The European market potential for mobile application development services

The European mobile app development market is growing. The most promising European markets are the United Kingdom, Germany, the Netherlands, France, Sweden, and Central and Eastern Europe (CEE). These countries are home to many IT firms and have very active startup ecosystems. However, many of these countries do not have enough IT professionals. This makes them attractive for mobile app development companies from developing countries.

Contents of this page

- Product description: mobile application development

- What makes Europe an interesting market for mobile application development services?

- Which European countries offer the most opportunities for mobile application development services?

- Which trends offer opportunities or pose threats in the European mobile application software development market?

1. Product description: mobile application development

Mobile application development (also called mobile app development) is the creation of software applications that run on mobile devices, such as smartphones, tablets and smartwatches. Mobile apps are designed specifically for the hardware and features of mobile devices, creating an optimised user experience. These apps are usually built for particular operating systems, mainly Android or iOS. They can also be accessed through mobile web browsers.

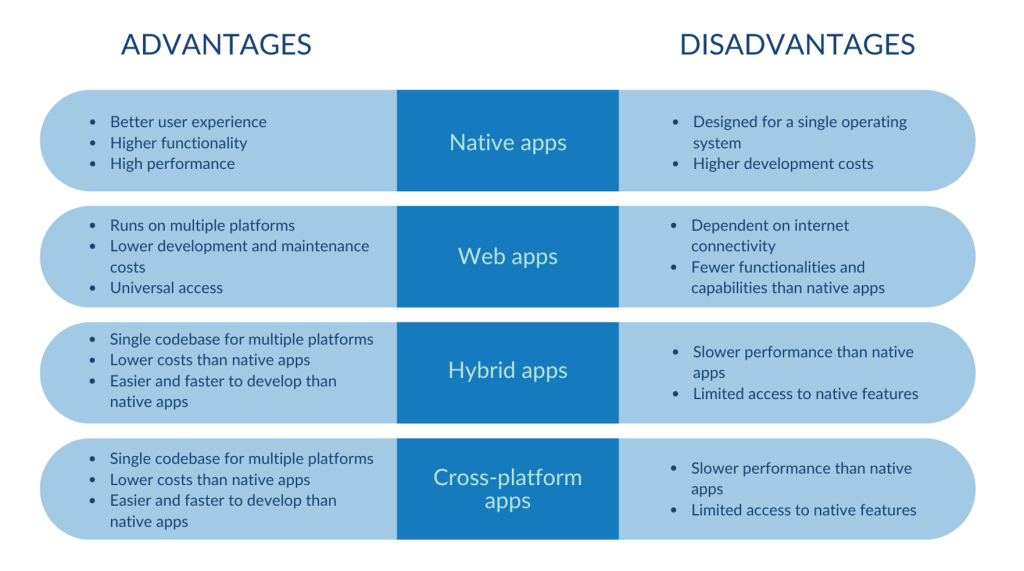

There are four types of mobile apps:

- Native apps: Native apps are created for one operating system, like Android, iOS or Windows. This means you need to develop separate apps for each platform, using the tools and languages that the platform supports. For example, the two programming languages for iOS app development are Objective-C and Swift, while Android apps use Java and Kotlin.

- Web apps: Web apps look like native apps but run in a browser. Web apps are platform-independent. This means they can be used on all platforms. Users can access them through URLs. Sometimes they need to create an account. Web apps are developed using web technologies like HTML5, CSS and JavaScript.

- Hybrid apps: Hybrid apps are built using a single codebase, meaning they can be used on any device or platform. They are developed with widely accepted technologies like HTML, JavaScript and CSS. They are then wrapped in a native container using platforms like Cordova, Ionic and Capacitor.

- Cross-platform apps: Cross-platform apps are also developed using a single codebase that works on multiple platforms. Popular cross-platform frameworks include Flutter, React Native and Kotlin Multiplatform.

