7 tips to go digital in the processed fruit and vegetables sector

As demand for online shopping and efficient supply chains increases, processors need to keep up with digital trends. This allows them to remain competitive in the global market. This is impossible without having a good understanding of digitalisation. Companies should be aware of the practical uses of digital tools in almost every area of their operations. These include fulfilment, finance, processing, sales, managing production, e-commerce, online marketing and supply chain management.

Contents of this page

- Keep on top of digitalisation in all segments

- Make use of digital e-Commerce platforms

- Move into the era of smart farming and processing

- Explore modern supply chain and quality management tools

- Use big data providers to support your production and sales

- Digitise your logistics solutions

- Source digital technologies locally and regionally

1. Keep on top of digitalisation in all segments

Digitalisation has many advantages for exporters of processed agricultural produce. It can help your company become more efficient, save money and offer better services. Companies can use machines and robots to monitor crop growth and process crops more quickly and accurately. Using automated sorting machines can help companies separate good produce from bad. This saves time and reduces waste.

Companies also can boost their trading and sales by using digital trading platforms and by building their own website. Online marketplaces can make it easier for exporters to connect with local and global buyers. The platforms allow firms to meet, share information about products and prices, and reach deals quickly. Online marketplaces like Alibaba, Amazon and eBay can help exporters find customers and grow their businesses.

Ignoring digitalisation can lead to negative results, such as lost sales from not connecting with new buyers. Without digital tools, it takes more time to manage orders, track shipments and communicate with customers. Manual paperwork can also lead to costly mistakes in orders and invoices.

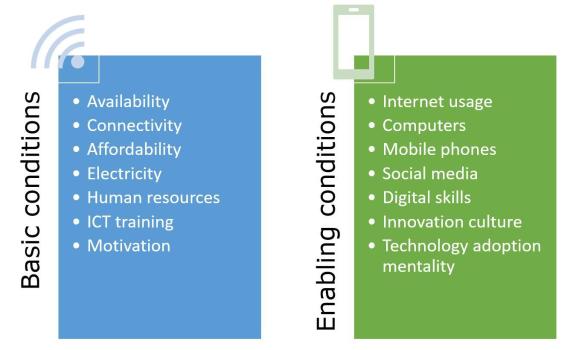

A recent FAO briefing explains that digitalisation requires some minimum conditions to become possible. Digitalisation also depends on enabling conditions. These enablers are additional factors that assist the adoption of technologies. Although basic conditions are mostly present everywhere, make sure your firm can provide the enabling conditions.

Figure 1: Conditions for successful digitalisation in agri-food processing companies

Source: Autentika Global, FAO

SMEs from developing countries should consider the following digitalisation strategies to optimise their business:

Collect information with precision agriculture and IoT

Digital technologies like Internet of Things (IoT), Artificial Intelligence (AI), computer vision, drones and Machine Learning (ML) can help small processors optimise their businesses. Companies can monitor important crops remotely and produce data by using precision agriculture techniques.

IoT devices are those that are connected to the Internet. As they transfer data, they can be used as soil moisture, sunlight, temperature and humidity sensors, for example.

Other types of data are gathered with drones. Drones can be used in activities such as crop monitoring, damage control and precision agriculture. Computer vision in commercial agriculture involves the use of AI algorithms and ML techniques to analyse and process images and videos that are captured by cameras or sensors.

This technology allows companies to identify, analyse and interpret various aspects of crop and farm operations. It can improve decision-making, enhance productivity and reduce costs.

Supply chain visibility and traceability

Digital solutions can enhance transparency, track product movement and help identify potential issues in real-time. Firms can use barcodes or QR codes on product packaging to store essential information such as origin, production date and batch number. RFID tags can store more information than barcodes and can be read from a distance. Vehicles can be equipped with GPS tracking devices to monitor their location and routes in real-time.

Blockchain technology solutions are becoming more popular as a new decentralised, unchangeable ledger of product information.

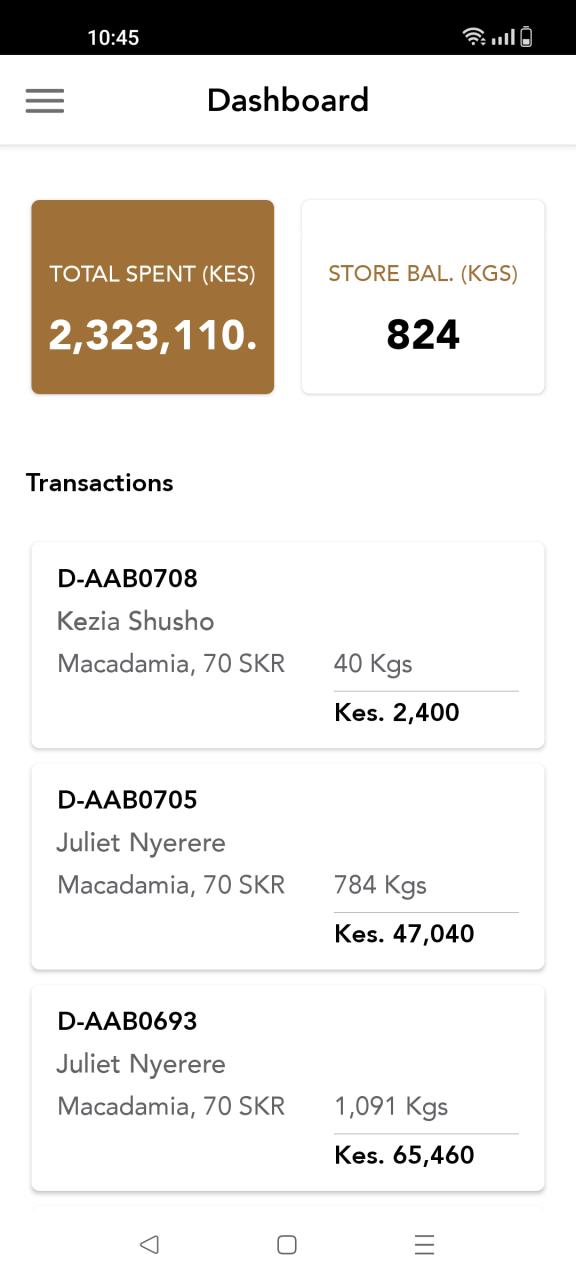

Figure 2: Digital sourcing platform used by Ten Senses Africa

Source: Julius Osanjo Ten Senses Africa, Autentika Global

E-commerce and digital marketing

Use e-commerce platforms like Alibaba, Amazon, Ebay, or national and regional ones to expand market reach and boost sales of consumer-packaged goods. These platforms are much less important for bulk ingredients.

