Entering the European market for socks

Socks belong to the ‘basics’ category. Even though socks might seem like a simple item, production can be quite complex and specialised. Similar to fashion and textiles, the sock business is affected by ever-stricter legislation on sustainable production introduced in the European Union (EU).

Contents of this page

1. What requirements and certifications must socks meet to be allowed on the European market?

When exporting socks to Europe, you need to comply with several requirements. Some are mandatory, both legal and non-legal. Other requirements are voluntary, but meeting them can give you a competitive advantage. Some requirements only apply to niches in the sock market.

What are mandatory requirements?

There are several legal requirements for exporting socks to Europe, including those concerning product safety, the use of chemicals (REACH), quality, and labelling. Check the EU Access2Markets online helpdesk for an overview.

Follow these steps to ensure that your product complies with the relevant legal requirements:

- Make sure your product complies with the European Union’s (EU) General Product Safety Regulation (GPSR: 2023/988). If your buyer supplied the product design, it is their responsibility to guarantee it is legally safe for end-consumers to use;

- Make sure you comply with the EU’s REACH Regulation. It restricts the use of chemicals in apparel and trims. Test input materials before production to prevent non-compliance;

- Pay particular attention to the following safety standard that applies to socks for children: EN 14682;

- Specify the material composition of every pair of socks that you export to the EU, in line with Regulation (EU) 1007/2011. Check the EU Access2Markets online helpdesk on how to do so;

- Do not violate any intellectual property (IP) rights, and do not copy or share designs with other buyers. If your buyer provides the design, they will be liable if the item violates a property right.

Tips:

- Read the CBI study on buyer requirements for an extensive overview of the legal, non-mandatory and niche requirements for apparel exports to Europe, including specific national requirements.

- Check the EU Access2Markets online helpdesk for an overview of all legal requirements for your product.

Additional regulations for work socks

If you are exporting workwear socks designed to protect against specific risks (for instance cold, moisture or chemicals), they are classified as PPE (personal protective equipment). Such socks must comply with EU Regulation 2016/425. This means they must be CE-marked, meet relevant standards, such as those for thermal protection or chemical resistance, and include technical documentation detailing design, manufacturing and testing results.

Socks that are treated with biocidal substances to prevent odour or bacterial growth must comply with the EU’s Biocidal Products Regulation (BPR 528/2012). Only approved active substances may be used, and products must be labelled with information about the biocidal treatment, including the active substance used and its purpose. Manufacturers must also provide information to consumers within 45 days upon request.

Tip:

- Be aware that illegal branding and/or copying of socks happens often in the industry. Make sure that your buyer has permission to use the brand name, logo and designs.

Non-legal mandatory requirements

Buyers may confront you with additional, company-specific terms and conditions. Such requirements are usually written in a buyer manual. By signing a contract with your buyer, you confirm that you will comply with all the requirements listed in the manual. You will be held accountable in case of a problem after the delivery of an order. If a buyer does not have a manual, make sure all terms and conditions are clear and agreed upon beforehand to avoid unpleasant surprises.

The following topics may be included in a buyer manual.

Figure 1: Demand for socks made with sustainable materials is growing in Europe

Source: Vodde

Payment terms

For first-time orders, European buyers may give you a down payment via bank transfer (for instance 30%). They will pay the rest (70%) before shipment, again via bank transfer, or bank guarantee. This statement guarantees that the sum will be paid at a certain date.

Another payment method is the L/C (Letter of Credit). With an L/C, the buyer’s bank must pay the supplier when both parties meet the conditions they have agreed upon. This is the safest payment method for a manufacturer. An L/C can also be used to get finance to purchase materials. Many buyers don’t favour L/C payments, because the payable amount is blocked in their bank account to secure payment.

For follow-up orders, most European buyers will ask for a TT (Telegraphic Transfer/Open Account) after 30, 60, 90 or sometimes even 120 days. This means that payment will be made the agreed number of days after you have handed over the shipment. You as the manufacturer take full financial risk.