Figure 1: Types of mobile apps: advantages and disadvantages

Source: Globally Cool

Tip:

- Before you start developing mobile apps, work out the best approach to software development. For more information, read IBM’s articles on mobile application development, iOS app development and Android development.

2. What makes Europe an interesting market for mobile application development services?

The European mobile app market is growing. Consumers are spending more time on their mobile devices. The EU also supports digital transformation through its policies and funding programmes. There has been significant growth in jobs in the EU’s app economy. At the same time, many European companies are experiencing shortages in terms of IT skills. This creates opportunities for you to enter the European market.

Europe’s mobile app market is growing

According to Statista, the global revenue from in-app purchases (IAP) was €171.2 billion in 2024, an increase of 6.6% compared to 2023. This growth was particularly strong in the United States and Europe, boosted by the amount of time consumers spend on their mobile devices and their growing comfort with making mobile purchases. In terms of Europe’s top markets, there was especially strong growth in the United Kingdom (UK) and Germany.

European countries make up a large part of the top 20 largest mobile markets worldwide. With an In App Purchase (IAP) revenue of €4.1 billion, the UK is Europe’s largest mobile app market. The UK is followed by Germany, France, Switzerland, Italy and Spain.

Source: Statista, 2024

In Europe, the UK, Germany and France had the most app downloads in 2024, totalling around 2.8 billion. In terms of time spent on apps, the UK was the highest in Europe, spending 63.9 billion hours in 2024. The UK was followed by Germany, Italy and France. They spent between 48.9 billion and 57.8 billion hours on apps.

Tip:

- In addition to studying growth trends in the European market, work out which niches and segments offer the most potential, how competitors position themselves and what local consumer behaviours are like. This will help you identify the best market opportunities.

The European app job economy is growing

There has been a notable increase in jobs in the EU app economy. In October 2023, there were more than 2.9 million jobs in the EU app economy, a 53% increase compared to 2019. Including the UK, Switzerland and Norway, there were 3.7 million jobs in the app economy in the EU in 2023 (+56% compared to 2019).

*Europe: EU plus UK, Switzerland and Norway

Source: PPI, 2023

The increase in the number of app jobs was driven by two factors:

- Digitalisation has created more demand for tech-skilled employees;

- More essential services are now delivered through mobile apps. These include financial, shopping, healthcare and government services.

As mobile apps become more important to everyday life, more jobs are needed to build, update, maintain, support and secure apps.

The European countries with the most app economy jobs are the UK, Germany and France (661,000–667,000 jobs in 2023). They are followed by the Netherlands and Spain, with 331,000 and 185,000 jobs, respectively.

IT and mobile app development skills shortage

European companies continue to struggle with a shortage in IT skills. There is a large gap between the number of software development jobs and the number of available software developers. In 2024, 58% of EU companies that recruited or tried to recruit ICT specialists had difficulties filling these vacancies. This shortage varies considerably across EU countries, from 21% in Montenegro to 72% in Germany.

*of enterprises that have recruited or have tried to recruit ICT specialists.

Source: Eurostat, 2025

In 2024, 15% of all companies in the Netherlands were looking for ICT specialists. 63% of them had difficulties finding them. To fill the shortage, companies in Europe try to hire software developers from abroad. A cheaper option is to outsource software development tasks. Smaller ‘end-user’ companies in particular often outsource IT tasks locally. In turn, these local IT companies often look for nearshore or offshore outsourcing partners, like you.

In 2024, 72% of EU companies outsourced ICT functions to external suppliers. This percentage has been relatively stable since 2020. How much of this percentage is outsourced to offshore providers is unclear.

There is a shortage of skilled professionals in mobile app development. According to Forbes’ IT Skills Gap report, mobile app development is one of the ten most sought-after IT skills in the UK job market, mentioned by 16% of respondents. In France, Silkhom evaluated how difficult it is to find candidates for specific jobs, using a scale from 0% (easiest to find) to 100% (most difficult). They rated the difficulty for all types of app developers (Android, iOS and cross-platform) at 85%, indicating a significant challenge.

