Entering the European market for canned pineapple

Europe accepts canned pineapple only when exporters follow strict food safety, hygiene and manufacturing rules. Buyers may ask for extra proof of safe production, low residues and full traceability. Suppliers who also show good labour and green practices can stand out with supermarkets and eco-minded consumers. Importers offer the easiest market entry, but firms must keep steady volumes, clear paperwork and flexible packs. By meeting these demands, SMEs can still compete with the big Asian suppliers and secure stable, higher-value sales.

Contents of this page

- What requirements and certifications must canned pineapple comply with to be allowed on the European market?

- Through which channels can you get canned pineapple on the European market?

- What competition do you face on the European canned pineapple market?

- What are the prices of canned pineapple on the European market?

1. What requirements and certifications must canned pineapple comply with to be allowed on the European market?

See our study on general buyer requirements for processed fruit and vegetables. Below is an overview of specific requirements for canned pineapple.

What are mandatory requirements?

Canned pineapple must follow strict European food safety rules. Canning factories use strong processing and sterilisation methods. Because of this, microbiological contamination is rare. However, physical or chemical contamination can still happen.

From 2020 to 2024, the European Rapid Alert System for Food and Feed (RASFF) reported 27 pineapple notifications. Most alerts were about fresh pineapple. Only 3 notifications involved canned pineapple. None of these cases involved pesticides or microbiological problems.

RASFF is a system in which any EU country can report unsafe or illegal food. Exporters should follow common issues shown in RASFF reports.

Food safety

The EU’s General Food Law says that only safe food can be sold on the European market. This means food must not contain harmful levels of chemicals or contaminants. For example, EU Regulation (EC) No 396/2005 sets maximum residue levels (MRLs) for pesticides in food. These limits apply to fresh and canned pineapples and are the same across the EU. If a pesticide is not allowed, only a trace amount of 0.01 mg/kg is permitted. Exporters must make sure that their pineapples stay within these limits.

Contaminants and heavy metals

The EU sets limits for heavy metals in canned fruit. Regulation (EU) 2023/915 sets maximum levels for lead, cadmium, and tin in food. Cans can release tin or lead, especially from solder or seams if they are made poorly. So, the EU limits how much tin can be released from cans into food. Like most canned foods, canned pineapple must not exceed 200 mg/kg of tin. The lead limit is 0.10 mg/kg, and the cadmium limit is 0.02 mg/kg.

In July 2024, the EU flagged canned pineapples from Thailand for excess lead (0.218 mg/kg). This amount was more than twice the legal limit of 0.10 mg/kg. Food that goes over EU contaminant limits cannot be sold. Products that are identified as unsafe will be typically recalled from the market, destroyed, returned to the supplier, or subjected to other measures. In April 2023, tin levels of 263 mg/kg in canned pineapple slices from Thailand triggered an alert. Producers should use food-grade cans and follow good practices to keep metal levels as low as possible.

Food additives and composition

Canned pineapple may only include approved food additives. The product is usually sold in syrup or juice. It must not include banned preservatives or colourings.

Regulation (EC) No 1333/2008 lists the additives allowed in canned fruits. For example, citric acid (for pH) and ascorbic acid (for colour) are allowed. But all additives must be listed on the label. Many canned pineapples contain only pineapple, sugar syrup, and sometimes an acidity regulator. So, they should not have artificial dyes or sulphites unless clearly allowed and labelled. If sulphite is used (rare in canned pineapple), it must be listed because of allergen rules. Regulation (EU) No. 1169/2011 lists sulphur dioxide and sulphites as allergens.

The product must follow the Codex Alimentarius standard for certain canned fruits. This standard includes canned pineapple and helps guide quality. Codex rules allow optional ingredients like spices, herbs, and spice oils. Antifoaming agents and antioxidants listed in tables 1 and 2 of the Codex Alimentarius general standard for food additives are also allowed.

Figure 1: Private-label canned pineapple and fruit cocktail products in European supermarkets

Source: Autentika Global

The canned fruit standard defines not only additives but also the product type and quality rules for canned pineapple. The Codex Alimentarius guidelines for packing media for canned fruits sets the Brix levels for syrup used in canned pineapple.