Delivery terms

Free on Board (FOB) is the standard Incoterm used by buyers and sellers to agree on the delivery of goods. Some buyers may ask you to agree to Delivery Duty Paid (DDP) due to rising shipping costs. This is the riskiest Incoterm for you as a manufacturer.

Nominated suppliers

Some buyers may require you to purchase materials from a nominated supplier. This means that you are responsible for the ordering, delivery and payment of materials. This may negatively impact your flexibility, cost, speed and liquidity. Discuss locally available solutions with your buyer to replace nominated suppliers.

Acceptance quality limit

Your buyer may set an acceptance quality limit (AQL). This refers to the worst quality level that is still acceptable. For instance, AQL 2.5 means that your buyer will reject a batch if more than 2.5% of the items are defective. Different countries and buyers have different quality standards. Focus on buyers that share the same quality standards.

Packaging requirements

Your buyer will instruct you how to package the order. If you agree to delivering Free on Board (FOB), your buyer will clear customs in the country of import. It is their responsibility to ensure instructions on the packaging comply with EU import procedures.

Make sure to minimise unnecessary packaging materials by not packing each individual item and avoiding empty space. Use reusable packaging (reusable cardboard boxes for instance) and choose packaging containing recycled materials (such as recycled cardboard, including hangers) or biodegradable plastics (polybags). Provide clear labelling for recycling and composition.

Restricted substances

Ask your buyer if they use a Restricted Substances List (RSL). These lists are often based on the guideline on safe chemicals use from the Zero Discharge of Hazardous Chemicals (ZDHC) foundation or AFIRM.

Certification

Many European buyers require suppliers to get certified for sustainable and/or fair production or the use of sustainable materials. The most popular standards and certifications in Europe include WRAP, SA8000, Sedex, B-corp, OEKO-TEX® STeP, GOTS and Recycled Claim Standard.

Amfori provides a list of organisations that can perform an audit. Note that Amfori BSCI is almost a standard requirement for many European apparel companies.

Transparency

Supply chain transparency is key in the European apparel industry. Share information about your own operations with buyers, and help them gain as much insight as possible into your entire supply chain and the materials used.

The new Ecodesign for Sustainable Products Regulation (ESPR, 2024) will introduce a Digital Product Passport: a digital identity card for garments and materials. Information on this card can include:

- The product’s technical performance;

- Materials and their origins;

- Repair activities;

- Recycling capabilities;

- Lifecycle environmental impacts.

Worker happiness

Your buyer may require that you pay attention to diversity and inclusion in your workforce. All individuals in your company should have equal opportunities, regardless of gender, race, religion or other characteristics. Watch the CBI webinar on worker happiness for background information and tips.

Animal welfare

If you use natural protein fibres such as wool (including speciality wools such as merino, alpaca, cashmere or silk), animal welfare is an important concern. Buyers may require that you only use RWS-certified wool. If you use merino, buyers may require that you use only non-mulesing wool.

Regenerative agriculture

Regenerative agriculture is a concept focused on phasing out harmful fertilisers and pesticides and ‘regenerating’ nature. Several large European apparel retail groups have set goals in this area, including H&M and Inditex.

Carbon footprint

Many European brands have committed to climate neutrality. Calculating the CO2-footprint of an apparel item is a complicated process, which starts with carefully measuring your emissions before reducing them. Read our tips to measure and reduce your carbon emissions for more information.

Recycling

The EU is introducing new legal measures to increase circularity, including new directives on durability and ecodesign of textile products and a ‘right to repair’. The EU is also considering the introduction of an EU-wide extended producer responsibility (EPR) for apparel. This makes companies responsible for the way their products are disposed of, recycled or repaired. Some countries, including France, the Netherlands and Sweden, already have national EPR schemes. Recycling and repurposing materials helps your buyers reduce waste and save resources.