Tip:

- Research the most in-demand job roles and required skills in mobile app development in your target market. Use platforms like IT Jobs Watch and Indeed. Identify which hard and soft skills local companies often need by analysing job vacancies.

Digital transformation and the mobile-first approach in Europe

Digital transformation means using digital tools and technology to change how organisations work. It is used in all areas of an organisation, from processes to operations and products. This is done with the goal to allow for customer-driven innovation.

Digital transformation is a priority for the EU. With the policy programme Europe’s Digital Decade, the EU has set concrete targets and objectives for 2030 in:

- Digitally transforming businesses;

- Digitalising public services;

- Skills;

- Creating secure and sustainable digital infrastructures.

The EU has set the goal that all its citizens should have access to their electronic health records by 2030. In 2024, 48% of the EU member states provided citizens access to their e-health records through online portals and mobile apps.

EU funding programmes accelerate the trends surrounding digital transformation. For example, the Digital Europe Programme (DIGITAL) is a funding programme that has a budget of over €8.1 billion. It focuses on bringing digital technology to businesses, citizens and public administration systems.

Mobile applications are often thought of as the gateway to digital transformation. In the EU, mobile phones are the most common way to access the internet. In 2023, 86% of people aged 16–74 used mobile phones to go online.

Mobile devices are essential for businesses and consumers. For example, mobile apps help engage customers, show real-time business data and increase sales. This pushes non-tech companies in a variety of sectors to partner with mobile app developers.

3. Which European countries offer the most opportunities for mobile application development services?

There are a lot of factors you can think about when looking for European countries with the best opportunities for you, such as:

- Outsourcing market size (openness to offshoring);

- The country’s digital maturity;

- Shortages of mobile app developers;

- Number of app economy jobs;

- IAP revenue.

Figure 5: Promising European markets for mobile app development services

Source: Globally Cool

Table 1: European countries that offer opportunities for mobile app development services

| IAP revenue (in € 2024)** | Europe app economy jobs per country (October 2023) | European enterprises with hard-to-fill vacancies for ICT specialists (% in 2024) | |

|---|---|---|---|

| UK | 4.1 billion | 667,000 | 84 |

| Germany | 3.9 billion | 633,000 | 72.41 |

| France | 2.2 billion | 611,000 | 61.77** |

| The Netherlands | 0.7 billion | 331,000 | 63.10 |

| Sweden | 0.6 billion | 163,000 | 53.03 |

CEE countries: Poland Czechia Hungary | 0.4 billion 0.2 billion N/A | 121,000* 52,000* 31,000* | 32.25 70.74 62.43 |

*Data from 2021, **IAP revenue estimate for 2024

Source: Globally Cool, based on information from Eurostat, Hyve Managed Hosting IT and Tech Skills Gap Report 2024, the PPI EU App Economy report, PPI Europe App Economy 2021, and Statista

The following countries offer the most opportunities: the UK, Germany, France, the Netherlands and Sweden. Europe’s largest mobile app markets in terms of IAP revenue are Germany, the UK and France. These countries are some of the top ten largest mobile app markets in the world and show strong growth. The Netherlands and Sweden are smaller but have relatively large mobile app job economies. They also have lower barriers to entry (such as language and openness towards ITO) than Germany and France.

Central Eastern European (CEE) countries like Poland, Czechia and Hungary also have opportunities. Although CEE countries can be seen as competitors to companies from developing countries, they also offer opportunities for partnership. CEE countries are an important nearshore outsourcing location for the main European markets. However, due to growing prices and the lack of skilled professionals in these countries too, you may be able to partner with CEE companies.

The United Kingdom: The biggest app job economy in Europe

The UK is Europe’s most advanced digital economy. It is a leading destination for investment, startups and tech companies. London is Europe’s main startup hub thanks to it being home to top financial companies and fintech industry, venture capital ecosystem and many businesses that operate in artificial intelligence (AI) and deep-tech.