Use your own digital marketing tools and build your own commercial presence on the web. There are excellent online platforms available to build your web store, such as Shopify, PrestaShop, BigCommerce and Wix eCommerce. Use digital marketing platforms to market your products to the right audience effectively. Also use them to build your online presence. Leading digital marketing networks are Google ads, Facebook ads, Instagram ads, LinkedIn ads (for B2B marketing), TikTok ads and Pinterest ads.

Digital payments and financing

Adopt digital payment solutions (e.g. mobile money, online banking) to facilitate faster and more secure transactions. If you are a small company, look at new digital financing options such as crowdfunding platforms or peer-to-peer lending. Examples of successful African crowdfunding platforms are Cape Town-based Thundafund and Africa's largest online fundraising platform, Kenya's M-Changa.

Africa has many peer-to-peer lending platforms, such as ThriveAgric, aimed at farmers in multiple countries; Kiakia; FundColony; Fairmoney and Farmcrowdy in Nigeria; UbaPesa in Kenya; and Aella Credit in Nigeria and Ghana. There are successful simple mobile phone payment services, such as Kenya-based M-PESA, which is also active in Ghana and Egypt. Nearly 83% of farmers in Kenya use mobile money for some purpose.

Safaricom launched a mobile-based digital credit service for farmers, Digifarm. It offers farmers many services, including market access, learning content on farming, soil testing, and crop insurance and credit for inputs.

If you work with farmers in remote or unbanked communities, help them set up Kiva accounts. Kiva is an international non-profit that helps direct microloans reach the unbanked. Such loans help women start businesses, farmers invest in equipment, families get emergency care, and students pay for tuition.

Digital logistics and transportation

Utilise digital logistics platforms or partner with digital freight companies like Flexport, Freightos, blockchain-powered Morpheus.Network and Shippeo. They can help optimise shipping and transportation processes. This helps reduce costs, minimise delays and improve overall efficiency.

The following sections offer a closer look at some of the most important digital trends throughout the supply chain of processed fruit and vegetables.

Tips:

- Adopt digital strategies that best fit your business and customer type. Focus on solving acute problems in your existing business operations.

- Address the current needs of your suppliers and farmers. When growers face payment problems, explore new digital payment solutions, if available. When growers need more crop cultivation advice, focus on mobile-based learning content.

2. Make use of digital e-Commerce platforms

E-commerce is short for electronic commerce. It has completely changed the way businesses work by making trade across borders easier. E-commerce allows SMEs to reach a wider customer base. E-commerce platforms can help firms expand their market presence and establish stronger connections with their customers. It is also important to be aware of both business-to-business (B2B) and business-to-customer (B2C) e-commerce platforms.

SMEs can use e-commerce platforms to reach new markets at a lower cost by avoiding traditional trade channels. Standard channels often involve middlemen and wholesalers, which can increase the final price to customers. Digital trade platforms allow firms to control and build their brand. This can lead to enhanced customer loyalty and repeat business. E-commerce platforms can additionally yield data about customer habits, market trends and pricing.

Exporters of processed fruit, vegetables and nuts should be aware that these platforms host many sellers. This can put pressure on prices. Also, the use of these platforms requires digital skills and might be limited by technological barriers such as poor connectivity, problems with electricity supply, or lack of IT equipment.

Online marketplaces

A leading non-product-specific e-commerce B2B platform is Alibaba. It offers trade insurance, logistics support and secure payment options. Other non-specific B2B options are Amazon Business and eBay Seller Hub.

Available B2C options for exporters to the EU, EFTA and UK include Amazon, Bol.com (a popular e-commerce platform in Netherlands and Belgium), Allegro (Poland) and Cdiscount (France). However, processed fruit, vegetables and nuts are a specific market that usually requires preparatory steps for trade. Involved steps are sending samples, processing facility audits, and processing goods according to buyer specifications. Traditional B2C platforms can be used for product visibility but not as a direct step to exports.

In the processed fruit and vegetables sector, B2B marketplaces are mainly used to connect European buyers and suppliers from other continents. However, keep in mind that overseas orders are not commonly made online, and rarely for imports from countries outside of Europe. Still, connections can be made through B2B platforms. Some of the specific online B2B marketplaces that are relevant for processed fruit and vegetables producers include:

- Frozen B2B – online marketplace for frozen food professionals (subscription required)

- Saladplate – international wholesale marketplace for sourcing food, beverages and hospitality products

- Biolinked – B2B e-marketplace for small and mid-sized organic food suppliers

- Tridge – market intelligence and online sourcing hub

- GreenTrade – online marketplace for organic products

- 21food – a leading food B2B e-marketplace located in China

You can use local or regional end-to-end platforms to source food and agricultural produce from cooperatives or growers, like Nairobi-based Selina Wamucii, which facilitates the purchase of produce and logistics management; Nigeria’s Farmcrowdy; and Kenya’s Twiga Foods, a mobile-based B2B platform that can help SMEs connect with smallholder farmers.

A common problem of online marketplaces is the unbalanced presence of buyers and suppliers. Many relevant European and international buyers do not participate in online marketplaces. Suppliers dominate online marketplaces, and even the COVID-19 pandemic did not significantly increase the presence of international buyers. Developers of online marketplaces usually allow buyers to register for free while suppliers pay a subscription.

