Entering the European market for dried ginger

Europe buys dried ginger for the food industry, retail and service segments. Exporters must meet EU limits on contaminants and pesticide residues and provide clear labelling. To access buyers across Europe, ensure you have an HACCP system in place and opt for recognised sustainability certification. The main competitors in the European market are companies from China, Peru, Nigeria and India. Nigeria lost a lot of market due to low yields, allowing China to consolidate further, especially in the food industry.

Contents of this page

1. What requirements and certifications must dried ginger meet to be allowed on the European market?

Dried ginger must meet the general requirements for spices and herbs. You can read more about these rules in the CBI study on the requirements for spices and herbs. Another useful tool is ‘My Trade Assistant’ on the Access2Markets website. It lists the rules for each European country and your own country.

What are mandatory requirements?

Dried ginger coming into the EU has to be safe. For this reason, the EU sets strict limits for microbiological contamination, pesticide traces, traces of PAH, mould toxins and mineral oils. Keep your ginger below these limits to comply with EU regulations. Ginger that exceeds maximum levels is withdrawn from the European market.

Official food controls

Dried ginger coming into the EU from other countries is often checked. Tests can happen at the border or further on in the supply chain. If a shipment is not in accordance with EU food safety legislation, it is reported in the Rapid Alert System for Food and Feeds (RASFF). If a country has many problems, the EU can choose to increase checks or stop imports.

Right now, dried ginger from Ethiopia is checked at the border 30% of the time because of high levels of aflatoxins. India also faces extra checks—20% of its dried ginger shipments are tested due to high levels of pesticides, especially ethylene oxide.

Microbiological contaminants

Regulation (EC) No 2073/2005 sets the rules for bacteria levels in food. Dried ginger has no special limits, so the general rules apply. The main risk is Salmonella, which must not be present in spices and herbs. Between 2022 and 2024, four cases of non-compliance due to microbiological contaminants were reported: 2 with Salmonella and 2 with Bacillus cereus. In all four cases, the product had to be recalled.

Tips:

- Steam-treat ginger before shipping it. This is a natural method that does not use chemicals or radiation, and many European buyers prefer it.

- Implement the Codex Alimentarius Code of Hygienic Practice for Low-Moisture Food (CXC 75-2015) to improve the safety of your product.

Contaminants

Contaminants are unwanted substances that unintentionally end up in food. They can get into the product during farming, drying, packing, transport, storage, or as a result of environmental pollution. Some contaminants can harm people’s health. The EU sets strict limits for many of these substances in food to protect consumers. There are specific limits for lead, aflatoxins, ochratoxins and polycyclic aromatic hydrocarbons (PAH).

Between 2022 and 2024, the most-reported contaminant was polycyclic aromatic hydrocarbons (PAH), which was reported 4 times. Other contaminants that can occur in dried ginger are mycotoxins like aflatoxins. Between 2022 and 2024, 2 cases of aflatoxins exceeding residue limits in dried ginger were reported.

Pesticide residues

Regulation (EC) No 396/2005 sets the maximum levels of pesticide residues in food and feed made from plants. These limits are called maximum residue levels (MRLs). If a product contains more pesticides than the allowed limit, it cannot be sold in the EU and must be removed from the market.

Between 2022 and 2024, 6 cases of dried ginger exceeding the MRL of pesticides were reported. 4 of them were contaminated with Chlorpyrifos.

Food additives

Buyers and European authorities can reject products if they have undeclared or unauthorised levels of extraneous materials, or if these levels are too high. There is specific legislation for additives (like colours, thickeners) and flavourings that lists which E-numbers and substances are allowed to be used. Additives that are authorised are listed in Annex II of the Food Additives Regulation.

Although you might consider using food additives in the production of dried ginger, remember that European traders and consumers prefer additive-free spices.

Food fraud

Food fraud in the spices and herbs sector is a serious issue, and European buyers are increasingly attentive to it. Many European laboratories have increased testing to discover this type of fraud in spices and herbs. Concerns around ginger include adulteration with spent ginger, flours and starch products. Ginger adulteration constitutes food fraud, which is illegal and will affect a supplier’s reputation in the European market.

Tips:

- Adapt the Codex Alimentarius Codes of Practice for the prevention and reduction of mycotoxins in spices and low-moisture foods.

- Always discuss with potential buyers whether they want steam sterilisation. If you cannot sterilise your ginger yourself, look for local sterilisation companies that can provide this service.