British adults spend around 4 hours and 20 minutes online per day. Of this, 75% is spent on their smartphones. In 2024, 94% of British people older than 16 owned smartphones. In 2023, this was 87%. On average, UK smartphone users had 38 apps installed on their phones. 52% of users had Apple iPhones and 47% had Android smartphones (1% selected ‘neither’ or ‘don’t know’).

The UK app development industry is valued at €33.6 billion in 2025 and has grown at a compound annual growth rate (CAGR) of 12.9% over the past five years. The UK has around 14,527 businesses active in the app development industry. The average growth between 2019 and 2024 was 5.6%. Looking specifically at jobs in the UK app economy, the number increased from 380,000 jobs in 2019 to 667,000 jobs in 2023, representing a 75% change. This makes the UK the biggest app job economy in Europe.

App development costs vary a lot depending on factors like the complexity of the app, platform choice, design, user experience, features, integrations, and development team and location. Depending on these factors, the average cost of developing an app in the UK varies from around £10,000 to more than £150,000.

One major challenge UK companies face is a major shortage of IT and tech skills. In a 2024 survey of 505 UK businesses, 84% reported IT and tech skill shortages, and 81% said these shortages affected their operations negatively. These companies claimed to work with suppliers or managed service providers (35%) to address this. Almost two-thirds of the UK business leaders use managed service providers.

The UK has a long history of outsourcing software development. It is considered as having an outsourcing-friendly culture. Of the European markets, the UK is the most open to offshore outsourcing. This openness is driven by the UK’s cost-conscious business culture and historical connections with many countries around the world. Even traditional businesses are more open to remote and offshore teams even after the Covid-19 pandemic.

You should know that the UK is a very competitive market, and there is a lot of competition from nearshore and offshore providers. When working with British companies, keep in mind that they value professionalism, punctuality and clear communication. British clients also want value for their money. Premium pricing only works if you have a strong portfolio.

Germany: Strong focus on privacy and data security in mobile app market

Germany has Europe’s biggest economy. With a population of over 84 million, it represents 19% of EU’s total population. Revenues in the ITO market were expected to reach €29.3 billion in 2025. Between 2025 and 2029, the market is expected to grow at a CAGR of 7.4%, reaching a market volume of €38.9 billion.

Germany’s mobile app market is expected to make €27.7 billion in revenue by 2030. The sector is driven by a well-developed digital infrastructure and a high level of smartphone use. The mobile app market is predicted to grow at an annual rate of 14.5% from 2024 to 2030. In 2023, Germany made up 5% of the total global mobile app market in terms of revenue. Germany has the second largest economy for app-related jobs in Europe. The number of jobs increased from 458,000 in 2019 to 633,000 in 2023, an increase of 38%.

When developing apps for the German market you should consider the country’s strong focus on privacy, data security and strict regulations. Germany is a leader in data privacy. This means apps should comply with strict security standards. You have to make sure your apps are GDPR compliant, use advanced encryption to protect the data and provide secure data storage. The app should handle user data in a safe way, ask for user consent and allow for data access and deletion rights.

E-commerce and fintech related apps are popular in Germany. As remote work grows, interest in productivity and business apps does too. One notable trend is the integration of the IoT, especially in the automotive and smart home sectors. According to a 2024 Bitcom study, 46% of Germans use at least one smart home app, and the average user has seven apps installed. The main reasons for the use of smart home apps are convenience, quality of life, saving energy and home security.

Germany’s app market is very competitive, with both local developers (like Ambient Digital) and global companies (like Appinventiv). To succeed, you should focus on high quality and using the latest technologies. For example, tech-savvy German users expect apps to use advanced technologies like AI, AR/VR and IoT. The costs of developing a customised mobile app in Germany vary from €37,000 to €280,000 depending on the client’s needs.