Tips:

- Read the buyer manual carefully, and don't be afraid to negotiate terms and conditions before signing an agreement. Never agree to comply with requirements you cannot realistically meet.

- Don't take financial risks with new buyers. Check their credibility, insure your orders via an insurance company or insist on a Letter of Credit. If you agree to an extended payment, don't forget to calculate and add interest.

- Never accept payment terms that are too risky for your factory. Don’t be afraid to discuss shorter payment periods or partial payments throughout the production process.

- Consider factoring to finance materials. This means selling your order to a bank or factoring company that pre-pays you a certain percentage of the value of the order, in exchange for a commission. An additional benefit is that the bank will perform due diligence on the buyer, which tells you whether they are a trustworthy business partner.

- If inflation in your country is high, maximise local sourcing to cut costs. If your buyer has foreign nominated suppliers, try to advise about local alternatives. Also make sure that your buyers pay in USD or euro. Getting paid in local currency will increase the risk of lower profits in case of inflation.

What additional requirements and certifications do buyers often have?

In addition to mandatory requirements, there are many services that buyers implicitly expect or highly appreciate if you want to do business with them.

Product design and development

European buyers are always looking for unique designs, materials or production methods that will help them stand out in the market. Interesting materials and innovations that have recently been applied to socks include:

- Recycled polyester (rPET);

- Recycled cotton;

- Organic cotton;

- Hemp fibre (durable, antibacterial, eco-friendly);

- Bamboo viscose;

- Graphene-infused yarn (improves thermal regulation, anti-odour);

- Copper-infused fibres (antimicrobial, antifungal);

- Moisture-wicking polyamide;

- Merino wool (natural temperature regulation, anti-odour);

- Elastane/spandex with zoned compression (for compression in specific areas: arch, calf);

- 3D knits (seamless knit zones to improve fit);

- Silicone grip or heel tabs (prevents slipping);

- Smart sock sensors (embedded pressure and shock sensors that track gait, posture and step count);

- Phase change materials (heat release and absorption based on skin temperature).

Figure 2: Sock production is a highly automated process, requiring specialised machinery and worker skills

Source: Forward in Fashion

Styles

Different socks are used for different occasions. Popular sock styles by length include half socks (covering the front part of a foot), low-cut socks (also called sneaker socks, not visible with naked ankles), ankle socks (regular socks covering the ankle), crew socks, quarter socks, knee-high socks, over-the-knee socks, thigh-high socks and toe socks.

When sorting socks after washing, finding the pieces that make a pair is always a challenge. Some brands have therefore added a coloured stitching line or button to identify the pair.

Another way to classify socks is by weight, as seen in the table below.

Table 1: Different weight classifications, common uses and features of socks

| Weight category | Thickness | Purpose | Common features |

|---|---|---|---|

| Ultralight/featherweight | Very thin | Hot weather, dress wear | No cushioning, maximum breathability, tight shoe fit |

| Lightweight | Thin to moderate | Running, cycling, everyday wear | Light cushioning (usually at heel/toe), moisture-wicking |

| Midweight | Medium | Hiking, trekking, sports, work | Moderate cushioning and insulation, good balance of comfort and breathability |

| Heavyweight | Thick | Cold weather, mountaineering, skiing | Dense cushioning, strong insulation, may feel bulky |

| Extra heavyweight/expedition weight | Very thick and dense | Extreme cold, winter sports, military use | Maximum insulation and protection, may require larger footwear |

Source: FT Journalistiek

According to media outlets, the long white sports sock has made a massive comeback in Europe, especially among younger generations (Gen Z). Low-cut sneaker socks and ankle socks are supposedly more popular among millennials and older European end consumers.

