The European market potential for AI software development services

The European AI market is growing fast, and there are opportunities in many different sectors. The top six markets that offer the most potential for service providers from developing countries include the United Kingdom (UK), the Nordic countries, Germany, the Netherlands, France and Estonia. All these countries have well-developed AI ecosystems and startup industries. However, most of them face shortages of AI professionals, making them interesting markets for service providers from developing countries.

Contents of this page

1. Product description

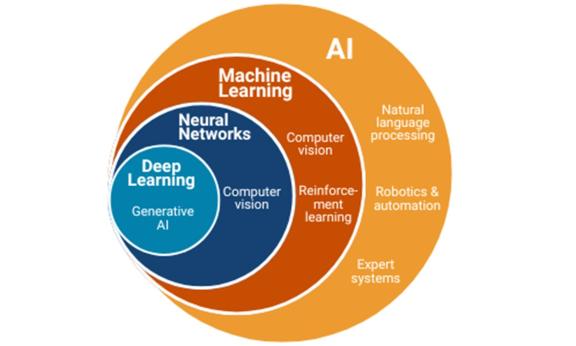

AI is a set of technologies used to create intelligent systems that can simulate human thinking abilities and behaviour. The goal of them is to perform tasks like humans would.

Figure 1: AI technologies

Source: Globally Cool

AI is an umbrella term that covers a variety of technologies, such as:

- Machine learning (ML): ML involves teaching computers and machines to recognise patterns in data and make decisions or predictions based on that data without being specifically programmed for it. An ML algorithm consists of three components: a decision process, an error function and an updating or optimisation process;

- Deep learning: This is a subfield of ML. It uses neural networks with many layers (hence ‘deep’) to model complex patterns. These neural networks are designed to mimic the decision-making capabilities of the human brain more closely;

- Generative AI (Gen AI): Gen AI is a deep learning model that can generate new complex content based on users’ prompts or requests. This content can be text, images, videos, audio or other file types;

- Reinforcement learning: A type of ML where an agent learns to make decisions by interacting with an environment and receiving feedback in the form of rewards or penalties. The agent learns to complete tasks by trial and error. Examples of autonomous agents include robots and self-driving cars;

Computer vision: This technology allows computers to interpret and understand digital visual information from the world, using ML and neural networks. Image recognition, facial recognition and object detection fall into this category;- Natural language processing (NLP): NLP is a subset of AI that breaks down human language into small pieces. It helps computers understand and work with human language in text or voice form. Examples of NLP include predictive text, voice assistants and converting speech into text (speech recognition);

- Robotics and automation: Robotics combines AI with mechanical engineering to create autonomous machines capable of performing tasks. AI in robotics helps robots perceive their environment, make decisions and carry out tasks without human intervention;

- Expert systems: These are AI programmes that mimic the decision-making of a human expert by using a knowledge base and a set of rules (inference engine). They are used in medical diagnosis, financial services and for quality control in production processes, among other areas.

Tip:

- To learn more about the different AI technologies, read the AI topics explained by IBM.

2. What makes Europe an interesting market for AI software development?

There is a large demand for AI software development services in Europe. This is driven by a severe skills shortage, an increasing understanding of the opportunities that AI offers and the desire many companies and governments have to benefit from these possibilities.

European companies are becoming more open to the idea of using AI technologies. AI technologies can reduce the need for certain types of labour and enable further automation. Many European companies find it difficult to fill their vacancies, and AI technologies could be part of the solution.

However, Europe does not have enough AI developers to meet the current and future demand. As a result, companies are looking for outsourcing partners.

EU’s commitment to becoming a global leader in AI

The EU is taking a lot of actions to support AI innovation in Europe. In February 2025, the EU launched InvestAI. This initiative aims to mobilise €200 billion in AI investments. In April 2025, the EU launched the AI Continent Action Plan. With it, the EU aims to make Europe a leader in AI.