Be aware that German companies are generally less open to offshoring than other countries like the UK and the Netherlands. However, as German businesses face skill shortages and become more experienced in offshoring, their attitude towards it is improving. Germany has the most issues with filling vacancies for ICT specialists in the EU (72.4% in 2024). Whitelane Research showed that 44% of German IT-spending will increase nearshore outsourcing in 2024, and 29% planned to leverage offshore resources in 2023.

German companies generally prefer to work in German. Generally, you will need an intermediary in Germany to communicate with clients. Alternatively, someone within your company should be fluent in German.

The Netherlands: High digital maturity and scarcity of ICT specialists

The Netherlands has a lot of potential for mobile app developers. The country has high digital maturity, a strong business ecosystem, growing demand for digital solutions and a positive attitude towards international collaboration.

The Netherlands has the highest percentage of people with basic and above-basic digital skills and use the internet in the EU. Smartphone usage and mobile app adoption are very high amongst consumers and businesses. The government and private sector also share a ‘digital-first’ mindset, actively promoting mobile integration across services.

App developers play a crucial role in the Dutch digital economy. They affect wide variety of industries, such as retail, finance, healthcare and education. The Netherlands is home to major startups and scaleups like Booking.com, Picnic, Adyen and Bird. The Dutch app developer community is diverse. It consists of independent freelancers, small and medium-sized enterprises (SMEs), and large international companies with offices in the Netherlands. In 2023, there were around 331,000 app-related jobs in the Netherlands.

There is significant demand for apps in healthcare, fintech and e-commerce. The Netherlands leads these sectors. Other strong sectors with mobile demand include education tech, smart cities and public services, green tech and mobility innovation.

The strong competition from local and international mobile app developers is a challenge in the Dutch market. You should also be aware that expectations for design and user experience (UX) are high. Dutch users expect you to make well-designed, user-friendly and intuitive apps. As such, you need solid user interface (UI) and UX capabilities.

Dutch companies are generally open to outsourcing. A 2024 survey by Whitelane Research showed that 74% of organisations that spent money on IT planned to keep or increase their IT budgets for external providers in the next two years. The main reasons for outsourcing IT services are a lack of talent, the need to scale operations and a desire to focus on core business activities. In 2024, 63.1% of recruiting companies faced issues with filling vacancies for ICT specialists. In the mobile app segment, there is a shortage of mobile developers, UX designers and product-focused engineers.

Many IT organisations plan to expand nearshore operations alongside offshore and onshore strategies. 44% expect nearshoring to increase. However, there is not enough capacity in nearshore markets to meet this demand. Prices and staff turnover are likely to go up. This will make large transitions to nearshore markets more difficult. This creates a lot of opportunities for companies looking to offer services to the Dutch market.

Sweden: Strong startup and innovation ecosystem

Sweden is a highly digitalised country, with high smartphone penetration and early adoption of new technologies. The country has a strong startup and innovation ecosystem, especially in Stockholm, Gothenburg and Malmö. Sweden is the birthplace of companies like Spotify and Klarna. Many scaleups and established businesses need external app development partners to grow fast.

Sweden’s web and mobile application development industry is strong and growing. In 2023, there were around 163,000 jobs in the Swedish app economy. With mobile and tablet devices being the main way users engage with businesses online, the need for mobile app development is still on the rise.

Sweden is well-known for its video game industry. It has the third highest concentration of gaming companies in Europe. There were 1,010 gaming companies in 2023, an increase of 7.6% over the previous year. Major players like King (creators of Candy Crush) top the revenue charts. The expected revenue for mobile gaming in 2025 was €322 million. The industry is known for its innovation, using upcoming technologies like virtual reality (VR) and augmented reality (AR).

Other sectors with a strong demand for mobile apps include fintech, healthcare, green tech and sustainability, and public services. For example, more businesses in different industries are integrating financial services into their platforms. This has led to strong growth in fintech applications. Between 2023 and 2024 downloads increased by 14.9%. Sweden has a strong focus on sustainability, particularly on cleantech and climate tech. Its climate tech sector is one of the strongest in Europe, with around 500 companies.