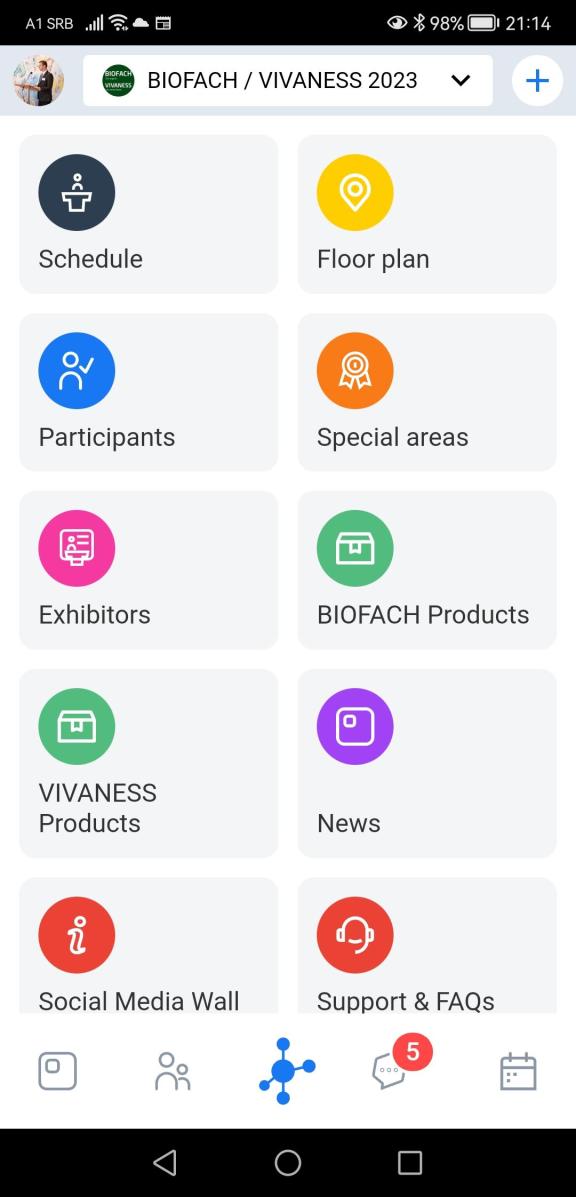

Digital trade events

Many international food trade fairs switched to virtual events because of the COVID-19 pandemic. Live events have now resumed, but many trade events still have a virtual option for participation that can lead to new opportunities. Biofach 2023, the world’s leading trade fair for organic food, held in February 2023, attracted almost 36,000 trade visitors from 135 countries. Around one in four participants used the Biofach digital event platform.

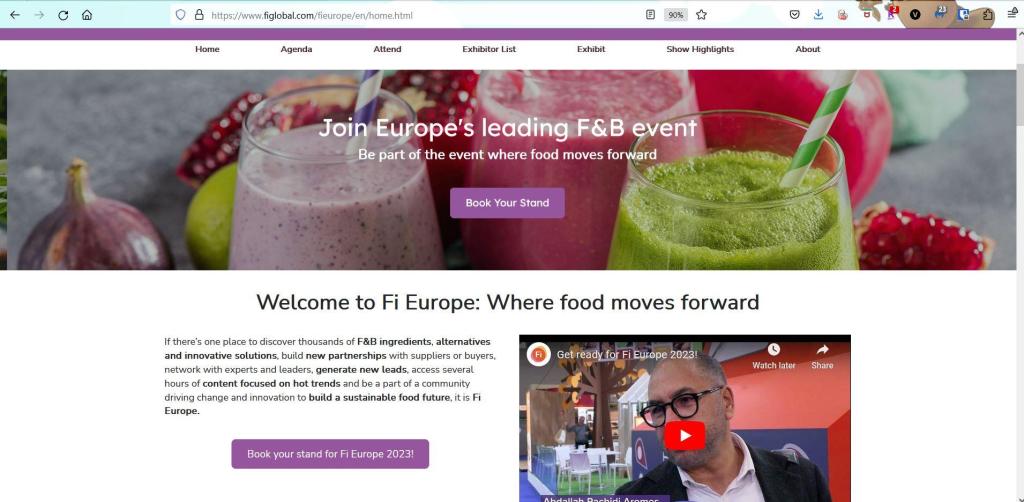

Food Ingredients Europe, the largest gathering of food and beverage ingredient buyers and suppliers, is offering live and online passes for their event in November 2023. The online pass offers remote access to live and on-demand content, and allows holders to schedule meetings with exhibitors.

Figure 3: Food Ingredients Europe website

Source: Food Ingredients Europe, screenshot by Autentika Global

The world’s largest food event, ANUGA in Cologne, adapted to the COVID-19 changes by launching a hybrid event edition in 2021 and establishing a permanent digital platform, Anuga @home.

Specialised product focus events have also started using online matchmaking tools, such as the International Nuts and Dried Fruit Conference. The 2023 congress will be held in London, and registered participants will have access to live chat and be able to schedule meetings with other participants via the online platform.

Most major fairs in Europe have their own applications that can be downloaded for Android and iOS. They can be used to enhance your digital presence and require an entrance fee.

Figure 4: Biofach/Vivaness 2023 mobile app

Source: Biofach/Vivaness mobile app, screenshot by Autentika Global

Tips:

- Get a good grasp of e-commerce platforms that suit your company's needs, and use them.

- Explore general B2B and B2C e-commerce platforms like Alibaba and Amazon to find potential business opportunities. Also consult specific online B2B marketplaces that are closer to your niche.

- Always seek new pathways to connect with buyers and suppliers. If you cannot attend in person, there are many options for virtual attendance.