Figure 3: The long white sports sock is a popular style choice among younger Europeans

Source: Anastasia Anastasia via Unsplash

Printing

Printed socks are often included in European fashion collections. There are different printing techniques: lithography (using printing plates and rollers on fabric); digital printing (inkjet and laser, allows for small production runs) and screen printing (transferring images onto fabric using a fine material or mesh/film). Printing can be outsourced, but having your own printing and embroidery machines increases your flexibility.

Communication

Smooth communication is crucial. Always reply to emails within 24 hours, even if it is just to confirm that you have received the email and will send a longer reply later. If you have a problem with a production order, immediately let the buyer know and offer a solution. Create a critical path for every order and share it with your buyer. This is a list of every single step in the production and delivery process, and the time each step takes. This will help you manage expectations and monitor progress.

Flexibility

If you want to start a business relationship with a European buyer, be prepared to accept complicated orders at first. Buyers will want to test your factory before giving you large, easy orders. Make sure from the start that a buyer will not continue to place only difficult orders with you, and convenient orders elsewhere. Expect a European buyer to require in their first order:

- High material quality and impeccable workmanship;

- Order quantities below your normal minimum order quantity (MOQ);

- A lower price level than you would normally accept for small-quantity orders.

To increase flexibility, factories can install a sample room (to produce small orders), a modular production setup (an island instead of a production line), or a U-shaped setup, where employees can control several machines at the same time.

What are the requirements for niche markets?

Although most of the manufacturing business is focused on mainstream volume, there are other segments that might offer opportunities.

Seasonal socks

Seasonal and festive socks are typically designed with bold, thematic patterns, such as snowflakes, reindeer or pumpkins, to align with holidays like Christmas, Halloween or Valentine’s Day. They often use bright, contrasting colours and elements like glitter, embroidery and 3D add-ons. Many brands release limited-edition collections or gift-boxed socks specifically timed for seasonal gifting.

Sustainable socks

More European sock companies are using sustainable materials in their collections, such as natural or recycled fibres. Consider the following materials and production methods:

- Organic cotton. This is cotton grown without the use of GMOs (genetically modified organisms) and synthetic chemicals. Read more about organic cotton in the CBI study on sustainable cotton;

- Use of fabrics blended with eco-friendly fibres. These include hemp, regenerated fibres such as Tencel®, Modal® and Refibra™ (by yarn manufacturer Lenzing); Vodde; other sustainable fibres such as Recover, REPREVE and Infinited Fiber; or even innovative bio-based polymer fibres such as PLA, milk, seaweed and soy;

- Saving water during production by dyeing fabrics with new techniques (using CO2 instead of water), such as Dyecoo;

- Fabrics dyed with only natural ingredients such as Fibre Bio and Greendyes, or dyes made from recycled materials such as Recycrom.

Compression socks

Compression socks are made with strong, elastic materials such as nylon, spandex (elastane) and sometimes polyester to promote blood flow. They must maintain consistent compression levels over time, and are designed to reduce swelling, prevent thrombosis, support circulation and aid in muscle recovery. Users include athletes, frequent travellers, people with circulatory issues, pregnant individuals and workers who stand or sit for long periods. For more information, read the CBI study on adaptive apparel.

Promotional socks/licensed

Socks sold as promotional wear are a large niche market, showing a specific product or even city (logo), and are often sold in tourist shops. Socks made with different comic prints are sold in large quantities for both adults and children. Make sure to only use copyrighted brands, logos or images if you are licensed to do so.

2. Through which channels can you get socks on the European market?

Before you approach European sock buyers, you need to determine what market segment fits your company best and through which sales channel(s) you want to sell your product.

How is the end-market segmented?

European sock buyers are best classified by price/quality level.