AI innovation capabilities will be developed around several key pillars. One key pillar is building a large-scale AI data and computing infrastructure. Between 2021 and 2027, the EU will invest €10 billion in AI factories, setting up at least 13 AI factories by 2026. In addition, through InvestAI the EU will mobilise €20 billion for setting up five AI gigafactories. The EU also wants to triple the data centre capacity on the continent in the next five to seven years. Other pillars of the AI Continent Action Plan include:

- Improving access to large and high-quality data;

- Strengthening AI skills and talent;

- Developing algorithms and accelerate the adoption of AI in strategic sectors (e.g. healthcare and the automotive sector), and;

- Simplifying regulations.

Tip:

- Make sure you stay informed about the European approach to AI and its key milestones. You should also be aware that the EU has launched an AI innovation package to help European startups and SMEs develop trustworthy AI.

The European AI market is growing fast

The fast-growing European market for AI is expected to reach a value of €51.2 billion in 2025. Between 2025 and 2031, the market is predicted to grow at an average yearly rate (CAGR) of 26.3%. The driving factors include the growing use of digital technologies, awareness of the potential of AI and the convenience that online services offer.

*Size classes: small enterprises (10–49 employees), medium enterprises (50–249 employees) and large enterprises (250 or more employees).

Source: Eurostat

In 2024, 13.5% of EU enterprises with ten or more employees and self-employed people used at least one of the following AI technologies (listed in order of importance):

- Text mining;

- Natural language generation;

- Speech recognition;

- Machine learning for data analysis;

- AI-based software robotic process automation;

- Image recognition/processing and/or;

- Technologies that enable machines to physically move by observing their surroundings and taking autonomous decisions.

In 2024, 58% of these companies used commercial ready-to-use AI software or systems. 29% used AI technologies that were developed or modified by external providers.

Large enterprises use AI more than small and medium-sized enterprises (SMEs), but SMEs are catching up. Across EU enterprises of all sizes, the most cited reason for not using AI technologies is the lack of relevant expertise – ahead of concerns about topics like legal consequences and data protection/privacy violations.

IT and AI skills shortage

European companies continue to struggle with a shortage in IT skills, including AI skills. There is a large gap between the number of software development jobs and the number of available software developers. In 2024, 58% of EU companies that recruited or tried to recruit ICT specialists had difficulties filling these vacancies. This shortage varies considerably across EU countries, from 21% in Montenegro to 72% in Germany. Although AI can automate repetitive tasks and reduce the need for some IT jobs, it will most likely not solve the IT skills shortage in the short term.

*% of enterprises that have recruited or have tried to recruit ICT specialists.

Source: Eurostat

In 2024, 15% of all companies in the Netherlands were looking for ICT specialists. 63% of them had difficulties finding them. To fill the shortage, companies in Europe try to hire software developers from abroad. A cheaper option is to outsource software development tasks. Smaller ‘end-user’ companies in particular often outsource IT tasks locally. In turn, these local IT companies often look for nearshore or offshore outsourcing partners, like you.

In 2024, 72% of EU companies outsourced ICT functions to external suppliers. This percentage has been relatively stable since 2020. How much of this percentage is outsourced to offshore providers and how much is AI-related work is unclear.

In 2023, ARISA studied the AI roles and skills needed in Europe. In the job vacancies analysis, they clustered the requested skills into the following categories:

- AI general skills: AI uses many different programming languages. Languages such as Java, Javascript, Python and C++ are in high demand. Traditional skills like SQL and Big Data are also still needed in the job market;

- ML and deep learning are a crucial part of AI skills. It is needed in all AI job roles and industries;

- Big data and data analytics are both important core aspects of AI;

- Cyber security and data security: In the context of AI, this relates to protocols, security certifications and how security is built within AI systems, and;

- Large Language Models (LLM): The demand for skills related to LLM is growing significantly. The application areas of LLMs are also evolving.

Overall, ARISA identifies the following gaps concerning AI professionals in the European market:

- Areas: NLP/LLM, computer vision, robotics, ML, deep learning and data engineering;

- Roles: Data scientists, data engineers (especially ML engineers, including NLP engineers) and computer vision engineers. The role of prompt engineering is also becoming increasingly important due to the rise of LLMs, and;

- π-shaped professional: A π-shaped professional has both technical AI expertise and expertise in the field in which it operates (e.g. finance or supply chain). This professional is also able to communicate with people from other disciplines.