3. Move into the era of smart farming and processing

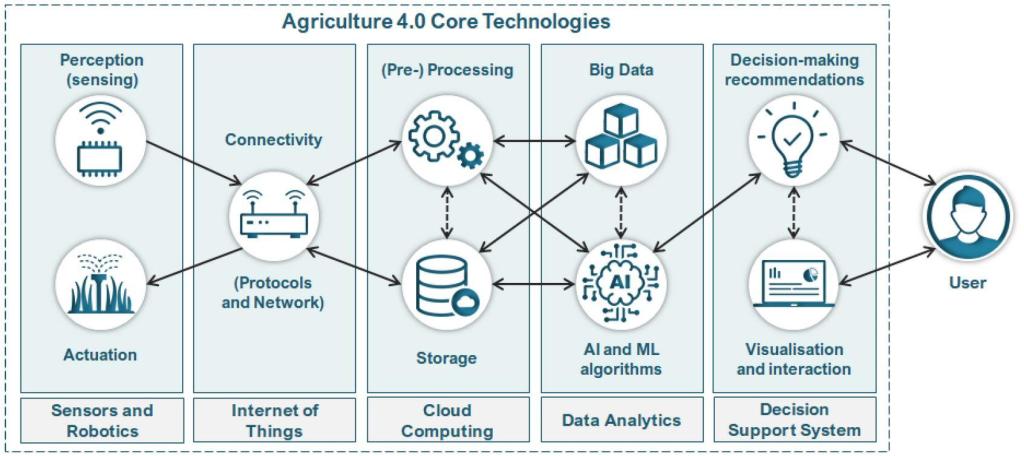

As the world rapidly changes, global food production is changing with it. We are currently living in a digital agricultural revolution, also known as Agriculture 4.0. This fourth farming revolution emerged in the early 2010s and involves the use of new industrial technology and digitalisation.

By adopting new technologies such as AI, IoT, drones and robotics, firms can boost efficiency, quality and traceability while aiming to meet the high standards of European consumers. Data collected from AI and IoT systems can help SMEs make informed decisions and manage costs and risks more effectively.

Companies that fail to adopt these technologies may struggle to compete with rivals that do. Without new technologies, firms will find it difficult to meet European standards for traceability and quality.

Figure 5: Agriculture 4.0 core technologies

Source: Characterising the Agriculture 4.0 Landscape—Emerging Trends, Challenges and Opportunities by Araújo SO, Peres RS, Barata J, Lidon F, Ramalho JC., used under CC BY 4.0, cropped from original

Use of drones

Drones can be highly beneficial to fruit, nut and vegetable processing companies. They can be used for crop monitoring, precision agriculture and data collection. They can also be used in different modes.

Crop monitoring and scouting drones are equipped with high-resolution cameras and multispectral sensors. They monitor crop health, identify pests and diseases, and assess field conditions. Regular drone flights allow firms to gather accurate and up-to-date information about their crops. The senseFly eBee Ag can cover large areas in a single flight. It can capture detailed images for crop monitoring, yield estimation and irrigation management.

Precision agriculture drones can be used to optimise resource usage by applying fertilisers, pesticides and water precisely where they are needed. Drones equipped with sensors can identify areas that require more attention, enabling targeted application of resources and thus minimising a company’s waste and environmental impact. The AGRAS T40, for example, can carry a spray load of 40 kg and a spread load of 50 kg.

Data collection, aerial mapping and analysis drones can collect vast amounts of data, including weather conditions, soil moisture levels and growth patterns. This data can be analysed to improve decision-making and operational efficiency. The PHANTOM 4 RTK can be used as an accurate low-altitude mapping solution.

Harvesting assistance drones cannot directly harvest crops but can help companies plan their harvesting strategy efficiently. By identifying ripe fruits, nuts and vegetables, drones can help companies schedule their harvesting operations at the optimal time. This ensures maximum yield and quality.

Quality control and traceability drones can track the quality of produce by taking images and recording data at various stages of production. This information can be used to ensure product quality, safety and traceability.

Figure 6: Conducting Drone Biological Control Operations

Source: Trusted user53, CC BY-SA 4.0, via Wikimedia Commons

Drones can be a valuable asset for fruit, nut and vegetable processing companies. Their use can help improve efficiency, reduce waste and optimise resource usage. Be careful to select the appropriate drone technology and to fully utilise the data collected to make more informed decisions.

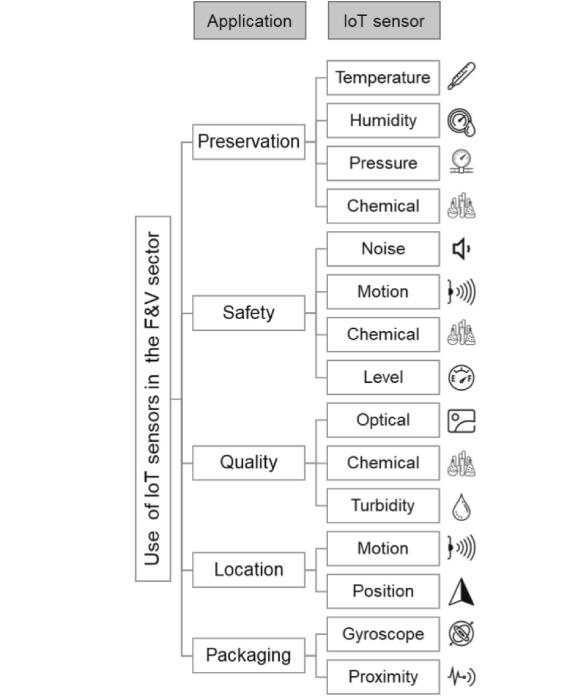

Use of IOT sensors

Processors who use IoT equipment and sensors improve efficiency, productivity and quality control while reducing costs and waste. IoT sensors have multiple uses in farming and in processing facilities. Possible uses in fruit, vegetable and nut processing are:

Monitoring environmental conditions by using sensors in processing facilities to monitor temperature, humidity and light levels. An optimal environment for raw materials and finished products will reduce spoilage and waste. Lascar Electronics has a range of Wi-Fi IoT monitors to log temperature and humidity in real-time.