In 2024, 53% of Swedish companies struggled to fill vacancies for ICT specialists. According to Tech Sverige, eight out of ten of its member companies find it challenging to attract the right talent. Areas that face shortages include mobile development, UI/UX and backend integration. As a result of the skills gap, Swedish companies are increasingly turning to international talent. Between 2024 and 2029, the Swedish outsourcing market is expected to achieve an annual growth of 8.6%.

When developing apps for the Swedish market, be aware that users have high expectations and standards. Make sure to develop high-quality apps that are fast and bug-free. Swedish users have very high demands for UX, design and quality. If your company does not have a strong focus on UI or UX, it can be difficult to enter the market. To stand out, you need to offer niche skills (for example Flutter or fintech experience), strong references or case studies, good communication and effective project management from start to finish.

France: Mobile development jobs experience a strong growth

France is a strategic and fast-evolving market for mobile apps. It is a large market, digitally ambitious and increasingly mobile-first. The market has its own challenges in terms of language and competition.

In 2024, 91% of French people had smartphones, an increase of 4% compared to 2023. Most smartphone users have Android operating systems (73%) and only 25% have iOS. 54% of the French have tablets at home.

The French app economy had 611,000 jobs in 2023. This is an increase of 41% compared to 2019. However, the French IT market is still affected by a skills shortage. This has led to considerable tension in the labour market. According to Silkhom (an IT recruitment company), mobile development jobs are undergoing strong growth. In 2024, salaries related to Android and iOS went up by 10%. Salaries of cross-platform developers increased by 13.9%. These three professions saw significant increases in salaries.

Table 2: Salaries and requested skills of mobile app developers in France, 2024

| Mobile app developers | Median annual salary | Increase median annual salary compared to 2023 | Skills needed |

|---|---|---|---|

| Cross-platform developer | €51,250 | +13.9% | Flutter, React Native, Ionic, Java, Android, SDK Android, Kotlin, Objective-C, Swift and/or Golang |

| Android developer | €49,500 | +10% | Android, SDK Android, Java and Kotlin |

| iOS developer | €49,500 | +10% | SDK iOS, Xcode, Swift, Objective-C and Apache Cordova |

Source: Silkhom, 2024

The frontend technologies that were most in demand at Silkhom from January 2023 to May 2024 were React.js, Angular, Vue.js and TypeScript. The most requested back-end technologies were Java, Node.js, PHP and Python.

Table 3: Most requested frontend and backend technologies in France

| Most requested frontend technologies* | Most requested backend technologies* |

|---|---|

| React.js 18% | Java 29% |

| Angular 13% | Node.js 17% |

| Vue.js 12% | PHP 16% |

| TypeScript 10% | Python 12% |

*Frequency of mentions in job offers in web or mobile frontend/backend development on Silkhom from January 2023 to May 2024

Source: Silkhom

In the French market, you will have to deal with strong competition from domestic suppliers. France has many strong local agencies, especially in the Paris and Lyon regions. French companies active in mobile app development include Lunabee Studio, Yield Studio, Galadrim and Hello Pomelo. Competing on price alone is not enough. You will have to specialise, be reliable, offer high client service and deliver high-quality design. French clients have high standards for design, aesthetics and branding.

Be aware that French is the preferred business language. This is especially true of SMEs and the public sector. Larger companies and startups might use English, but this is not always the case. When serving the French market, you should have French-speaking team members in your organisation. This makes France especially interesting for mobile app development companies from French-speaking African countries (for example Senegal).

CEE countries: From competitors to potential partners

CEE countries can be seen as competitors for mobile app developers from developing countries. They are an important nearshore outsourcing location for the Western and Northern European ITO markets. However, CEE countries are facing increased prices and serious skills shortages. As such, CEE countries also offer opportunities for partnerships.