Table 2: Sock market segmentation

| Consumer type | Price level | Fashionability | Material use | Functionality | Order quantities |

|---|---|---|---|---|---|

| Luxury consumers | Very high retail prices | High-comfort, fashionable designs and shapes | Highly innovative, luxury materials | Very high requirements regarding design | Low order quantities |

Mainstream fashionable consumers | Medium retail prices | Combination of fashionable and casual multi-purpose items, brand image | Good quality, sometimes sustainable materials | High requirements regarding comfort | High order quantities |

Price-conscious consumers | Very low retail prices | Basic styles with a focus on comfort | Medium-low quality materials | Low functionality | High order quantities |

Source: FT Journalistiek

Luxury consumers

High-fashion consumers shop luxury brands like Prada or Gucci and visit retailers like Galeries Lafayette (France), KaDeWe (Germany) and de Bijenkorf (Netherlands). These consumers expect their socks to represent a strong brand image and the latest fashion trends, with a focus on maximum comfort. Sock brands in the luxury market require top-quality materials and manufacturing, plus the latest technical innovations.

Mainstream fashionable consumers

In the middle market, lifestyle sock brands like Bleuforêt, Happy Socks and Falke cater to mainstream sock consumers. These companies sell collections created around a brand image and offer a quality product for a mid-level price. Products must have the technical look of a high-end product, but retail prices are lower.

Price-conscious consumers

The budget market includes companies like Primark, H&M and Zeeman, which cater to the price-conscious recreational athlete and sock consumer. Design and technical innovation are less important, but the apparel item needs to give the impression that it is fit for purpose and in line with the latest fashion trends. Prices are low and competition is strong in this segment, both in terms of retail and manufacturing.

Tips:

- Visit online shopping platforms for socks, like YOOX (luxury and upper-middle market segments), Zalando (all market segments) and ASOS (middle and budget market) for inspiration on styles and colours.

- Collaborate with EU-based distributors, wholesalers or retailers to gain market access. Don’t forget to choose an entry strategy, whether it is exporting directly to retailers, participating in trade fairs or establishing a local presence.

Through which channels does a product end up on the end market?

A buyer's place in the value chain determines how they will do business with you. Each buyer requires a specific approach. Always try to find out what part of the value chain your buyer is operating in, what challenges they face in the market, and how you can contribute to their sales strategy.

| Who is your buyer? | Requirements | Examples |

|---|---|---|

| European end-consumer | You can target European end-consumers directly with your own online shop (with promotion via social media), or indirectly via existing platforms. You will need to invest in an online shop, stock, order management and customer service. Your biggest challenges will be return policies and a lack of brand awareness. Note that online B2C-platforms may require a percentage of each sale and/or a monthly fee. If you sell to European end-consumers directly, you need a legal representative in Europe to ensure compliance with the EU’s General Product Safety Regulation (GPSR: 2023/988). | Alibaba, Wish, Amazon, ASOS marketplace, Rakuten (Spain, France), Allegro (Poland), Bol (Netherlands, Belgium), Wolf & Badger |

| Online multi-brand platform | Online multi-brand platforms sell existing brands and often develop their own private collections, mostly value brands. They can detect market interest quickly and will immediately react to sales data. Usually, such companies will place a small test order first. If the item is selling well, they will place the actual production order. Fast delivery is a must. | Zalando (YOURTURN), ASOS (ASOS DESIGN), Farfetch, Boozt (Scandinavia), ABOUT YOU, La Redoute (France), YOOX |

| Retailer | Socks are sold by big retail chains in shops and online, and by smaller boutique shops found in almost every European city. Retailers sell existing brands and may order collections specially developed and manufactured for them. | H&M, Inditex, Primark, M&S, C&A, Galeries Lafayette, KaDeWe, de Bijenkorf, Decathlon, Carrefour |

| Brand | Apparel brands typically develop a collection 6 to 9 months in advance. You will need a sample room, as brands require salesman samples (SMS) of each collection style. Every salesman sample needs to be actual: it must look exactly like the product will in the shop. It may take many months before orders are placed. | Bleuforêt, Happy Socks, Falke, Burlington, Punto Blanco, Schiesser, Giesweinn |

| Intermediary | Agents, traders, importers and private-label companies sell your product on to buyers higher up the value chain. They are extremely price-focused and require flexibility in quantities and qualities. Some are located near or in production countries and primarily do sourcing and logistics. Others work from Europe and also do market research, design and stockkeeping. Their service level determines the commission rate they charge. | Li & Fung, Brand District, Worldtex, Miles Group, Dewhirst |