Table 1: Packing media that can be used for canned pineapples

| Name and label | Composition (°Brix) |

|---|---|

| Water | Water |

| Lightly sweetened* | Greater than or equal to 14° but less than 18° |

| Heavily sweetened* | Greater than or equal to 18° but less than 22° |

| Extra light syrup or slightly sweetened syrup** | Greater than or equal to 10° but less than 14° |

| Light syrup** | Greater than or equal to 14° but less than 18° |

| Syrup** (optional label) | Greater than or equal to 17° but less than 20° |

| Heavy syrup** | Greater than or equal to 18° but less than 22° |

| Extra heavy syrup** | Greater than or equal to 22° |

| Water and fruit juice or fruit juices, in which the fruit composition exceeds 50% | |

| Nectars |

*Fruit juice or fruit pulp or blend, ** syrup (mixtures of water and foodstuff with sweetening properties such as sugars or honey)

Source: Autentika Global, FAO Codex Alimentarius, 2025

Material in contact with food

The pineapple can and all packaging must be safe for food contact. Regulation (EC) No 1935/2004 says packaging must not release chemicals into food at unsafe levels.

Cans are often coated inside to stop metal from affecting the food. These inner coatings, often made from epoxy resins, must use approved substances. For example, the EU limits how much bisphenol A (BPA) can pass from the can lining into food. Manufacturers should use cans that follow EU or similar safety standards to avoid chemical risks. Packaging must also follow EU environmental rules, which limit heavy metals to reduce pollution.

Some countries, like France, have extra packaging rules. France’s anti-waste and circular economy law (AGEC) bans some single-use plastics and requires recyclable or compostable packaging for many foods.

Figure 2: Pineapple slices inside a can

Source: Autentika Global

Labelling and consumer information

Labelling is required under Regulation (EU) No 1169/2011. According to this regulation, canned foods must have clear labels in the official language of the targeted EU country. All label information must be correct and not mislead buyers. Because pineapple is solid in liquid, the label must show the drained net weight.

The label must show:

- Product name (for example: 'Canned pineapple in syrup');

- List of ingredients (for example: pineapple, water, sugar);

- Allergen information;

- Net weight and drained weight;

- Best before date;

- Lot number or identification;

- Name and address of the EU importer or food business.

Hygiene and certifications

Canned pineapple must be made in clean and hygienic conditions. EU Regulation (EC) No 852/2004 on food hygiene says food producers must follow hygiene rules. They must also apply a food safety system based on Hazard Analysis and Critical Control Points (HACCP). HACCP is a method to prevent food safety problems.

There is no EU requirement to register foreign factories, but importers will only buy from factories that pass food safety audits. At import, shipments may be checked by authorities. EU authorities use the TRACES system to check import documents and health certificates. Canned pineapple is a low risk and does not need a phytosanitary certificate, but border checks may include random samples.

After Brexit, the UK made its own food laws, but they still follow EU rules closely. The UK Food Standards Agency (FSA) enforces similar requirements for canned foods. EU laws such as the food information regulation were added to UK law and still apply. These rules are now called retained EU regulations in the UK. Always check the latest UK rules from the UK’s Food Standards Agency (FSA) or the Department for Environment, Food and Rural Affairs (DEFRA) before exporting to the UK. In general, if you meet EU rules, you will also meet UK standards.

What additional requirements and certifications do buyers often have?

Besides legal requirements, many European buyers and retailers have their own rules and preferences. Importers and supermarket chains often expect extra quality, safety, and ethical standards from canned fruit suppliers.

Food safety certification

Most European retailers only buy canned pineapple from suppliers with an internationally recognised food safety certificate. This usually means a Global Food Safety Initiative (GFSI)-approved scheme such as:

GFSI is a private initiative from the Consumer Goods Forum, a group of global food companies.

Supermarkets in the EU often ask for a BRCGS or IFS certificate to show that the supplier has a strong food safety system. Exporters should be ready for regular audits by independent auditors.

Quality and residue standards

European buyers often apply stricter rules than the official EU limits. This means that a product that passes border checks may still be rejected by a buyer if it does not meet their private standards.

To meet these standards, exporters should use integrated pest management on farms and monitor pesticide residues closely. Some buyers may reject products with any trace of certain chemicals, even if those levels are legal. For example, EU rules might allow small amounts of ethephon on pineapple, but a retailer might demand zero residue.

Buyers also care about organoleptic quality. This includes bright and natural colour, firm texture, and a natural sweet-tart taste without off-flavours. They may have product standards that are even above the Codex standard in terms of allowed defects (like blemished pieces, presence of core material). Exactness in drained weight and Brix levels in syrup are also checked.

Sustainability and ethical requirements

Canned pineapple usually comes from developing countries, so buyers want clear information about the whole supply chain. Buyers may ask suppliers to follow a code of conduct that includes labour conditions, environmental impact, and fair trade.