Several CEE markets offer opportunities, each for different reasons. Poland is a large market with a relatively large economy for app-related jobs. In 2021, there were 121,000 app-related jobs. Czechia is a smaller market but struggles with finding ICT specialists. After Germany, Czechia has the most issues with filling vacancies for ICT specialists (70.7%). The high need for ICT specialists creates opportunities for mobile app companies from developing countries.

Examples of companies that develop mobile apps in CEE countries include CoreTechs Solutions, Mindtech Apps (Hungary) and Ackee (Czech Republic).

Tips:

- Study how mobile app developers promote their services in your target market. This will help you understand market priorities and how to stand out from competitors. For example, look into Appinventiv’s mobile app development process, unique value proposition (UVP) and focus areas in the German market.

- Make sure you clearly highlight what sets you apart from competitors in the European market. Simply offering lower prices is not enough. For example, focus on strengths like fast delivery, niche expertise, strong case studies, high-quality design or excellent communication.

- Check out Open Trade Gate Sweden’s report The Swedish Market – IT Services for more information about the technical requirements for IT software providers in the Swedish market, important trade fairs, business associations and recommendations for IT companies from developing countries.

- Check out Sortlist to find mobile app agencies in the Netherlands. It provides an overview of the companies, the services they offer, their skills in mobile app development, and so on.

- Visit relevant trade fairs and events in your target market to meet potential partners and learn about the trends in the market. These include the DecompileD Conference, WeAreDevelopers World Congress (Germany), Appdevcon (The Netherlands), London Tech Week, TECHSPO London (UK) and MWC Barcelona (Spain).

4. Which trends offer opportunities or pose threats in the European mobile application software development market?

AI is evolving rapidly. This has consequences for the mobile app development market. Users now expect smarter, more intuitive and user-friendly apps. At the same time, Europe’s growing focus on sustainability is driving demand for greener app development practices. The Internet of Things (IoT) is also becoming more integrated into everyday life, with mobile apps playing a key role as dashboards and remote controls for connected devices.

Integrating AI: Users want smarter and more convenient apps

There is a growing trend of integrating AI features into mobile apps. This is caused by the fast-changing digital world, with users expecting smarter, more convenient, and easier-to-use apps. Some say that AI integration is more than a trend; it is a necessity. By using AI, app developers can build apps that are more personalised, efficient and user-friendly.

According to SensorTower State of Mobile 2025 report, generative AI apps made a powerful entrance into the market in late 2022. Worldwide IAP revenue from AI chatbots and AI art generators increased from €26 million in 2022 to €1.1 billion in 2024. The leading markets for Gen AI apps are the United States, the UK and Germany.

Figure 6: Downloads for apps that mention AI in top European mobile app markets, in millions

Source: SensorTower

In 2024, the top European mobile app markets saw a significant increase in downloads for apps that mentioned AI. Compared to 2023, downloads went up by 50% in Germany and France, and 33% in the UK.

By the end of 2024, chatbots were the most used type of AI app. However, AI features are also integrated into many other types of apps, such as games, photo and video editing, education, finance and lifestyle. In general, many sectors are adopting AI, and mobiles are the main interface.

Integrating AI into mobile apps offers opportunities. For example:

- AI-powered personalisation: AI enables a highly personalised user experience. AI algorithms can analyse user behaviour, preferences and interactions to tailor content, features or services to individual users. For example, Spotify uses AI to personalise the listening experience. It gives the user music recommendations and personalised playlists.

- AI for automation and productivity: AI-powered chatbots and virtual agents can be embedded into mobile apps, offering instant help and improving user satisfaction. For example, the language learning app Duolingo uses an AI-powered chatbot to help users practice a language.

- AI-supported predictive analysis: AI can empower mobile apps with predictive analytics by analysing large datasets to uncover patterns, trends and future outcomes. This is interesting for many sectors such as finance, healthcare, retail and energy apps. For example, the online retailer Zalando uses AI in trend forecasting and inventory management.