- For the control of contaminants, use only services of laboratories that are ISO/IEC 17025-accredited. Presence of aflatoxins must be tested according to the EU regulation on methods of sampling and analysis for the official control of the levels of mycotoxins in foodstuffs.

- Read the Guidance on Authenticity of Herbs and Spices published by the UK Food and Drink Federation to find out more about actions and initiatives that can help avoid fraud in your supply chain.

Labelling

Dried ginger must be labelled properly. Bulk packs should show:

- Name and variety of the product;

- Batch code;

- Net weight in the metric system;

- Shelf life of the product, or best before date, and recommended storage conditions;

- Lot identification number (or identification mark);

- Country of origin;

- Name and address of the manufacturer, packer, distributor or importer (or identification mark);

- Batch details (may also be included in the Product Data Sheet).

If you are exporting a product packed for the end consumer, follow Regulation (EU) No 1169/2011 on food information. This regulation explains what information must be shown for nutrition and origin, how to list allergens, and the smallest font size allowed for these details.

Figure 1: Labelling for ginger packed for the end consumer

Source: Globally Cool (June 2025)

Packaging requirements

For shipping, bulk dried whole ginger roots should be packaged in PP or PE woven bags with good respiration/ventilation.

Ginger processed into slices or powder is packaged in multi-wall laminated bags weighing from 1 to 25 kg. Common weight classes are 12.5 kg and 25 kg.

Tips:

- Ask your buyer for their specific packaging requirements.

- Store packaged ginger in a dry, cool place to prevent quality deterioration. If you offer organic, certified ginger, physically separate it from non-certified ginger.

What additional requirements and certifications do buyers often have?

European buyers have additional legal requirements. The main topics of these requirements are quality and safety. Social and environmental sustainability are also becoming key.

Quality requirements for ginger

The quality of dried ginger is very important for European buyers. Colour, taste and smell all help decide whether the ginger is good. Many European buyers ask suppliers to follow the rules in the European Spice Association (ESA) Quality Minima Document, which is not public. This document sets key quality points for ginger, such as:

- Cleanliness or purity: herbs must be free from off-odour, off-flavour and foreign matter. However, requirements vary per buyer and may include more specific indicators. The maximum ash content is 8% and the acid-insoluble ash maximum is 2%.

- Moisture content: maximum moisture content of 12%.

- Volatile oils: minimum volatile oil content of dried ginger of 1.5 ml/100g.

Some aspects that may vary depending on the buyer are the size of the mesh for ground ginger and the flavour. Some buyers might need specific flavour profiles for their recipes. The flavour profile can vary based on geographic location, climate and growing conditions.

The ISO organisation also published a standard for dried ginger under ISO 1003:2025. The ESA recommends sampling according to ISO 948:1980. The Codex Alimentarius also has a standard: CXS 343-2021 for dried or dehydrated ginger.

Allergens

Many European buyers want ginger that is free from allergens, particularly traces of peanut. To show that you control this risk, you can explain how allergens are covered in your HACCP plan. If you also have a recognised food safety certificate, like FSSC 22000 or BRCGS, it already includes allergen control steps. This gives buyers more trust in your product.

Food safety standards

In Europe, just following legal food safety rules is not enough. Buyers often expect suppliers to have a clear food safety system in place. You should start with a proper HACCP plan to control risks during production. In addition, getting a food safety certificate recognised by the Global Food Safety Initiative (GFSI) is highly recommended, for example FSSC 22000, BRCGS or IFS.

Sustainability compliance

Many European buyers value social and environmental sustainability. Large spice and herb companies in Europe have set clear goals to buy sustainably sourced products and improve transparency in their supply chains. Because of this, suppliers are often asked to follow the buyer’s Code of Conduct.

The Sustainable Spice Initiative brings together many major players in the European spice market. This group has created a list called the SSI Basket of Standards. It includes certifications that prove spices are grown sustainably. These are the standards that many European buyers now expect.

The basket uses the SAI FSA 3.0 benchmark, common in the food and drink sector, to compare sustainability standards. Any certification verification scheme benchmarked against FSA 3.0, scoring silver level or above, either stand-alone or in combination, will be acceptable under the SSI Basket of Standards. Some well-known certifications in the basket are Rainforest Alliance and Fair for Life. Companies supporting this initiative aim to buy spices only from producers with these certifications.