They often check this through social compliance audits. One common platform is Supplier Ethical Data Exchange (SEDEX) and its audit format called Sedex Members Ethical Trade Audit (SMETA). Many major food retailers in Europe accept SMETA audits. Large importers often ask if you are registered with SEDEX or if you have a yearly SMETA audit report. This helps avoid each buyer sending their own auditor. You can share one SMETA report with many clients.

Environmental sustainability is also very important. Buyers may prefer suppliers with sustainability certificates or programmes. For example, some pineapple processors, like Kiburi Fruit Canning Company in Thailand, choose ISO 14001 for environmental management. Others join carbon footprint reduction programmes to attract eco-conscious clients.

Voluntary certifications and labels

Some EU buyers prefer products with specific certification labels. One common certification is Fairtrade. Fairtrade standards make sure pineapple farmers get a fair price and extra money for community projects. If canned pineapple is Fairtrade-certified, it can carry the Fairtrade logo and attract consumers who care about social impact.

Most European retailers also want suppliers to have a traceability system and a recall plan. They may carry out audits or ask for documents to check this. You should be able to trace each batch (origin, date of processing, etc.) within hours, so any issue can be solved fast.

What are the requirements for niche markets?

Some markets in Europe need extra steps beyond the basic requirements. Selling to a niche market often means following extra rules like organic, sustainable farming, or religious food laws.

Organic market and sustainable agriculture

The organic market in the EU is large and requires full compliance with EU organic rules. Regulation (EU) 2018/848 explains the rules for organic products. To sell canned pineapple as 'organic', the fruit must be grown without synthetic pesticides, chemical fertilizers, or GMOs. The processing must also be certified organic. For example, organic canned pineapple cannot include non-organic sugar in the syrup. All ingredients must be certified organic.

The whole supply chain, from farm to cannery to exporter, must be inspected by a certified organic body. The exporter must get certification from a control body approved by the EU. Also, organic products need a Certificate of Inspection (COI) from an approved issuing body/authority to enter the EU.

The organic market pays more but also checks more strictly. Residue testing is common. If they find banned substances, the batch may lose its certification. Organic buyers also want eco-friendly packaging, so use recyclable cans and avoid Bisphenol A (BPA) linings in cans.

Rainforest Alliance (RA) certification may help you sell to buyers who want proof of eco-friendly farming. RA-certified pineapples protect biodiversity, soil, water, and show good farm management. If you use RA-certified pineapples and your facility has chain-of-custody certification, you can add the RA logo.

Dietary and religious niches

Canned pineapple fits vegetarian and vegan diets, but some consumers want extra certifications. For example, Halal certification may help if you sell to Muslim communities in Europe. Pineapple is a plant, but some buyers still ask for a Halal certificate. This proves there was no contact with alcohol or non-Halal ingredients during processing.

Kosher certification can help you sell to Jewish buyers and Kosher shops. Focus on countries or regions that have significant Jewish communities.

Health-focused products are another niche. Canned pineapple with no added sugar (in natural juice) may attract health stores or consumers who are monitoring their sugar intake.

If you use sweeteners, you must follow EU labelling rules. You must follow Regulation (EC) No 1333/2008 for sweeteners and Regulation (EU) No 1924/2006 for claims like 'no sugar added'.

Tips:

- Subscribe to AGRINFO email updates for recent changes to regulations, policies and standards impacting AGRINFO partner countries. Partner countries are low-income (least developed), lower-middle income and upper-middle-income economies.

- Join the FAO’s Responsible Tropical Fruits project. To learn more about the project, download the flyer (PDF) and write to the project team at Responsible-Fruits@fao.org to ask to join the project if you wish. Participation is free, and open to anyone in the pineapple supply chain.

- Check product sheets, like the technical sheet for canned pineapple from Thailand, to help build your product specs.

- Explore the most important social and environmental impacts for your business in the Sustainability snapshot for canned fruits published by the Sustainability Consortium.