Tracking and tracing with IoT-enabled devices such as RFID tags and GPS trackers, to monitor the location and movement of raw materials, finished products and equipment. This can help improve inventory management and improve logistics and overall efficiency. One example is the Impinj M700 series tag chips for item-level visibility.

Predictive maintenance and energy management sensors are used to monitor performance parameters such as vibration, temperature, and energy consumption in the processing plant. The PowerLogic ION9000 from Schneider Electric can be used for revenue metering and power event analysis.

Figure 7: Typical applications of agricultural IoT in the fruit and vegetable sector

Source: Applications of the main IoT sensors in the fruits and vegetables (F&Vs) sector, a paper by Abdo Hassoun et al., licensed under CC BY 4.0

These are specific examples of useful types of sensors for fruit, vegetable and nut processing companies:

Soil moisture sensors that measure water content and can be used with data loggers to collect data remotely. The METER Group EC-5 soil moisture sensor is used for commercial farm applications. Sentek also produces soil moisture data probes that can be used with irrigation decision-aiding software.

Sunlight sensors are used to precisely measure and collect data on the sunlight that plants can use to grow in the field. This helps farmers increase their crop yield, and helps growers optimise crop production: the Apogee Instruments Quantum Sensor products are for long-term outdoor use, and the LI-COR LI-190R Quantum Sensor is used in commercial agriculture.

Temperature and humidity sensors take measurements of field temperature and relative air humidity. These sensors can be used just to measure temperature or humidity, or as combined sensors to collect more data. Data can be wirelessly transmitted or collected with data loggers. One combined sensor in commercial farming is the HOBO Temperature/Relative Humidity Data Logger.

Note: the availability of these specific products is subject to change. Compare prices from various suppliers and check for various models in categories of interest.

Smart farm and food technologies

AI and machine learning (ML) can help optimise the quality and yield of processed fruits, vegetables and nuts. These technologies help firms use precision agriculture and allow exporters to better predict crop yields, improve sustainability and obtain higher-quality produce.

ML is used to identify and respond to real-time input in farming. AI is mostly being developed for farm robotic applications, such as robotic harvesters and robotic weeding machines.

Business Insider estimated in 2021 that nearly 12 million agricultural sensors will be installed globally by 2023. Meanwhile, tech giant IBM (PDF) estimated that an average farm can generate half a million data points per day.

Agriculture-focused AI platforms are emerging to help monitor weather conditions, process data collected via IoT sensors and drones, and manage risks.

Usually, small farm help and guidance is offered by farm extension workers and services. There is often only one extension worker for over 1,000 farmers. This makes it hard for small farmers to improve farming methods.

Processors can help smallholder farmers try out some grower-focused AI solutions directly. Plantix is an AI-driven mobile app that identifies plant diseases, pests and nutrient deficits using image recognition technology. This can help farmers manage crop health more effectively and determine the optimal times to apply treatment. Other AI-powered digital services that might help smallholder farmers across Africa and Asia are Agrio and Plant Insights.

The farmbetter app is a free farmer digital advisory tool optimised to work in low internet connectivity areas. Its target audience is smallholder farmers in Burkina Faso, Uganda, Tanzania, India and Nepal. The HallerFarmers app in English and Swahili was also designed for smallholder farmers. It offers low-cost and sustainable farming techniques that are replicable across Africa.

Figure 8: Example of an AI-driven mobile app for growers and processors

Source: Google Playstore website, screenshot by Autentika Global

Be aware that digital tools, together with data science, are transforming farming through innovation. Processors and growers of fruits, vegetables and edible nuts can benefit from the new era of smart farming. Companies like Climate Corp use AI and machine learning algorithms to help farmers make data-driven decisions and optimise crop yields, including for fruits used in processing.

Tips:

- Invest in drones that fit your needs, for example with high-resolution cameras and multispectral sensors. Then establish a suitable flight schedule to use the drone's capabilities and collect data.

- Collaborate with data analysts or invest in data analysis software to process the data collected by drones. Utilise the insights to improve operations and optimise your use of resources.

- Automate and improve environmental data collection, energy management, and tracking with IOT sensors in processing and farming.

- Harness the power of AI and machine learning to improve farm-level operations.

- Explore blockchain technology to increase trust and transparency in your food-processing business. It can help track products, share sustainable practices and verify certifications.

4. Explore modern supply chain and quality management tools

Modernise supply chain management

Modern supply chain management (SCM) tools can help exporters of processed fruit, vegetables and edible nuts streamline their operations. Other benefits of SCM tools are that they help optimise inventory and improve compliance with European import regulations.

SMEs face a choice of many digital products for different aspects of supply chain and quality management. When choosing a software solution, remember to focus on solving real problems in your day-to-day operations.

For example, if you have a high-value product that is being counterfeited, such as organic extra virgin olive oil, then a blockchain-based traceability solution might be a tool to address that problem. If you want to improve SCM, look for a digital SCM tool that can easily integrate with your existing software systems and equipment. Consult your equipment suppliers for their advice on the best integrations. Make sure that the solution is worth the investment.

Firms can use GFSI-compliant software that gives real-time information about product movement and inventory levels. GFSI stands for Global Food Safety Initiative. It is a business-led initiative for the development of food safety management systems to ensure safe food.

- One non-cloud solution is JustFoodERP. There are also cloud software products such as FoodLogiQ Connect and SafetyChain.