As of June 2025, there are 38 Rainforest Alliance-certified farm groups for ginger worldwide. These producers are spread throughout Nigeria and India (both countries supplying the largest volumes), China, Sri Lanka, Bangladesh, Tanzania, Peru and Côte d’Ivoire. Together, producers in these countries produce around 5,800 tonnes of ginger.

Since 2022, the European Spice Association (ESA) has developed a Code of Conduct for responsible sourcing. Some buyers might develop their codes based on this.

Other common standards in the sector are the Ethical Trading Initiative (ETI) and the Business Social Compliance Initiative (BSCI).

Notably, the popular certification scheme Fairtrade is not included in the basket, because it does not rank silver in the FSA 3.0 benchmark. Also, GLOBALG.A.P. is only sufficient with the GRASP add-on.

Tips:

- Get a certification recognised by the GFSI. Quality is a key aspect in supplier selection for buyers in Europe.

- Check the latest FSA Benchmarking results (May 2025) to identify standards or standard combinations that are considered to be silver or higher.

- Obtain a sustainability certification from the SSI Basket of Standards.

- Read the CBI study on the requirements spices and herbs must comply with to be allowed on the European market for all applicable requirements.

What are the requirements for niche markets?

Some markets in Europe have additional requirements, often in the form of certification. The most relevant one is organic certification.

Organic certification

To market dried ginger as organic in the EU, it must be cultivated through organic production methods that adhere to EU organic regulations. Additionally, growing and processing facilities must undergo audits by an accredited certification body.

To market your ginger as organic, it must comply with the regulations of the European Union for organic production and labelling. Obtaining an EU organic certificate is the minimum legislative requirement for marketing organic ginger in the European Union. If you want to export to countries outside of the European Union (EU), check the required legislation per country. For instance, Switzerland has its own Swiss Organic Law and the UK has its Organic Products Regulations 2009.

In addition to the EU organic standard, most European countries also have their own voluntary organic standards, like Bio-Siegel (Germany), AB mark (France) and the Ø logo (Denmark). Some countries also have private standards or labels, like Naturland (Germany), Soil Association (United Kingdom), Bio Suisse (Switzerland) and KRAV (Sweden). Note that the EU organic standard is usually sufficient for most buyers.

Figure 2: Organic-certified dried ginger in a German discounter

Source: Globally Cool, February 2025

Tip:

- Check Regulation (EU) 2018/848 to see the EU standard for organic products.

2. Through which channels can you get dried ginger on the European market?

The main market segment for dried ginger is the food processing industry, which makes up about 75% to 90% of all sales. The main users are bakeries (for products like gingerbread and cookies), companies making ready meals, soups, sauces and frozen foods, the meat industry, and drink producers, including infusion brands. Dried ginger is also used in homes, restaurants, hotels and cafés (HORECA). This use makes up about 10% to 25% of the total market.

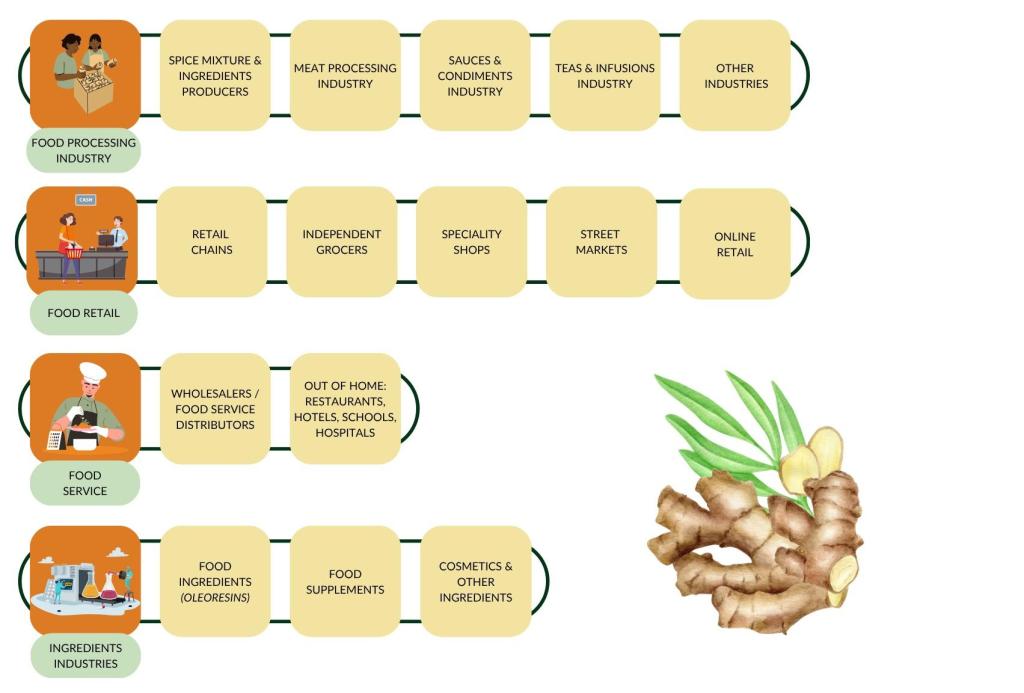

How is the end market segmented?