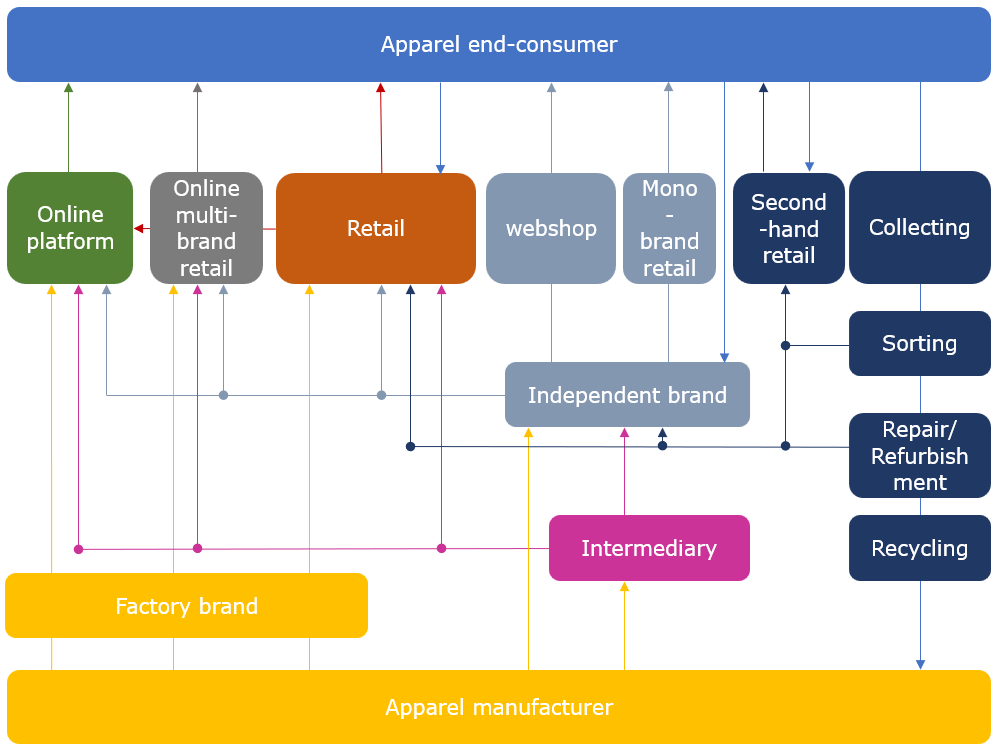

Figure 4 shows the many ways you can get your product on the European market, either via an intermediary, your own or other brands, retailers or online (multi-brand) platforms. Ideally, consumers can return apparel items to the seller after use, to be reused, repaired, refurbished or recycled.

Figure 4: Apparel market value chain

Source: FT Journalistiek

What is the most interesting channel for you?

As you move higher up the value chain, your margin will increase, and so will the service level your buyer expects from you. If you are a smaller factory with little or no experience in exporting to Europe, intermediaries and brands are the best starting point. Such companies have the largest market share and service every price/quality segment in the market. Intermediaries and brands are also used to working with suppliers in different production countries worldwide.

Tips:

- Find potential buyers on the exhibitors' list of trade fairs such as Pitti Immagine (Italy, fashion), Première Vision (France, fashion), Modefabriek (Netherlands, fashion), ISPO (Germany, sportswear) or A+A (workwear, Germany). If you plan to meet a potential buyer at a fair, research their collections, buy one or two items, and prepare matching or even improved samples. Also work out costing before introducing your company and samples to a potential buyer.