Tip:

- Find the right people. Consider hiring people with the necessary talents who still need to develop the required competencies. You can train them on the job. Also make sure you have access to the right people to scale up operations and serve clients at short notice.

Growing AI adoption across industries

There is high demand for AI technologies in all sectors. The developments in generative AI have lowered the threshold for using AI software significantly. These technologies are used increasingly in a range of applications, from virtual assistants and chatbots to forecast and modelling, text analytics, speech analytics, computer vision and predictive maintenance.

In 2024, AI technologies were used the most by companies in the information and communication sector (48.7%) and professional, scientific and technical service areas (30.5%). However, adoption of AI across all industries is growing. European AI companies like DeepMind (UK), Aleph Alpha (Germany) and Mistral AI (France) are key drivers of innovation.

Table 1 provides an overview of sectors with opportunities for AI technologies. All these sectors offer opportunities for IT service providers from developing countries. Please note that the list is not exhaustive.

Table 1: Sectors with opportunities for AI technologies

| Sector | AI applications |

|---|---|

| Healthcare and medicine | AI-powered diagnostics, personalised treatment plans, drug discovery and development, virtual health assistants and chatbots. |

| Finance and banking | Fraud detection and risk assessment, AI-driven stock trading and investment management, automated customer support (chatbots), and loan and credit approval automation. |

| Retail and e-commerce | Personalised product recommendations, chatbots and virtual shopping assistants, inventory and supply chain optimisation, and AI-powered pricing strategies. |

| Manufacturing and industrial automation | Predictive maintenance for machinery, robotics in assembly lines, quality control and defect detection, and supply chain optimisation. |

Transportation and automotive | Self-driving cars and autonomous vehicles, AI-powered traffic management, route optimisation for logistics and deliveries, and predictive maintenance for vehicles. |

Education and e-learning | AI-driven personalised learning, automated grading and assessment, AI tutoring systems, and virtual reality (VR) and augmented reality (AR) in education. |

Marketing and advertising | AI-driven content creation and ad targeting, chatbots for customer engagement, sentiment analysis for brand monitoring and automated social media management. |

| Cybersecurity | AI-powered threat detection and prevention, automated incident response, fraud detection and prevention, and behavioural analysis for security threats. |

Tips:

- Specialise in an AI subfield (e.g. NLP, computer visions or predictive analytics) and offer custom AI solutions to specific industries (e.g. healthcare, fintech or manufacturing). Specialising in a niche gives you a competitive advantage. You should gain expertise and references in your local and regional markets first;

- Keep following the developments, as AI is forecast to be used intensively in ever more sectors. Even small IT companies in developing countries should have a small Research & Development (R&D) team to focus on AI in any areas relevant to them.

3. Which European countries offer the most opportunities for AI software development?

There are a range of factors you can consider when looking for opportunities in European countries for AI software development, such as:

- Outsourcing market size (openness to offshoring);

- Shortage of ICT specialists;

- AI startup industry (AI hubs);

- Governments’ readiness and support;

- Percentage of companies that uses AI technologies, and;

- AI investments.

Figure 4: Selected promising European markets for AI outsourcing services

Source: Globally Cool

Taking all these factors into consideration, Northern and Western European countries offer the most opportunities. In particular, the UK, the Nordic countries (Denmark, Sweden, Finland and Norway), Germany, the Netherlands, France and Estonia score highly on these elements and therefore show high potential for exports.

Table 2: European countries that offer opportunities for AI software development, 2024

| Top European countries in the AI startup industry (ranking 2024) | EU enterprises that use AI technologies (% in 2024) | Government AI Readiness Index (score 2024) | EU enterprises with hard-to-fill vacancies for ICT specialists (% in 2024) | |

|---|---|---|---|---|

| UK | #1 | N/A | 78.88 | 84 |

| Nordic countries* | #7 and 9–11 | 24.45 | 75.68 | 44.35 |

| Germany | #3 | 19.75 | 76.90 | 72.41 |

| The Netherlands | #8 | 23.06 | 77.23 | 63.10 |

| France | #4 | 9.91 | 79.36 | 61.77** |

| Estonia | #2 | 13.89 | 72.62 | 54.02 |

*Average scores of Denmark, Sweden, Norway and Finland combined. **Data from 2022.