The food processing industry is the largest buyer of dried ginger in Europe, followed by retail, food service and food ingredients (additive segments).

Figure 3: End-market segments for ginger in Europe

Source: Globally Cool

Food processing industry

The food and drink processing industry uses an estimated 75–90% of all dried ginger in Europe. Major users include producers of spice mixes, ready meals, snacks, bakery goods, sauces, soups, drinks and confectionery.

Spice mixture producers are companies specialised in the production of spices and seasonings for different applications. These companies are constantly investing in research to develop custom formulations for food processing companies, and to help launch new and attractive flavours.

Examples of these companies are AVO (a German producer with a factory in Poland and France), Bieze Food Group, Sabater, Libra Food Ingredients (part of the Food Ingredients Group), Kalsec, EHL Ingredients and Ion Mos.

The meat industry is also an important user of dried ginger. It is often not supplied directly, but through spice and food ingredient companies. The European sauces, seasonings and soups industry is also an important user of dried ginger. However, this market is dominated by international brands such as Kraft Heinz, McCormick and Maggi (Nestle).

Food retail

The retail and food service segments for spices and herbs are dominated by European (often national) spice brands/companies, such as Fuchs in Germany, Verstegen and Euroma in the Netherlands, Santa Maria (part of the Paulig Group) in Scandinavian countries, and multinational brands such as McCormick and Kraft Heinz. Some strong brands are also developing in Eastern Europe, such as Prymat Group. These spice companies import spices directly from all over the world and have in-house processing and R&D facilities.

Private-label supermarket brands play an important role. European spice packers and blenders produce for these brands, as supermarkets require large volumes and specific packaging. This makes direct supply from origin countries difficult. Products packed at origin are mostly found in ethnic shops or markets, or online.

Most retailers sell individually packed spices or herbs and a range of specific mixtures. Overall, tailored spice and herb mixtures are becoming more popular in the retail segment. This is partly due to the increasing interest in ethnic food, but also due to the growing demand for convenience.

Leading supermarket chains in Europe include Schwarz Gruppe (Lidl and Kaufland) and ALDI (both in Germany), Ahold Delhaize (Netherlands), Carrefour (France) and Tesco (United Kingdom).

Food service

The food service channel (hotels, restaurants and catering) is usually supplied by specialised importers or wholesalers. These companies are sometimes the same brands that supply the retail segment. The food service segment often requires larger packaging sizes of dried ginger, such as cans of 300 to 500 grams or sacks of a few kg.

World cuisines, healthy food and food enjoyment are major driving forces in the food service channel in Europe. The fastest-growing business types are likely to be new (healthier) fast food, street food, pop-up restaurants, international cuisines and sandwich bars.

Ingredients industry

The ingredients industry is made up of ingredient formulators that serve various end-using industries, such as food, cosmetics and health care. Ingredient formulators are often large-scale companies operating globally, like Givaudan, DSM Firmenich and Symrise. These companies focus on cutting-edge technology and usually source from various global suppliers. They have very strict sourcing protocols for quality control and consistency, as well as sustainability.

Tips:

- Attend trade shows in Europe, depending on the segment you want to target. To find big spice importers in the industry, attend Fi Europe. If you want to contact private-label packers, attend PLMA in Amsterdam.

- Explore non-food options. Read CBI’s guides on Exporting natural ingredients for cosmetics to Europe and Exporting natural ingredients for health products to Europe. They map regulations, buyers and price points—use them to create your pitch before contacting prospects.

