggest production facility for plant-based food and drinks is in Wevelgem, Flanders.

Figure 7: Alpro coconut milk and coconut cream-based beverages

Source: Autentika Global

Danone also owns the Activia brand of plant-based yoghurts. Danone’s production site in Rotselaar specialises in dairy products, including Danone Fruit, Activia Fruit, Actimel, and Light & Free branded products. The site also has an organic line, Provamel, that uses organic coconut.

Barry Callebaut operates the world’s largest chocolate factory in Wieze, Belgium. It offers products that contain coconut milk, such as fresh fruit preparations with coconut milk powder. Barry Callebaut stated in its Ice Cream Concepts 2025 report that 75% of consumers worldwide, including Europe, want to try new ice cream flavours. Unilever’s Belgian operations for Magnum Vegan ice cream use coconut fat and milk to create dairy-free ice creams.

Belgium’s high-quality organic food brand Nutribel sells canned coconut milk from Sri Lanka. Nutribel was known as Nutridia until 2021.

Belgian supermarket chains often have their own coconut drink and dessert products, sometimes produced by Alpro or other contractors. Significant quantities are sold under private labels by the leading retail chains, like Albert Heijn (AH label), Colruyt, Aldi (Mama Nature label), Jumbo (Jumbo label), Carrefour and Lidl (Vita D’Or label).

Tips:

- Find Belgian buyers of coconut milk among the 170 members of the Royal Belgian Association of the Chocolate, Pralines, Biscuit and Confectionary Industries (Choprabisco);

- Search for Belgian food companies on the food.be site, maintained by the Federation of the Belgian Food Industry (Fevia). You can narrow your search by using filters for product type or specialities.

Italy: A growing importer

Italy is an attractive growing market for coconut milk, even though Italian cuisine does not traditionally use coconut milk. Italy is the third-largest economy in the EU. The Italian market for dairy alternatives has been expanding rapidly.

Coconut milk demand in Italy is also driven by vegan communities, lactose-intolerant consumers (who are relatively common in Italy) and food enthusiasts experimenting with Asian recipes.

Health-conscious trends in big cities like Milan and Rome include smoothies with coconut milk and vegan gelato made from coconut cream. Thai curry restaurants are gaining popularity.

One of the larger coconut milk processors and traders in Italy is Unigra, with its OraSi brand. Mars Italia sells its coconut milk from Indonesia under the Suzi Wan brand. Italy’s largest alternative trading organisation CTM Altromercato sells fairtrade and organic coconut milk from Thailand under its Altromercato brand. Giusto Faravelli is an ingredient supplier and coconut milk importer.

Uniontrade is a leading importer, wholesaler and distributor of world food products. The company was acquired by Japan’s Nishimoto, a Wismettac Group company, in 2023. Global Trading from Parma imports ethnic products, including coconut milk.

Coconut milk is packed and sold by specialised organic and vegetarian food companies like Fior di Loto, Probios and Bordoni. It is also sold under the private labels of leading Italian retail chains like Conad, Selex, Coop and Esselunga.

Italian distributor Atlante has been importing coconut milk, launching its own organic Berry Sanders coconut milk line in 2023. The coconut milk market had a value of around €3 million in 2022 and experienced growth slightly above 20% compared to the year before.

Another Italian company, Granarolo (traditionally a dairy company), has entered the plant-based market with coconut-based yoghurts and drinks.

4. Which trends offer opportunities or pose threats in the European coconut milk market?

European consumers look for healthier and plant-based foods. This is good for the demand for coconut milk. After the pandemic ended, high food inflation and high commodity prices limited the purchasing power of European consumers. This made it harder for them to afford typically more expensive vegan dairy alternatives.

Below is a summary of the trends for coconut milk. To find out more about general trends, read our study on trends in the European processed fruit and vegetables market.

The rise of plant-based milk consumption and flexitarians

In addition to the growing popularity of coconut milk in Asian cuisine, plant-based milks are consumed by 12% of Europeans on a daily basis, according to a 2023 European consumer survey. About 36% of Europeans consume plant-based milk at least once a week, according to the November 2023 survey by the Smart Protein Project.

Some 29% of surveyed consumers asked for more plant-based milks, and 30% asked for more plant-based sweets and snacks. Coconut milk and cream are products that can meet part of this additional demand.

There is a difference between consumption intentions expressed in surveys and actual consumer behaviour. The UK’s leading coconut ingredients supplier First Grade International warned in its end-of-year 2023 report that consumer behaviour has been affected by high inflation and the cost of living crisis.

This has resulted in consumers avoiding branded goods in favour of private-label items. Also, flexitarians have turned from speciality vegan products to cheaper, mainstream products such as dairy. Manufacturers have been ordering and selling reduced volumes. Food inflation is more noticeable in premium products, and those products are facing a drop in demand.

Consulted industry sources in Europe said the demand for vegan coconut products is increasing at a rate above 10%. However, the category is no longer seeing explosive growth like it did five years ago when it started at a low level.

Prices for 200g coconut milk yoghurt packages range from €0.99 to €2 in retail. The market is still searching for balance in terms of price and quality. According to some consulted industry sources, strong growth is expected in this category in the next few years, and there is strong competition. This competition includes retailers with private labels. Other consulted sources remain sceptical about the potential for coconut yoghurt and milk growth because consumers seem to prefer the taste of traditional dairy yoghurt.

One specific target consumer group for coconut milk exporters are flexitarian consumers. Flexitarians are consumers with a semi-vegetarian diet that is centred on plant foods with limited addition of animal-based food products.

Sustainable coconut production goes mainstream

Coconut milk suppliers to Europe might benefit from putting more emphasis on sustainability certifications than on organic certifications. Sustainable production is an opportunity. There is a real drive among brands to increase their sustainability and ethical credentials. When coconut milk products get these certifications, they also become more attractive to consumers who want to buy organic products. This is partially reducing the demand for organic coconut milk.

The global coconut industry faces significant issues related to sustainability. These issues include climate change, the age of coconut tree plantations, effects from natural disasters, and a lack of financial, farming and technical knowledge among growers. The issues are reflected in low-quality produce, low earnings for growers and old production technology.

In March 2021, the EU announced legislation on due diligence. To comply with this objective, several European companies have launched their own support projects in coconut-producing countries. A notable example is the Catz Charity Foundation, founded by Catz International.

In 2020, industry leaders like AAK, FrieslandCampina, Harmless Harvest, Nestlé and Unilever launched the Sustainable Coconut Charter (SCC). The charter is a voluntary framework for companies involved in the coconut supply chain. It aims to promote sustainable practices in the coconut industry.

The SCC evolved into an innovative assurance system in 2024. The idea is to verify sustainability claims made by companies. As much as 99% of coconut volumes traded still do not support sustainable farming practices.

Kentaste is a coconut milk, cream and oil producer in East Africa. The company sources coconuts from organic-certified smallholder farmers to supply buyers in Europe. Kentaste sources all its coconuts from over 2,000 smallholder farmers in over 50 rural villages across the Kenyan coast; 50% of these farmers are organic and fair trade-certified.

Tips:

- Read about the differences between the nutritional value of plant-based milk alternatives and regular milk in this 2024 ProVeg report;

- Visit the Free From Food Expo regional show that promotes products with special certifications across Europe. The event promotes vegan, plant-based, organic, functional and healthy lifestyle foods;

- Consult ProVeg’s pan-European survey report on European attitudes towards plant-based eating. For more insights, read the extended report.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research