2. Through which channels can you get canned pineapple on the European market?

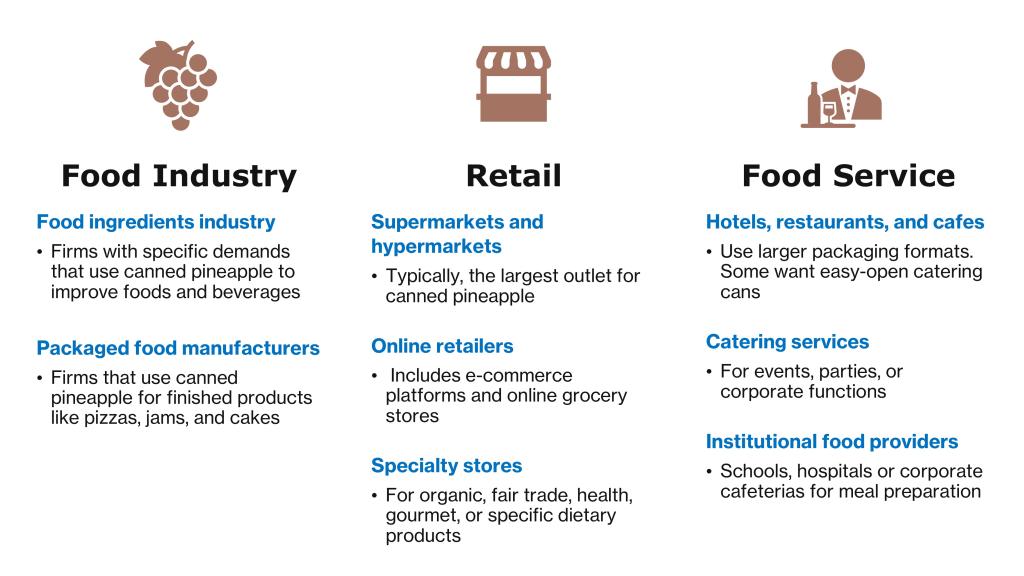

European buyers use canned pineapple in retail, food service, and the food industry.

How is the end market segmented?

Most canned pineapple in Europe is sold in retail. The rest goes to food service and food manufacturers.

Figure 3: End market segments for canned pineapple in Europe

Source: Autentika Global

Retail market (B2C)

Retail is the largest segment. Supermarkets, hypermarkets, and discounters sell most canned fruit. Consumers buy canned pineapple in tins or jars, usually packed in syrup or juice. Products range from basic private-label options to premium brands and organic lines. Retailers sometimes buy directly from producers but usually work with importers.

Most large grocery chains in Europe sell canned pineapple. They offer both branded products (like Del Monte, Dole, Princes) and private-label options. Private labels are important. In the UK, they made up around 49% of canned fruit sales in 2024.

Private-label food sales in the UK grow over 3 times faster than brands, says a May 2025 report. Consumers trust supermarket brands. As a result, premium private-label sales have also grown.

Several formats are common, such as 400 g cans, 565 g/580 g cans (more common in Southern Europe), 227 g or 250 g cans (sold as single-serve formats, sometimes in multipacks) and 350–500 ml glass jars. Discount retailers or hypermarkets also offer larger multipacks, such as 3×400 g or 4×250 g. Formats are standardised to match consumer habits and meal sizes.

Retail canned fruit sales in the UK rose 3.9% year-on-year to €180.4 million by 7 September 2024. Own-label sales grew 5.6% to €88.7 million, says an annual survey by The Grocer. Top-selling brands in the UK include Del Monte, Nature’s Finest, Princes, Opies and Dole.

Discounters like Lidl and Aldi (part of Germany’s Schwartz and Aldi Süd/Nord groups) sell large volumes of cheap canned pineapple under their own brands. Retail buyers have strict rules. Suppliers need food safety certification (like BRCGS or IFS), must follow codes of conduct, and use correct multi-language labels if necessary. Many retailers and importers also ask for proof of ethical sourcing, such as a SMETA audit or a similar check.

Buyers prefer healthier product options. Supermarkets often stock pineapple in juice or light syrup (low sugar) and low sodium to match health trends. Large suppliers have already introduced canned pineapple products that meet these needs. Canned fruits that are sold in heavy syrup are often equally tasty when packed in lighter syrups according to the University of Minnesota Extension service.

Food service (catering) market (B2B)

Hotels, restaurants, and catering firms use canned pineapple as a topping or ingredient. This segment is smaller than retail, but important for uses like pizza, desserts, and cocktails. Food service buyers often buy in bulk, using large 3 kg cans of pineapple chunks or other forms. They prefer stable supply and often choose pineapple in juice (rather than syrup) for more flexible use. Food service demand follows the hospitality sector. Demand fell during the COVID-19 pandemic, but has since recovered.

Main players include wholesalers and cash-and-carry stores that serve food service. Metro Group (Germany) sells large tins under its Metro Chef food service brand in over 30 countries. Food wholesaler Bidfood (UK) supplies canned fruits to the catering sector. Some wholesalers also do their own packing or sourcing. They want consistent quality and easy-to-use and easy-to-handle packaging, such as easy-open catering cans.