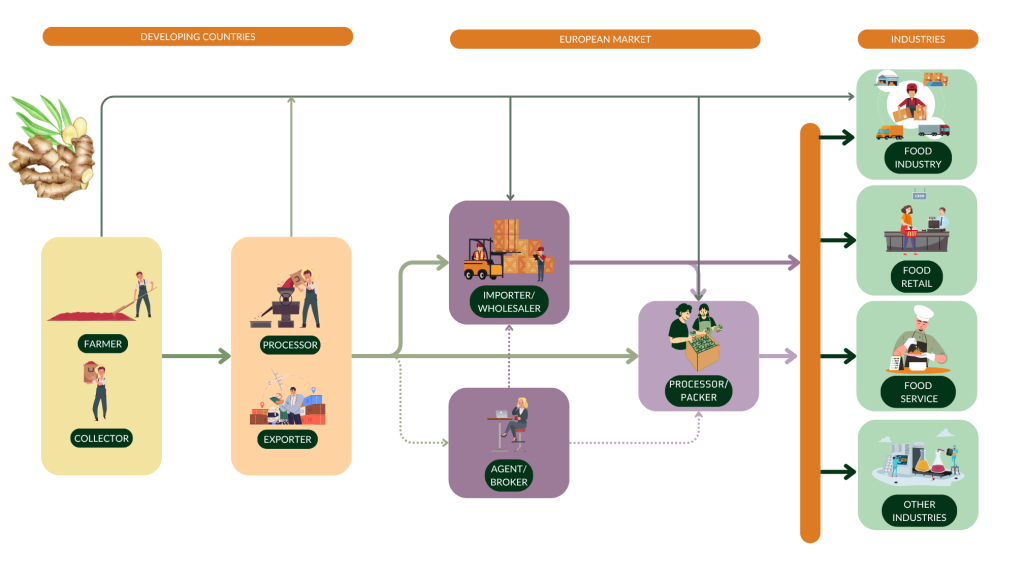

Through which channels does a product end up on the end-market?

Dried ginger reaches the European market through several channels. Most of it enters the market via specialised spice importers. These importers often supply food processors, food service companies or retail packers. In some cases, big processors buy ginger directly from producing countries. They clean, grind and pack the ginger before selling it under their own brands or private labels. Agents or brokers also help connect exporters with European buyers, especially for special or certified products.

Importer/wholesaler

Importers and wholesalers—especially specialised ones—are the main channel for dried ginger in Europe. Sometimes dried ginger also reaches the market through agents or is sold directly to food processors or food service companies. Some wholesalers have packing facilities and supply private-label products.

Importers may focus on general spices or specialise. Some serve only the food processing industry, while others pack for retail chains. Many also trade in related products like beans, seeds, dried fruits, nuts, tea or delicatessen goods.

Retailers are putting more pressure on suppliers, demanding not just low prices but also added value like sustainability, transparency, organic or fair-trade labels. To meet these demands, many importers now follow strict sourcing policies and build long-term ties with trusted suppliers in developing countries.

Examples of bulk importers of dried ginger in Europe include Nedspice (the Netherlands), European Spice Services (Belgium), Husarich (Germany) and Saran Enterprises (Poland). Examples of spice importers supplying several segments are Isfi Spices (Belgium) and Verstegen (Netherlands).

Processor/packer

Large spice processors buy ginger directly from producing countries. They often work with many spice origins and have sourcing teams to manage supply. Most use several suppliers per spice to reduce risk. These companies clean, sterilise, grind, blend and pack the spices. Ginger is sold both as an ingredient and as a finished product, under their own brand or private label. Examples of large-scale processors in Europe are Euroma (Netherlands) and Fuchs (Germany), which have products for retail, food service and the industrial sector.

Figure 4: Trade channels for dried ginger in Europe

Source: Globally Cool, June 2025

Agent/broker

Brokers and agents are intermediaries who bring buyers and sellers together. They charge a commission for their services. European buyers can be trading companies, but they are mostly processors. Agents and brokers are interesting if you have a specialised product (such as high-quality or sustainably certified ginger) for which buyers are harder to find. The role of agents is slowly diminishing due to the increased transparency demanded by the market.

Tips:

- Search the members’ list of the European Spice Association (ESA). Here you will find member companies that could be potential buyers.

- Search the exhibitors' list of the specialised trade fair Fi Europe. The fair is the leading event in Europe where European ingredient companies gather. It takes place every year. In even years Fi is held in Germany, in uneven years in France.

What is the most interesting channel for you?

Specialised spice importers are often the best entry point for placing dried ginger on the European market, especially for new suppliers. Retail supply is more demanding and requires high investments in quality, logistics and packaging.

Importers often buy large quantities from various origins and break them into smaller batches for spice companies and other food producers. While many exporters aim to sell directly to smaller industrial buyers for higher margins, working with importers can help boost overall trade volumes and long-term profits.