- You can find intermediaries specialised in socks by using an online search engine. Use keywords such as ‘full service’, ‘garment’ or ‘socks’, plus ‘solution’. Traders' websites usually show the brands they work with.

- Stay updated on new technical developments in the market. To get an advantage over the competition, be an advisor as well as a producer.

3. What competition do you face on the European sock market?

Apart from dedicated sock brands like Bleuforêt, Happy Socks, Falke and Burlington, most apparel brands and retailers sell socks as a side product in addition to fashion or footwear. As such, they belong to the accessories category. Only highly specialised manufacturers cater to this market, limiting competition.

Which countries are you competing with?

Although sock production is a highly specialised trade with a limited number of suppliers, socks are produced worldwide. The four biggest sock-exporting countries are China, Türkiye, Pakistan and Vietnam.

Table 3: Competing sock exporters

| Country | Strengths | Weaknesses | Image in Europe | Future developments |

|---|---|---|---|---|

China | Scale, technical innovation, high efficiency, excellent customer service, local availability of materials. | Inconsistent quality standards, rising labour and production costs, no Generalised Scheme of Preferences (GSP). | Flexible and innovative. | Although companies are no longer fully focused on China, it is still not possible to manufacture apparel without some dependence on the Chinese supply chain. |

| Türkiye | Close to the EU, very short lead-times, high-quality apparel in small quantities, European business culture, payment in euros. | Relatively high labour and production costs. | High flexibility, but becoming expensive due to inflation and increasing costs. | Benefitting from near-shoring and investments in automation, growing competition from neighbouring countries. |

| Pakistan | Good quality, availability of local cotton and GSP. | High MOQs and security/transparency issues. Many buyers do not want to travel to Pakistan (or are prohibited from doing so by their company). | Attractive price level, but unsafe travel conditions. | Under pressure to improve compliance, invest in sustainable production and automation, and lower MOQs. |

Vietnam | High efficiency levels, relatively low production costs. No GSP, but a new free trade agreement with the EU. | High MOQs. Lack of local fabrics, accessories and trims. | Volume business and mainly focused on the US export market. | The Vietnamese apparel sector will remain an industry with a focus on exporting high-volume orders to the US market. |

Source: FT Journalistiek

Unpredictable American trade policy affects competitiveness

During the first half of 2025, the United States carried out a highly unpredictable trade policy. Many developing countries on the list of exporters are facing tariffs higher than the 15% base rate. The new measures include tariffs of over 19% on products from all six top exporters of apparel to the USA (China, Vietnam, Bangladesh, India, Indonesia and Cambodia). Most of these tariffs are in effect as of 7 August 2025. Expect stronger competition from countries affected by these policies, as they may (also) want to intensify trade with Europe as an alternative to trading with the USA.

Tips:

- Study the countries you are competing with, compare their strengths and weaknesses to yours, and advertise the competitive advantages of doing business with you. Besides GSP, consider factors such as distance to Europe, ease of doing business, transparency, political stability and general CSR compliance.

- Check if and how other countries benefit from the Generalised Scheme of Preferences on the EU’s website on international trade.

- Most online search engines let you create a news alert for a topic. This helps you to easily follow the latest developments in the apparel industry in a specific country.

Which companies are you competing with?

- Moody Socks Factory is a leading sock manufacturer based in Giza, Egypt. The company produces high-quality socks for both local and international markets. They specialise in private-label and wholesale services, offering fast production times and competitive prices. Moody Socks uses advanced Italian knitting machines to manufacture a wide range of socks, including options for men, women, children, sports and formal wear. The factory is known for using premium Egyptian cotton, which is soft, strong and breathable.

- Infiiloom is one of India’s largest sock manufacturers. It operates three factories, producing over 150 million pairs of socks each year. Infiiloom creates a wide range of socks for men, women and children. Their products include formal, casual, sports and medical socks. They work with many global brands, like Adidas, H&M and Puma. The company uses modern Italian knitting machines and eco-friendly materials to make their socks.