Transgourmet Holding (Switzerland) and Brakes (UK) also offer canned pineapple for the food service sector.

Organic and fairtrade canned pineapple is a small but growing niche. Because organic and fairtrade canned pineapple costs more than the regular kind, demand can change quickly. When prices rise or incomes fall, people usually buy less. Germany has Europe’s biggest organic food market (€16 billion in 2023), so it offers good potential for organic canned pineapple. For example, Morgenland (Germany) offers organic canned fruits in glass jars, and Fairtrade Original (Netherlands) sells fairtrade canned pineapple.

Food industry (manufacturing) market (B2B)

Food manufacturers use pineapple in products like bakery fillings, yoghurts, ice creams, and ready meals. This market is smaller, since some producers use fresh or frozen pineapple instead. Still, it is a good option for exporters that can supply in bulk.

Ready-meal and dessert makers need large, reliable pineapple supplies with specific sugar (Brix) levels. They often buy from importers or directly from producers for large volumes. For example, Dr. Oetker (Germany) needs pineapple for its frozen pizza line. Jam or fruit salad factories may buy canned pineapple as a semi-finished ingredient.

Some food processors want sustainability certificates or Corporate Social Responsibility (CSR) compliance, especially if they have such programmes. Conserve Italia (Italy) imports pineapple for its canned fruit cocktail products. Orkla Foods (Nordic region) also uses tropical fruit in its canned and jarred foods. These companies import in bulk and often prefer long-term deals.

Tips:

- Comply with European buyer requirements. Buyers expect HACCP, hygiene compliance, and BRCGS or IFS certifications.

- Highlight unique qualities, such as a sweet taste or unique flavour for niche segments. If your pineapple is organic or Fairtrade-certified, promote this to tap into the organic market in countries like Germany and France.

- Use the right packaging for the right market. Retail usually wants small net weight cans with labels. Food service needs larger (for example 3 kg) cans or aseptic bags. Understand segment needs and adapt packaging.

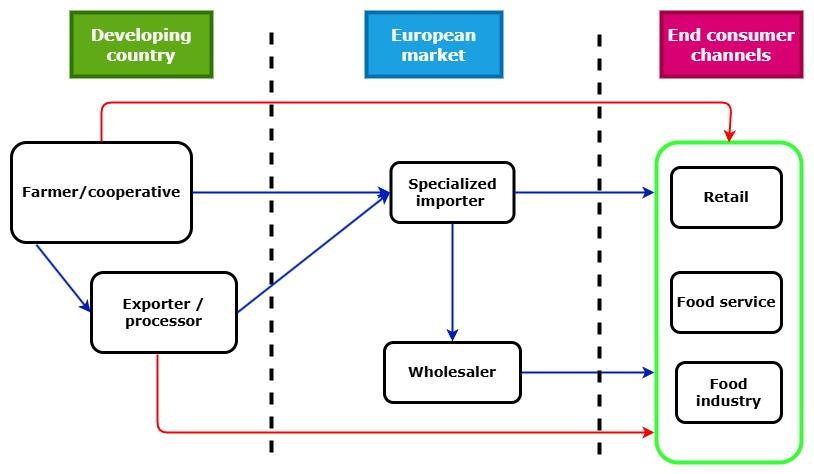

Through which channels does a product end up on the end market?

Canned pineapple reaches European markets through several distribution channels. The most common route is through specialised importers or distributors. Importers connect overseas producers with European buyers. They handle logistics, customs, quality checks, and sometimes storage.

Specialised importers or distributors

Importers are the best channel for new exporters because they buy in large volumes. Many importers also work as wholesalers and sell to retailers, food service buyers, or food producers. For example, Otto Franck Import (Germany) supplies canned tropical fruits to retailers and the food industry. Importers usually buy from several countries to keep supply steady and prices competitive. Another example is Andina Ingham in the UK.

Some importers own brands or pack for private labels. Large European importers often have long-term partnerships with producers in Thailand, the Philippines, or Indonesia. For example, Great Giant Foods Singapore, part of Indonesia’s Great Giant Foods, is a key supplier to Europe. It recently supplied over 70% of Germany’s canned pineapple imports.

Even Edeka, a major German retailer, uses its own import arm, Edeka Einkaufskontor, which managed about 17% of imports.

Figure 4: European market channels for canned pineapple

Source: Autentika Global

Direct sales to retailers (supermarkets)

In this model, large exporters or their agents sell directly to retailers or buying groups, skipping third-party importers. This is common for large, well-known suppliers or global brands. Retailers such as Lidl or Aldi sometimes buy directly from producers in origin countries to lower costs.