If you have limited experience exporting to European countries, agents can play a very important facilitating role. Agents can evaluate and facilitate connections with buyers and finance institutions. Be prepared to pay a commission for their work, usually ranging between 3 and 10%.

Good volumes are important in the spice trade to keep logistics costs low. You should be able to deliver full container loads. If you are unable to do so, you can work with other suppliers interested in supplying the European market.

Tips:

- Read our tips for finding buyers on the European spices and herbs market.

- Benefit from the experience and knowledge of specialised European importers and agents instead of approaching manufacturers directly.

- Look for commercial agents on the Internationally United Commercial Agents and Brokers (IUCAB) website.

- Visit or participate in trade fairs to test whether the market is open to your product, get market information and find potential buyers. The most relevant trade fairs in Europe are Anuga, SIAL, Food Ingredients Europe and BIOFACH (for organic).

3. What competition do you face on the European dried ginger market?

Suppliers from other developing countries are your main competitors. In 2024, the main suppliers of ginger were China, Peru and Nigeria. There has been severe disruption in the supply of Nigerian imports, which has increased imports from China. China has a stable supply, low prices and a flavour profile similar to Nigerian ginger, which is well appreciated in the industry.

* Volumes are estimated to contain imports of crushed or powdered ginger and an estimated portion of fresh ginger.

Source: UN Comtrade (May 2025)

Which countries are you competing with?

The main competitors in the European dried ginger market are China, Peru, Nigeria and India. China leads with low prices and a large, stable supply. Peru focuses on organic ginger, but exports less due to smaller harvests. Nigeria’s exports dropped following crop disease, though its strong-flavoured ginger is still used in industry. India offers a steady and affordable supply, both whole and powdered, but some buyers prefer China’s flavour.

China: main supplier and competitor

China is the top supplier of dried ginger to Europe. In 2024, China exported about 9,200 tonnes to Europe. This is double the volume of 2020, which was around 4,600 tonnes. The average yearly growth between 2020 and 2024 was about 18.7%. In 2024, Chinese dried ginger made up about 50% of all dried ginger imported into Europe, showing its dominant role in the market.

The United Kingdom was China’s main buyer in Europe. In 2024, it imported 5,240 tonnes, 57% of China’s total exports to Europe. This is a big increase from 1,908 tonnes in 2020, with a strong yearly growth of 28%. China’s growth is directly linked to the decline of Nigerian exports. Some companies in the food industry are pivoting to Chinese ginger, as they consider it relatively similar to Nigerian ginger. In addition, good volumes and low prices make for a strong industrial ingredient.

Germany was the second-largest buyer in 2020, but its imports dropped in 2024. It bought 1,280 tonnes, down from a high of 1,813 tonnes in 2022. Over the whole period, growth was modest, with a yearly average of 5.3%. The Netherlands, the third main destination, also saw a decline in 2022, but imports recovered in 2024 to 967 tonnes. Imports from smaller markets like Belgium, France and Ireland also grew.

The use of mechanised production methods enables China to produce and export larger volumes of ginger than other suppliers. This makes it difficult to compete with China if you are small. To compete with China, you should be able to:

- Deliver stable supplies of ginger, both in quantity and quality;

- Comply with delivery times;

- Comply with food safety requirements.

Due to its stable volumes, low prices and sensory profile, the position of Chinese dried ginger is expected to get stronger in Europe. Chinese exporters often meet European quality and safety standards, making them reliable partners. As a result, many European buyers see Chinese ginger as a low-risk, cost-effective choice.

Peru: key organic supplier facing production challenges

In 2024, Peru was the second-largest supplier of dried ginger to Europe, exporting about 2,755 tonnes. This was down from 4,600 tonnes in 2020, but Peru still accounted for around 15% of total imports. The Netherlands remained its main buyer, with 1,532 tonnes in 2024 (over half of Peru’s exports to Europe), though down from 3,127 tonnes in 2020. Spain followed with 518 tonnes and showed stable demand. Other buyers included Germany and the UK, with lower or stable volumes in 2024.

Peru’s dried ginger exports to Europe dropped between 2020 and 2024 mainly because farmers planted less ginger. In 2023/24, the growing area was 41% smaller than two years prior due to low prices and poor profits. Plant diseases and bad weather also reduced crop quality and volume. At the same time, the cost of growing and certifying organic ginger went up, making it harder for farmers to stay competitive.