- Angro is a family-owned Dutch manufacturer and trading company in legwear. The company started in 1995 and focuses on designing, producing and selling legwear and accessories. They offer a wide range of products, including socks and hosiery, to customers in various European countries. Angro works with a network of manufacturers to create both their own brand and private-label collections. Their clients include individual retailers, wholesalers, chain stores and online shops.

Tips:

- Check the free online database Open Apparel Registry. The website lets you look up the suppliers of hundreds of European fashion brands, including sock buyers.

- Read the CBI study ‘11 tips for doing business with European apparel buyers’ to learn how to approach and engage with buyers. The study also describes how to get practical help with understanding European business culture, analysing your unique selling points (USPs) and doing business with European buyers.

Which products are you competing with?

Socks are a very specific product category with very little competition. Competition for socks can be found mainly within the different sock categories.

The barefoot trend

Some European end consumers go barefoot, a summer trend helped along by footwear brands such as Vivobarefoot and the growing popularity of footwear styles such as espadrilles, loafers and ballerinas.

Sustainable socks

Some sock types are more popular than others, as trends go. Sustainable socks, athleisure socks and designer socks with bold colours, patterns and luxury branding are currently on trend.

Tips:

- Consider offering toe socks or half socks. These socks cover the toes and ball of the foot, leaving the ankle bare and visible. This type of sock has become very popular for people who prefer barefoot styles such as espadrilles and ballerinas, but still want the protection of a pair of socks.

- Follow the latest trends in sock styles and designs by reading online magazines like Business of Fashion, Fashion United and Vogue. Social media is another great source of market intelligence. Follow hashtags like #socksstyle or #fashionaccessories on Instagram or TikTok.

4. What are the prices of socks on the European market?

The production of socks is a highly automated process, with the socks themselves being almost entirely made by machines. In an average sock factory, four machines can be simultaneously controlled by a single worker. Ironing, finishing and packing are also managed by workers.

The factory price of your product is influenced by many factors, such as the cost of materials, the efficiency of your employees and your overhead and profit margin. For a step-by-step guide on how to calculate the FOB-price of an apparel item, read this CBI study on cost price calculation.

The average cost breakdown of your Free On Board (FOB) price for socks should look something like this:

Source: FT Journalistiek

Retail pricing

The retail price of an apparel item is on average 4-8 times the FOB price (the ‘retail markup’). It follows that the FOB price is, on average, 12.5-25% of the retail price of the product.

Exceptions do occur. In the budget market, some large European retail chains may only double the FOB price. Luxury brands may multiply the FOB price by 7-12. Retailers mark up the FOB price by 4-8 because they need to account for (among other things) import duties, transport, rent, marketing, overhead, stockkeeping, markdowns and VAT (15-27% in EU countries).

Some factories accept lower profit margins during the off-season, or when order volumes are high. In addition, the percentages for labour versus fabrics may differ, depending on the efficiency and wage level of the workforce and the price of materials. Higher costs due to inflation, increasing taxes, sustainability requirements, lower quantities or nearshoring can lead buyers to adopt bigger margins.

Source: Eurostat 2024

Europe’s most expensive countries for apparel

According to Eurostat’s 2024 comparison of retail prices for apparel in Europe, Denmark, Sweden and Finland are the EU countries with the highest price point compared to the European average (100), while Switzerland is the most expensive non-EU European country for apparel (143.4). Looking at Europe’s biggest apparel importers, Italy has the highest apparel retail prices (107.8), followed by Poland (103) and Germany (101.4). Retail prices in Poland have especially increased in recent years.

Tip:

- Read the CBI study on cost price calculation for a step-by-step guide on how to calculate your FOB price and develop a pricing strategy.

FT Journalistiek carried out this study in partnership with Giovanni Beatrice on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research