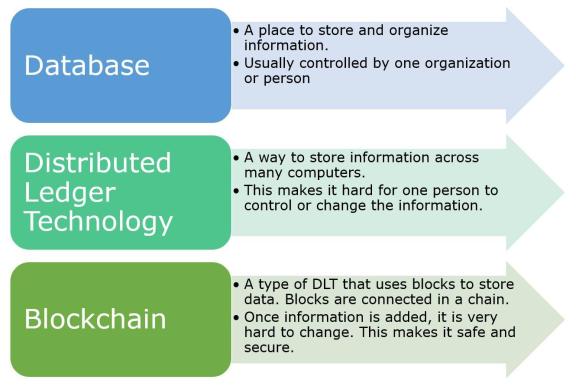

Explore new ways to ensure the full traceability and transparency of your production chain with the help of blockchain. Blockchain technology is a novel tool that can give end consumers insight into the farming, processing, transportation and distribution of products. Other benefits are improved safety monitoring, fraud prevention and reduced waste.

Compare what blockchain technology offers to what you need. The technology is rapidly evolving. An example of effective use of blockchain is the Vietrade iTrace247 blockchain tracing system developed by the Vietnam Trade Promotion Agency. The iTrace247 system traces fruit and vegetable products; it was launched in March 2023.

Figure 9: iTrace247 website

Source: Website (http://14.225.23.179/) screenshot by Autentika Global

Companies like IBM and VeChain provide blockchain-based solutions for supply chain management in the food industry, including processed fruits.

- The IBM Food Trust project is using blockchain technology to create a secure and shared digital record of agri-food data.

- VeChain Food Safety Track and Trace is a blockchain-enabled food traceability platform that provides the food and beverage industry with various traceability functions, such as product provenance and quality certificates.

- Italia Olivicola, the largest organisation of olive and olive oil producers in Italy, is developing an innovative supply chain solution utilising the open, public Algorand blockchain to improve traceability.

SMEs should consider low-cost and targeted blockchain solutions to explore whether they help address a pain point in their business. End consumers could query the blockchain to see the entire farm to fork cycle. This is usually done with mobile apps that can scan QR codes to query the blockchain for product information, for example through a system like IOHK's Atala Trace traceability solution for transparency in the supply chain. This solution uses the decentralised Cardano public blockchain.

There is an emerging trend that offers room to be creative and explore if certain solutions can give you a competitive advantage. Using a public blockchain platform such as Algorand or Cardano over a private blockchain solution might have various benefits. End consumers could directly send a reward or a 'tip' to the grower who produced the raw materials. This could be done through blockchain wallets, without a middleman. This will be possible because most public blockchains have publicly tradeable digital tokens that have commercial value.

SCM tools also include IoT sensors that can help monitor events during transport.

- Companies like Zest Labs provide IoT sensor and software solutions to track temperature, humidity, and other conditions of fruits during transportation and storage. Other suppliers of SCM software platforms are SAP Ariba and Infor CloudSuite Food & Beverage.

- Consider use or supply of data to HowGood, a digital tool for impact measurement. The platform helps companies demonstrate their commitment to fair labour and sustainability with data.

Distributed ledger technologies and blockchain

Agri-food firms want to prove their sustainable practices and the origin of their raw materials and products. Databases are data sources controlled by one actor. They are seen as less trustworthy and less accessible. Firms are now exploring possible uses of distributed ledger technology (DLT), even blockchains. A DLT is a record of data agreement that is maintained and confirmed by separate nodes. A blockchain is a DLT that saves the information in blocks that cannot be changed.

Figure 10: Difference between database, DLT and blockchain

Source: Autentika Global

Blockchain as a record of information is attractive for food exporters because the record cannot be changed and is decentralised.

Digitise your company's quality management

Digital quality management tools help firms standardise and automate their quality control processes, ensuring consistent product quality. Another important benefit is that these tools help companies keep up-to-date documentation for quality management, audit trails and regulatory compliance.

- SafetyChain is a well-known food safety and quality management software in the food and beverage industry. It can help firms improve compliance with European regulations and manage quality control processes.

- BRCGS offers the SafeFood 360 food safety and supplier quality management software.

Machine-learning algorithms can be of significant value to food exporters when integrated into quality-management and supply-chain software solutions.

- Companies like AgShift offer a food inspection platform that uses machine learning algorithms. Such platforms can analyse and grade the quality of fruits, vegetables and nuts. This automates inspections, lowers bias, and makes quality assessments more consistent. The AI solution is trained using millions of images and data points.

- Rival Tomra offers AI-powered laser, X-ray and camera-based sorting solutions for fruits, vegetables and nuts.

- Clarifruit offers a cloud-based solution that collects produce quality data with a mobile app. The data is analysed to deliver objective quality control inspections.

Automatic laser colour sorters are often used by cashew nut, peanut, macadamia and dried fruit processors. These optical sorters are sold by Tomra, Buhler and China's Taiho.

The olive oil and beverages industries use AI integrated with low-cost digital sensor technologies and/or near-infrared spectroscopy (NIR), in the form of electronic sensory or nose (e-nose) equipment. Solution providers include Alpha MOS, Aryballe and its portable e-nose NeOse Pro, and Estcal with zNose.

Tips:

- Incorporate digital tools for quality assurance. Automation and machine learning can boost the consistency of your product quality checks.

- Consider IoT sensors for better transport tracking. They can monitor conditions like temperature and humidity during product shipment.

5. Use big data providers to support your production and sales

Big data is increasingly one of the most valuable commodities in the global economy. Commercial market research companies continuously collect very large data sets on agri-food trade and end consumer sales to identify market behaviour and trends.

Data collection and analysis companies sell data on consumer behaviour and trends to firms to help them assess the market and make better marketing decisions. Notable examples are companies like Mintel, Nielsen, Euromonitor International, IRI, Kantar Worldpanel, GfK, Statista and Innova Market Insights. However, for most SMEs large data sets from leading data providers are too expensive. Some of these data providers do offer regular free updates and email newsletters with some free summarised information.

These big data sources can help SMEs gain insights into consumer preferences, market trends and competitors.