Looking ahead, Peru’s ginger sector faces an uncertain 2025 season. Poor weather, stricter controls and higher certification costs are resulting in lower yields and higher production costs. Some exporters even stopped shipping to Europe in early 2025 to avoid losses and protect their customers’ trust.

To stay competitive, the sector must improve field monitoring and farming practices. Some farmers are already harvesting early to reduce losses from internal rot. Despite these challenges, Peru is expected to continue supplying its main partners in the organic market, focusing on quality and reliability.

Nigeria: preferred ginger for the industry with falling production

Nigeria was the third-largest supplier of dried ginger to Europe in 2024, with a market share of around 10%. However, exports have dropped sharply in recent years. After reaching a high of 8,470 tonnes in 2022, exports fell to just 1,870 tonnes in 2024. This is a 62% decline within two years. In 2022, Nigeria was the biggest supplier to Europe, but its role in the market has become much smaller.

The sharp decline in Nigerian dried ginger exports to Europe between 2020 and 2024 is mainly due to a widespread outbreak of tuber rot disease, also known as blight disease in 2024, which severely reduced production and exportable supply.

Figure 6: Blight disease decimates Nigerian ginger

Source: TRT World @ YouTube

Germany was the largest buyer of Nigerian ginger, importing 4,670 tonnes in 2022, but this dropped to only 587 tonnes in 2024. Other main buyers like the Netherlands, the UK and Spain all reduced imports sharply between 2022 and 2024.

Despite the drop, Nigeria still held its position as the third-largest supplier, but its future on the European market depends on improving supply stability and quality. The ginger cultivation season in Nigeria runs from May to October, with the supply season extending up to nine months. This prolonged period provides a competitive edge in meeting continuous demand from Europe.

Nigerian ginger is also recognised for its strong aroma, pungency, and high oil and oleoresin content, making it especially attractive for industrial use. This has allowed Nigerian exporters to position themselves in the industrial market, a key segment of the European dried ginger market.

It is unclear whether Nigeria’s dried ginger exports will recover soon. One reason is that it is still unknown whether blight disease can be controlled. Industrial buyers are already switching to other suppliers. Once they make this change, it will not be easy for them to switch back again.

India: reliable and affordable ginger supplier

India was the fourth-largest supplier of dried ginger to Europe in 2024, with a market share of around 10%. In that year, India exported about 1,810 tonnes to Europe. While this is still below the 2021 high of over 2,200 tonnes, exports grew again after a drop in 2022 and 2023.

The United Kingdom was India’s top market in Europe, importing 653 tonnes in 2024. This number has been stable over the last three years. Germany was the second-largest buyer, with 365 tonnes in 2024, more than double the 2023 volume. The Netherlands also showed some recovery, importing 323 tonnes in 2024 after a drop in 2023.

India plays a big role in the dried ginger market due to its good growing conditions and large supply. Many experienced exporters know how to serve the European market well. Indian suppliers offer a wide range of products, like whole dried ginger, powder and extracts, meeting the needs of both the food and health industries.

Another advantage is price. Because production costs are lower in India, Indian ginger is usually more affordable, while providing good quality. This makes it a popular choice for many European buyers. However, some industrial buyers prefer the flavour of Chinese ginger over Indian ginger.

Which companies are you competing with?

The global ginger market has many strong players. If you grow or export ginger, your biggest competition comes from countries like China, Peru, Nigeria and India. To compete, focus on offering competitive prices, good quality and compliance with legal requirements.

Anhui Huafeng Spices Co., Ltd.: Chinese processor with good capacity

Anhui Huafeng Agricultural Plant Refinery Co., Ltd. is a Chinese manufacturer and exporter of spices, including ginger and other products. Located in Fuyang City, the company operates a factory of over 10,000 square meters. Anhui Huafeng supplies global markets, including Europe, the United States, Japan and Southeast Asia. The company’s main products include pure ginger oil, garlic oil, and a range of dried and ground ginger and garlic products, such as slices, granules and powders. Its annual production value exceeds USD 12 million.

Supracorp: Peruvian supplier with organic and conventional ginger

Supracorp is a Peruvian agro-industrial company based in Lima, Peru. It specialises in natural, dehydrated products and spices, both organic and conventional. The company offers high-quality ginger products processed using controlled temperature methods to keep their natural properties and aroma. Supracorp operates two processing plants—one in Junín (1,000 m²) and one in Chosica, Lima (1,500 m²).