Lastly, you can use AI in the mobile app development process. AI can automate routine tasks. This allows you to develop apps faster and more efficiently.

One company that uses AI in mobile app development is Growth Loops Technology. This India-based software development agency specialises in mobile app development, web development and AI development services. The company develops native and cross-platform apps. They offer custom mobile solutions, including services like predictive analytics, AI-powered automation, chatbots and virtual assistants, image and speech recognition, and AI-driven threat detection and response.

Tips:

- Study how you can implement AI into mobile app development. Read Uptech’s 7-step guide for more information on how to integrate AI into an app.

- For more information on AI, see our study Exporting artificial intelligence software development services to Europe.

Sustainability: Green app development

In 2020, the ICT sector (including data centres, communication networks and user devices) used approximately 4–6% of total global electricity use. This percentage keeps on growing. Mobile apps contribute to this, negatively affecting the climate.

According to Appinventiv, mobile apps are responsible for nearly 0.75 grams of carbon dioxide-equivalent emissions. This may not seem a lot. However, globally there are around 5 billion users, who spend an average of three hours per day on apps. Moreover, in 2024 alone, 137.8 billion apps and games were downloaded worldwide. This means apps contribute to approximately 6% of total digital carbon emissions.

There is increasing demand for sustainability in mobile app development. Green app development is all about designing, building and maintaining mobile apps with an emphasis on reducing environmental impact. It integrates sustainable practices throughout the whole app development lifecycle, focusing on aspects like energy efficiency, responsible data usage and sustainable architecture and infrastructure.

There are many things you can do to make mobile apps more sustainable, such as:

- Use efficient coding practices to lower energy consumption. Writing clean and lightweight code helps apps run better and saves battery;

- Select cloud hosting providers powered by renewable energy;

- Optimise data handling: Minimise network requests and data transfer to reduce energy use and bandwidth consumption;

- Promote user behaviours that reduce the carbon footprint. For example, offer energy-efficient settings and eco-friendly reminders.

Tips:

- Follow Appinventiv’s step-by-step process on how to develop a green app.

- For more information on sustainability, see our 7 tips on how to go green in the outsourcing sector.

IoT: Industrial IoT is leading in Europe

The Internet of Things (IoT) consists of everyday physical devices equipped with sensors, internet connectivity and software. They can collect, send and receive data. IoT devices can be anything from smart home appliances, to industrial machinery. IoT devices are increasingly embedded in our day-to-day lives.

Mobile apps act as dashboards and remote controls for IoT and Industrial IoT (IIoT) devices. They are the bridge between physical devices and digital control. As such, there is a lot of potential for mobile app developers to create mobile apps for IoT and IIoT. Mobile apps can be used for multiple purposes:

- IoT and mobile apps: Mobile apps serve as remote control panels or dashboards for users. For example, they can monitor device status (battery, activity, location), receive alerts and notifications (motion detected, door unlocked) and send commands (turn off lights, adjust temperature).

- IIoT and mobile apps: Mobile apps enable field operators, engineers and managers to monitor machine health and process performance, receive predictive maintenance alerts and manage industrial workflows remotely.

Tips:

- Research your target market in Europe to identify which sectors have high demand for IoT solutions. Focus on niche IoT applications within high-growth industries. Niche expertise will help you stand out from competitors and better meet local and sector needs.

- For more information on IoT, see our study on the European market for (I)IoT services.

- For more information on trends, see our study on trends in the European outsourcing market.

- In general, the European mobile app market is quite saturated. To stand out as a newcomer, you need a unique added value.

- Be aware that there are strict regulatory requirements you need to comply with when offering mobile app development services in the European market. Missteps may result in fines. See our study Entering the European market for mobile application development services for the requirements you need to consider.

Globally Cool carried out this study in partnership with Laszlo Klucs on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research