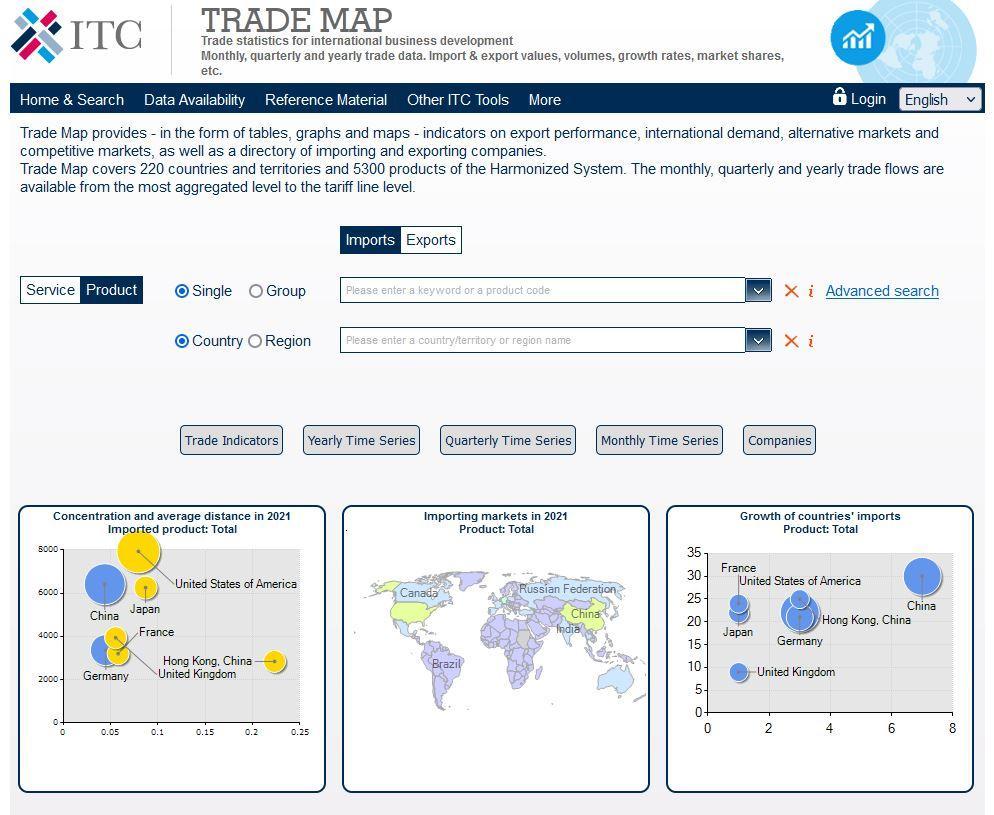

- One of the options for developing-country exporters is to use available free international trade tools such as TradeMap. TradeMap transforms the large volume of primary trade data into a user-friendly format. You can use it to analyse the market attractiveness of your product and to select the most promising markets.

- Another useful data tool is the statistics page of the EU Access2Market portal. The World Bank's WITS platform provides access to international merchandise trade as well as tariff and non-tariff measures (NTM) data.

- Eurostat, the EU's statistical office, provides various types of data, including on international and retail trade, and consumer behaviour for food and beverages.

- EU and EFTA countries and the UK also have national statistical offices that provide free data. This often includes trade, retail reports and pricing data in the agri-food and beverage industries. Examples are the UK's ONS, Germany's Destatis, France's INSEE and Italy's ISTAT. For other countries, you can search for their national statistical offices to access data.

- Some commercial sources of trade analysis solutions are Global Trade Tracker and Global Trade Atlas.

Big data sources are also available for agriculture. Some of the most well-known free platforms for data in agriculture and food are Global Open Data for Agriculture and Nutrition and CGIAR Platform for Big Data in Agriculture. The FAO also provides free access to such data for 245 countries and territories through FAOSTAT.

Figure 11: ITC Trade Map website

Source: ITC Trade Map, screenshot by Autentika Global

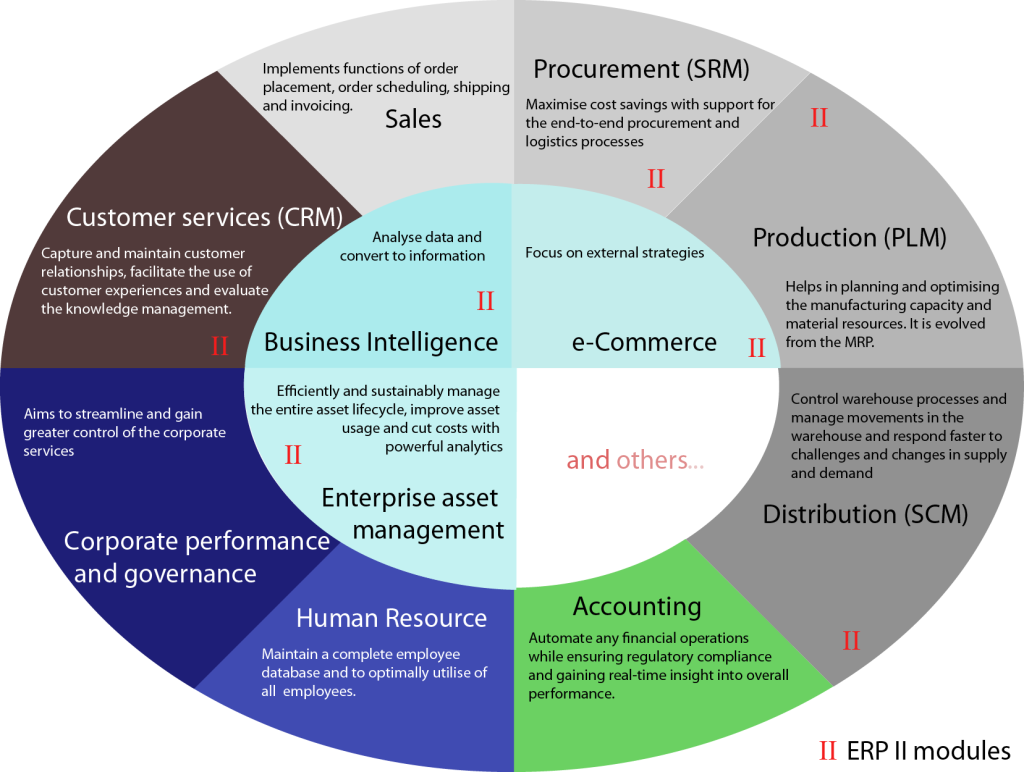

Improve your operations by adopting business software Enterprise resource planning (ERP) software applications. It can help SMEs streamline operations, improve efficiency and ensure regulatory compliance. ERP software is used to plan and optimise the use of company resources, as well as ensure supply chain and quality management. Other uses include managing finances, customer relationships, human resources, business intelligence and production planning.