Source: Globally Cool, based on information from StartupBlink Winners in AI Startup Industry 2024, Eurostat, Oxford Insights Government AI Readiness Index 2024, and Hyve Managed Hosting IT and Tech Skills Gap Report 2024.

Northern and Western European countries are generally the largest outsourcing markets. With regard to offshore outsourcing, the UK, in particular, is open to doing business with developing countries. Moreover, it is Europe’s top country for AI startups (ranking third globally) and ranks second in Europe in the Government AI Readiness Index. This index scores a government’s readiness for AI by using three pillars: government, the technology sector, and data and infrastructure.

In Nordic countries, a relatively high percentage of companies already use AI technologies, especially Denmark and Sweden (ranking first and second in the EU, respectively). Germany is a hub for AI startup companies (third position in Europe), it scores fourth on the Government AI Readiness Index and has the most difficulties with filling vacancies for ICT specialists (72.4%) in Europe.

The Netherlands also faces difficulties filling ICT vacancies (63.1%). It is an interesting market for AI software development. Many Dutch companies already use AI technologies (sixth position in the EU). The country is a hub for the AI startup industry (eighth in Europe), and it ranks third on the Government AI readiness Index. France has the highest score on the Government AI Readiness Index in Europe and ranks fourth in Europe’s AI startup industry.

Lastly, Estonia has gained a reputation for its success with tech startups. It is Europe’s second largest hub for AI startups and ranks second globally in AI startups per capita.

The United Kingdom: Europe’s AI leader

The UK is the third largest AI market in the world. In 2024, the UK’s AI market was valued at €19.2 billion and is expected to grow to €1.2 trillion by 2035. The UK has one of the world’s strongest AI strategies. There is significant government funding and research for AI. The UK has a National AI Strategy, a ten-year plan to make the UK a global AI superpower. It focuses on three pillars: investing in the long-term needs of the AI ecosystem, supporting an AI-enabled economy in all sectors and governing AI effectively.

StartupBlink ranks the AI startup ecosystems across the globe and highlights the top locations in the AI startup industry. The UK is leading in Europe. London is the leading AI city in Europe, with a 50.6% lead over Paris. Other AI hubs in the UK include Cambridge, Oxford and Bristol.

According to DSIT’s 2023 study on the UK’s AI sector, there are around 3,713 active UK companies providing AI products and services – this represents a 27% increase compared to the previous year. 96% of these companies are SMEs. The core capabilities of these companies lie in computer vision and image processing (33%), autonomous systems (29%), model development (23%) and ML for healthcare (19%).

Looking at future growth, AI companies have mentioned that developing new AI products (74%) and improving existing products using AI (61%) are the most important drivers. Rapid development and adoption of AI are seen in the financial services, professional services, life sciences, and research and development sectors. The lack of technical skills is mentioned (26%) as a barrier to future growth, among others. This is due to:

- The highly competitive market for AI talent;

- The UK’s education system. It does not keep up with the skills demanded in the rapidly changing AI industry, and;

- High salary demand. Small AI businesses in particular find the salary demands for AI talent challenging.

The difficulty of bringing talent from abroad into the UK is partly the result of the UK leaving the EU. In terms of UK businesses that use AI technologies, 16% of UK businesses used some form of AI technology in December 2024. The BICS Wave 123 edition shows the most commonly used AI technologies are: text generation using LLMs (7.7%), visual content creation (6.2%) and data processing using ML (5.4%). Companies mainly use AI to improve business operations (39.6%) and provide products or services to their customers (24.1%).

The use of AI technologies is the highest in the information and communication sector. AI is also used more than average in professional, scientific and technical activities.