They may sign contracts for private-label canned pineapple, shipped to their distribution centres. A retailer might hire a Thai cannery to produce pineapple under its private label. The retailer’s import team would manage the logistics.

Selling directly to retailers requires exporters to handle complex logistics and strict rules. But it can be profitable, as it removes middlemen and gives large, regular orders. This path is only open to exporters who can deliver large, steady volumes. They must also meet strict rules on quality, certificates, and delivery timing. Missing one delivery slot can kill the deal.

European food manufacturers or processors

In this channel, the buyer is a food company that uses pineapple in its products. They can be canneries, juice makers, or bakeries. Some large manufacturers in Europe import directly if their volumes are high.

This channel usually uses bulk packaging, like 220-litre drums, not consumer-sized cans. This channel sometimes overlaps with others. For example, one importer may sell to both retailers and food factories from the same stock. One example is SVZ from the Netherlands, which makes fruit preparations and may import pineapple for processing.

A jam manufacturer in Poland might directly import drums of pineapple pieces to use in tropical jam, or a yogurt producer in France might source aseptic pineapple tidbits to mix into dairy products. Many of these manufacturers still buy through importers or brokers, but a few engage in direct sourcing, especially if they require a specific variety or cut.

This channel often involves bulk shipments (like 220-litre drums or bulk containers of pineapple in syrup) rather than consumer-ready cans. An importer may supply both retail and industrial clients from the same stock.

Retailers in Europe often join multinational buying groups to purchase in large volumes. For example, AgeCore and Coopernic help retailers buy private-label goods together across different countries. Small or medium-sized exporters may find it difficult to sell directly to retailers, but not impossible. Some niche or smaller supermarket chains buy directly from specialised suppliers. This is more common for organic or Fairtrade canned pineapple.

What is the most interesting channel for you?

For small or medium-sized exporters (SMEs), importers or wholesalers are usually the best partners. Importers are often the best option for SME exporters. Importers are in the middle of the supply chain. They buy from you and sell to retailers, food service, or factories. They become your main customer and handle the hard work of reaching the market.

Tips:

- Be ready to discuss product details like shelf life and delivery terms.

- Learn the typical profit margins in the fast-moving consumer goods (FMCG) sector.

3. What competition do you face on the European canned pineapple market?

The canned pineapple market is dominated by developing countries in Asia and Africa.

Which countries are you competing with?

Canned pineapple markets depend a lot on the crop size in the main producing countries. The volume of canned pineapple also depends on how much fruit goes to fresh pineapple and pineapple juice production.

Indonesia, Thailand, the Philippines, Kenya, Vietnam, Eswatini, and Costa Rica are the main competitors in the European market. Other emerging suppliers include Peru, China, Guatemala, and Côte d’Ivoire.

Source: Autentika Global, ITC, 2025

Thailand: a top exporter with fruit supply problems

Thailand is one of the top 3 exporters of canned pineapple to Europe. Thailand exported 46,340 tonnes in 2024, down from 65,258 tonnes in 2023. In 2021 and 2022, Thailand exported over 90,000 tonnes to Europe. Exports to Europe fell at an average rate of 8.9% per year between 2020 and 2024.

Thailand has many pineapple farms, good factories, and low labour costs. But in 2023, production fell by 40% because of climate phenomenon El Niño. There is still a shortage of pineapples for canning. In late Q1 2025, canneries processed less than 3,000 tonnes of fruit per day, according to Henry Lamotte Food. Only small increases were expected, up to around 3,500 tonnes per day, before the summer harvest peak in April and May.

Many Thai canneries had to reduce production or stop working for a time because of the fruit shortage. This supply problem raised prices and made Thai suppliers seem less reliable to European buyers. Henry Lamotte Food cut its 2025 forecast for Thai pineapple to 700,000 tonnes. This is the second year in a row with a record low. In comparison, the 10-year average was 1.2 million tonnes. In the best years, Thailand processed almost 2 million tonnes, according to an industry source.

Pineapple grows in 2 seasons in Thailand: the summer crop from February to June, and the winter crop from October to December. European buyers used to see Thailand as a reliable and cheap source. But now there are more concerns about the sustainability of production.

One big difference with Indonesia and the Philippines is that Thailand gets most of its pineapples from small farmers. This makes it harder for processors to get sustainability certificates. If processors buy from many small farms, audits and paperwork are harder to manage and cost more.