Again, just like when choosing an SCM digital product, focus on real problems that need to be solved in your day-to-day operations. Consult your company's existing IT solutions supplier and your equipment suppliers. This will help you choose solutions that can be easily integrated into your firm's day-to-day operations.

Some of the best-known applications are SAP Business One, Odoo, Microsoft Dynamics 365 Business Central (which is tailored for SMEs), ORACLE ERP and Priority Pro. Note that the Odoo Community edition is a free and open source. There are several open-source ERP software solutions to explore.

Many ERP solutions are general solutions, but some are customised for food and beverage producers like Oracle NetSuite, SysPro, Just Food, Batchmaster, Deacom, Aptean Foodware 365 and Aptean Food & Beverage ERP.

Figure 12: Modules of ERP software

Source: Shing Hin Yeung, CC BY-SA 3.0 via Wikimedia Commons

Many ERP solutions are developed for large companies and can be too costly for SMEs. There are cheaper solutions that are more limited but may fulfil your company’s needs: there is free accounting software, project management, team management, business planning, video conferencing, customer relationship management (CRM) software, etc. Check out some free or inexpensive open-source alternative solutions available for SMEs, as well as open-source Windows business software.

Tips:

- Improve your supply chain and production with software and mobile apps that suit your needs. Read reviews of smartphone apps and ERP software for food and drink businesses.

- Use quality management software to meet European standards and regulations. SafetyChain and Intelex help track European food safety rules.

- Change your company’s digital adoption step by step. Look for local providers in your country. If needed, check global companies like Siemens, IBM or Microsoft.

- Search for new digital projects in the food sector in the European database EIT Food.

6. Digitise your logistics solutions

Simplify your logistics operations, reduce costs and improve the quality of your products by digitising logistics solutions. Here are some possible segments to focus on:

Autonomous vehicles and drones can be used to transport goods, spare parts or urgent deliveries, reducing human errors and increasing efficiency. Companies can use self-driving trucks for long-distance transport and drones for last-mile delivery. Drones are now available for end-to-end logistics delivery: Zipline, which is used in Africa, started servicing the Rwandan market in 2016, Ghana in 2019, and Côte d'Ivoire, Nigeria and Kenya in 2022. Companies like Nuro and Wing also provide autonomous vehicle and drone delivery services.

Keep an eye on developments that might suit your company, as the pace of change is very fast. Developing local and regional sales, combined with online commerce and delivery, is a good way of building digital know-how.

Predictive analytics and AI can help companies forecast demand, manage inventory and optimise delivery routes. AI-based systems from companies like FourKites, TransVoyant, Kinaxis and E2open provide predictive analytics and AI solutions for optimising logistics and reducing transportation costs for processed foods.

Tip:

- Set up trials to try out or test AI-powered systems for predictive analytics. Consider where these tools could help you anticipate demand, manage inventory and streamline delivery routes.

7. Source digital technologies locally and regionally

Food-exporting SMEs in developing countries should try to source digital technologies locally or regionally when it gives them an advantage. To do this, search for potential partners by leveraging technology hubs and potential partners.

Local technology providers understand the needs and market conditions in your region better. This can yield more fitting digital solutions. Local sourcing can also be more cost-effective and make communication and collaboration easier thanks to a shared language, culture and time zone. Other benefits include quicker support.

Some local companies can provide specific digital consultancy services or serve as a first point of contact:

- Zambia's technology and innovation training and consulting hub BongoHive and Nigeria's innovation consulting company Co-Creation Hub.

- Kenya's iHub runs the Women in Business programme, organises the Hack4Farming Nairobi hackathon and supports ICT innovators in agriculture from Kenya, Uganda, Madagascar, Tanzania, Ethiopia and Rwanda.

- Morocco's Numa offers workshops on topics like digital transformation.

- Rwanda's kLab supports development of innovative ICT solutions and business assistance.

- Other organisations are Cambodia's Impact Hub Phnom Penh, Ethiopia's youth agribusiness incubator blueMoon, Egypt's government-run TIEC center, Gaza Sky Geeks in the Palestinian Territories, innovation hub La Fabrique in Burkina Faso, and Senegal's CTIC Dakar.

There are also local suppliers of digital apps, software, e-commerce and ICT solutions, like Indonesia's Suitmedia, Myanmar's Myanmar Information Technology, Sri Lanka's Creative Software, Kenya's precision agriculture company UjuziKilimo, and Jordan's Optimiza in the MENA region.

Ghana's Agrocenta supplies digital financial services for smallholder farmers in Africa. Other providers of digital financial services for small growers are Apollo Agriculture in Kenya and Musoni in Kenya and Uganda.

Innovative agricultural insurance and digital products service provider Pula serves smallholder farmers in Africa, as does Uganda's Ensibuuko.

Tips:

- Connect with nearby technology centres and partners to consult on digital support for your needs.

- Find local companies for digital tools to save money and get the right tools for your business.

- Use local digital money services that help small farmers.

- Always weigh the advantages and disadvantages of sourcing digital technologies locally or regionally, considering factors such as cost, scalability, customisation, and the potential for long-term growth and collaboration.

This study was carried out on behalf of CBI by Autentika Global.

Please review our market information disclaimer

Search

Enter search terms to find market research