Their main product is dried ginger flakes, with over 1,000 tonnes sold yearly. Other products include ginger powder (60 mesh and ultra-fine), tea cuts, crushed flakes and fresh ginger. Packaging options include 25 kg paper or polyethene bags and 13.6 kg cardboard boxes. In Europe, Supracorp exports to Spain and Poland.

GACON Ltd: top ginger exporter from Nigeria

Gum Arabic Company Nigeria Ltd (GACON) is a Nigerian agro-exporter established in 1996, with over 25 years of experience in the sector. The company specialises in dried split ginger and other agricultural products. GACON exports to over 16 countries, including the United Kingdom, Germany, France and Italy.

It exports around 700 metric tonnes of dried split ginger each year. The company is HACCP-certified, ensuring high food safety standards, and has a fixed staff of 52, supported by over 200 seasonal workers. With headquarters in Lagos, a regional office in Kano and an aggregation centre in Southern Kaduna, GACON is also known for supporting local farmers and promoting women’s participation in agriculture.

NANI Agro Foods: flagship Indian exporter

NANI Agro Foods is a well-established Indian company that processes and exports spices, including dried ginger in both whole and ground form. With over 30 years of experience, the company serves both bulk buyers and retail clients. In addition to selling in bulk, NANI offers various consumer packaging options and provides private-label services for brands that want to sell ginger under their own name.

The company operates from modern facilities covering 45,000 square meters. Its production line processes at least 15 tonnes of ginger per day. To meet different packaging needs, NANI uses 38 Form Fill Seal machines, producing up to 1.1 million pouches daily. It also has automated lines for mono cartons, with a daily capacity of 100,000 units. This makes it possible for NANI to efficiently handle large orders for both bulk and retail markets.

NANI Agro Foods also invests in sustainability. It runs on solar and wind power, each with a capacity of 500 KVA. The company collects rainwater in a large reservoir that holds up to 3 million gallons and treats wastewater with its own sewage plant. These efforts support cleaner and more responsible production.

To meet international standards, NANI holds certifications such as BRCGS, halal and kosher. It has also completed a SMETA audit, showing its commitment to social responsibility and ethical business practices. These steps help the company meet the strict quality and safety demands of the European market.

Which products are you competing with?

Ginger has a unique flavour and aroma, which makes it hard to replace. In Europe, fresh ginger is its main competitor, followed by ginger paste, extracts and oils. These processed forms are widely used in ready meals, drinks, supplements and cosmetics. Extracts and oils are easy to measure and very concentrated, making them popular in industrial food and health products.

Tips:

- Identify the sensory profile of your ginger. Is it very pungent, like Indian ginger? Then you might want to target the health and ingredients sector. If it is softer, like Nigerian or Chinese ginger, you might want to target the food industry.

- Check the Food and Agriculture Organisation of the United Nations (FAOSTAT) website for ginger production data.

4. What are the prices of dried ginger on the European market?

Ginger is an annual crop. Prices fluctuate from harvesting season to harvesting season. The price of dried ginger also depends on the price of fresh ginger. In addition, different product varieties and origins have different prices.

Global market prices for ginger are strongly influenced by the largest producer of both fresh and dried ginger: China. Chinese ginger is, on average, the cheapest ginger available on the global market. To mitigate risks, some buyers might also prefer more expensive ginger from other suppliers.

The price of ginger that consumers buy in supermarkets consists of:

- Raw materials: 5-15%;

- Processing: 5-15%;

- Transport costs: 2-5%;

- Import and processing in Europe: 15-30%;

- Retail margin: 30-60%.

Here are a few examples of dried ginger available across Europe:

- Organic ground ginger in a 30 g plastic bag in Germany, €2.49 per kg;

- Candied ginger pieces in a 200 g plastic tray in Belgium, €17.45 per kg;

- Ground ginger in a 49 g glass shaker in Spain, €33.7 per kg.

The margins you can get as an exporter may differ. These are influenced by factors such as:

- Country of origin;

- Current and expected future harvest situation;

- Quality of the raw material;

- Level of processing;

- Level of demand;

- Trends in prices.

Margins and profits can be higher for you as an exporter if you are able to add value locally. For example, you can create a competitive edge and benefit more through further processing or certification.

Tips:

- See the Spices Board India website for up to date information on national and international ginger prices.

- Establish long-lasting relationships with your buyers. Buyers are willing to pay higher prices to suppliers that are able to help secure supply and comply with delivery times and food safety requirements. They will also be more willing to invest in your partnership.

Globally Cool updated this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research