The EU’s Generalised Scheme of Preferences (GSP) scheme does not apply to Thai canned pineapple. There is also no free trade agreement in place. So, Thai canned pineapple pays the full EU import tariffs for 'third countries'. To get the latest real‑time figure, run the product code through the EU TARIC/Access2Markets database.

Philippines: the only major exporter to Europe with rising sales

The Philippines is also among the top 3 exporters of canned pineapple to Europe. From 2020 to 2024, the Philippines exported between 37,000 and 63,000 tonnes to Europe each year. The Philippines ranked third in exports to Europe from 2020 to 2023 but became the second-largest exporter in 2024. It was also the only one among the top 4 exporters with positive growth, reaching a 0.9% average yearly increase over the past 5 years.

The Philippines has a strong, integrated pineapple industry, led by multinationals. Most pineapples grow on the island of Mindanao, where Dole Philippines (Dolefil) and Del Monte Philippines Inc (DPMI) have large operations. The industry controls the full supply chain, from farms to canneries. This setup allows full traceability, high food safety, and better sustainability and social standards.

The Philippines also has a trade benefit: canned pineapples enter the EU duty-free under the GSP+ scheme. Growing local demand and occasional typhoon damage can reduce export volumes. Also, since only a few big companies control the sector, buyers in Europe have less flexibility.

Indonesia: a growing and reliable supplier to Europe

Indonesia has become a major competitor in the European canned pineapple market in recent years. Although drought affected Indonesia too, its pineapple production stayed fairly stable. This is mostly thanks to integrated plantations, like the one run by Great Giant Pineapple (GGF) in Lampung Province.

European buyers see Indonesia as a reliable source with good quality. Most pineapples are of the Smooth Cayenne variety, like those from Thailand and the Philippines. This matches European taste preferences.

Indonesia’s integrated production helps balance supply changes in the market.

The industry also benefits from low labour costs and better technology in food processing. For example, Indonesian canneries are efficient and use modern quality control systems. Some factories even have more advanced automation than those in other countries.

Indonesia benefits from the EU’s GSP scheme, but still faces high import tariffs, between 14% and 22%, depending on the product format.

Kenya: Africa’s top canned pineapple exporter

Although it exports less than the large Asian producers, Kenya has some unique advantages. Del Monte Kenya leads the sector. It runs a large 10,000-acre pineapple plantation and cannery in Thika.

European buyers see Kenya and other African countries like Ghana as good alternatives to Asian suppliers. One big advantage is year-round production due to their closeness to the equator. This allows for continuous or staggered harvests, making these countries useful off-season suppliers for Europe.

Shipping from Kenya to Europe is faster than from East Asia, because of the Suez Canal route.

Kenya exports canned pineapple duty-free to the EU under its Economic Partnership Agreement (EPA). It uses GSP preferences for less than 2% of its exports, as most trade goes through the EPA. Since the EPA gives the same or better benefits, Kenya will leave the GSP on 1 January 2027.

Tips:

- Check the import tariffs for your product using the My Trade Assistant for goods tool on the Access2Markets website.

- Check if your country is on the EU's GSP list. The GSP helps developing countries by reducing or removing tariffs on their exports to the EU.

Which companies are you competing with?

Different types of companies export to Europe. Some are global multinationals, while others are national companies with integrated supply chains. There are also small and medium-sized exporters that can still compete.

Thai companies

Prachuap Khiri Khan province is home to large pineapple processors like Saico and Natfruit. These 2 companies are key players in Thailand’s canned pineapple exports.

Saico now includes TPC (Thai Pineapple Canning Industry), Thailand’s first pineapple cannery, founded in 1962. Saico serves both retail and food service buyers. It sells canned pineapple (rings, chunks), fruit cocktails, and value-added sauces. TPC’s factories helped make Saico one of the top global pineapple exporters. It exports products under both its own brands and private labels.

Siam Food Products is another major Thai exporter of canned pineapple. The company uses Smooth Cayenne pineapples for its canned products. In Europe, Siam Food supplies major retailers with private-label products. For example, it has packed Pirkka and K-Menu pineapples for Finland’s Kesko Group since 2002. The company passes regular food safety and social audits (like amfori BSCI) to meet EU standards.

Other Thai exporters include Kiburi, Sunlee, TBI, Praft, Trofco, Samroiyod, Siam Pineapple, and Natfruit.

Indonesian companies

GGP is one of the world’s biggest private-label producers of canned pineapple. It is part of the Gunung Sewu Group. GGP sells canned pineapples in over 60 countries. It also has trading offices in the USA, Singapore, Japan, and South Korea. Most GGP products come from 34,000 hectares of land in Lampung and East Java.

Its subsidiary, PT Great Giant Pineapple, is the largest private-label pineapple canner in the world. It says it exports over 15,000 containers to more than 60 countries, with a 25% market share.

Wilmond is another local exporter. Other exporters are listed here.

Filipino companies

Dolefil, part of Dole Food Company, runs one of the world’s biggest integrated pineapple farms and canneries in Mindanao. Its farms cover over 20,000 hectares. It packs up to 40,000 boxes of fresh pineapples per day. Its canneries in Surallah and Polomolok process about 1 million tonnes of pineapple per year. The products are shipped from ports in Gensan and Davao. Dolefil exports around 84% of all Philippine canned pineapples.

DPMI is based in Bukidnon and Misamis Oriental. It runs one of Asia’s oldest pineapple farms (since the 1920s) and a full processing plant. DPMI is best known for the Del Monte canned fruit brand, which is well established in Europe. Other important Filipino exporters include Philpack and Century Pacific Food.

Kenyan and other African companies

Most exports come from Del Monte, so the quality is consistent and meets global brand standards. Del Monte sells Kenyan canned pineapple in Europe under its well-known brand.

One weakness of the Kenyan origin is the low number of suppliers. This can reduce pricing flexibility because one big player controls the market. A few other companies like Premier Foods are also active.

In Ghana, Nano Foods runs a modern canning factory with its own quality lab. It uses Ghana-grown Smooth Cayenne and MD-2 pineapple varieties. Nano Foods plans to produce 8 million canned pineapples each year for Europe. It focuses on ethical sourcing (farm inspections, fair prices) and a sustainable supply chain.

Rhodes Food Group (RFG) is a top South African company and one of Africa’s leading canned fruit producers. Its Eswatini branch, Fruit Products Eswatini (formerly Swazican), produces large volumes of canned pineapple for export. Swazican began in 1954 as Africa’s first commercial pineapple cannery.

Tip:

- Commit to quality and safety. Use systems like ISO and HACCP, and get certified by standards trusted by EU buyers. Saico is a good example of success through strong food safety systems.

Which products are you competing with?

Most pineapple producers focus on the fresh pineapple market because of the higher prices. In Europe, consumers can buy fresh pineapple with or without a crown, or pre-cut in slices sold in plastic chilled tubs. Processed pineapple mainly competes with fresh pineapple.

This competition also happens in the fruit markets of supplier countries. Farmers prefer to sell to the fresh market because it pays more, so processors must compete to get fruit.

4. What are the prices of canned pineapple on the European market?

Canned fruit producers usually have little control over raw fruit prices. They must compete with many other buyers to get enough fruit. This includes buyers from the fresh fruit, frozen food, and juice industries. Their buying volumes and prices affect what smaller buyers like canners must pay for fruit.

High fruit prices in supplier countries can reduce canned pineapple production. This can push prices up. Because Europe depends fully on imports, its supply and prices depend on harvest sizes in main supplier countries.

Canned pineapple is already processed and packaged. It needs little extra work once it arrives in Europe.

Table 2 below shows a rough indication of margins in the value chain. Different origins have different duties and shipping costs, so this breakdown does not factor in those differences. Different end markets also have different value added tax rates.

Table 2: Sample structure of the retail price of canned pineapple (350 g branded can pineapple pieces in juice)

| Components | Description | Canned pineapple slices in 350 g can | |

|---|---|---|---|

| % of shelf price | € per 350 g can | ||

| Raw materials | Pineapple fruit + tin/label/carton | 20% | € 0.60 |

| Processor/exporter | Factory, labour, energy, inland haulage, margin | 28% | € 0.84 |

| Shipment | Ocean freight, insurance, EU customs clearance & domestic trucking. Freight costs can vary significantly. | 13% | € 0.39 |

| Importer | Wholesaler margin and costs | 9% | € 0.27 |

| Retail | Store & distribution centre costs + gross profit, excluding VAT | 23% | € 0.69 |

| VAT (7% on food) | Value added tax | 6.5% | € 0.20 |

| Total | € 2.99 | ||

Source: Autentika Global, 2025

Tips:

- Steel and coating prices are volatile. Separating this cost might help exporters negotiate a transparent 'metal surcharge' with their buyers instead of squeezing farm-gate or processing margins.

- Read CBI’s study on fresh pineapple to learn more about the competition and possible opportunities. One opportunity is to promote the sustainability of canned pineapple, especially its lower food waste and lower use of plastic packaging.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research