Most UK businesses adopt AI technologies through the purchase of external or ready-to-use software (38.1%). 18.5% developed the AI technologies in-house, and 11.7% outsourced this to external providers or third parties. Of the sectors that outsource AI technologies to third parties the most significant are:

- The information and communication sector (19.4%);

- Professional, scientific and technical activities (16.7%), and;

- Wholesale and retail trade; repair of motor vehicles and motorcycles (15%).

Issues that prevented or delayed UK businesses from adopting AI technologies include the level of expertise in AI, cost and difficulty identifying business use cases.

Of all European markets, the UK is the most open to offshore outsourcing and the least cautious about doing business with developing countries. This openness is due to the nation’s cost-saving business culture, its historical ties with many countries across the globe, and the English language.

Tips:

- Visit trade fairs and events like the AI Summit London in the UK to learn about AI trends and developments, and to expand your network. Also check out the exhibitor list to find out what companies will attend the summit;

- Visit the websites of UK trade associations techUK and UKAI to get familiar with the UK’s technology and AI sector.

Nordic countries: Towards a Nordic AI vision for 2030

Nordic businesses are quite familiar with the use of AI. In 2024, Denmark and Sweden had the highest percentages of enterprises using AI technologies in Europe, at 27.6% and 25.1% respectively. Finland ranked fourth, with 24.4%, and Norway eighth, with 20.8%. Nordic countries score relatively well in StartupBlink’s ranking of AI startup ecosystems. Looking only at the European countries on the list, Norway ranks seventh, followed by Finland (ninth), Sweden (tenth) and Denmark (11th).

Nordic governments are focused on creating a well-developed AI ecosystem. All four countries score high in the Government AI Readiness Index (top eight among European countries). The Nordic countries want to create a shared Nordic future in AI under the Nordic Co-operation. In August 2024, they started discussing a proposal for a Nordic AI vision for 2030, with the purpose of turning the region into a world leader in large-scale AI adoption.

One challenge that the Nordic countries face is access to talent and expertise. There is a great deal of need for advanced data knowledge, but there is a shortage of AI specialists. According to AI Finland’s Nordic State of AI Report, a lack of AI talent is the second largest challenge for companies in scaling the use of AI (38.2% of companies surveyed in 2024). To solve this problem and compete globally, Nordic countries need to invest in AI education and attract foreign talent.

In the same report, 62.6% of Nordic companies expected to recruit more AI talent in the next year. They are mainly looking for ML engineers (44.7%), data scientists (43.1%) and data engineers (32.5%). The AI technologies that Nordic companies use the most include Gen AI, NLP and LLM.

Individually, the Nordic countries are smaller than other European markets, but they are relatively open to outsourcing. People from these countries are also highly proficient in English, which makes doing business relatively easy.

Tips:

- Find out more about AI trends and innovations in the Nordic countries by visiting trade fairs and events, such as the AI & Big Data Expo of the Stockholm Tech Show in Sweden;

- For more information on applied AI, the AI ecosystem and AI sector initiatives in the Nordic markets, see AI Sweden, AI Finland and IKT Norway.

Germany: High shortage of AI professionals

In 2024, Germany ranked third in Europe as a top location for the AI startup industry. In the global market, it ranks seventh. This is three positions higher than in 2023. This growth is driven by an increase in AI funding in 2023 (+244%) and Germany’s strong innovative landscape, which boasts 463 AI startups. One particularly successful AI unicorn company is DeepL, which uses AI and ML to enhance language translation services. It has been ranked as the best unicorn startup in Western Europe in 2025. In Germany, the top AI city is Berlin, followed by Munich.

German companies are increasingly using AI. 19.8% of the companies used AI technologies in 2024, up from 11.6% in 2023. According to the ifo Business Survey (June 2024), 27% of the companies used AI. A further 17.5% planned to in the coming months. The highest use of AI can be seen amongst service providers, advertising and market research businesses (72%), and IT service providers (60%). Other sectors that score highly are the automotive, electronics, pharmaceutical, and textile and clothing industries (more than 33%).

In the EU, Germany has the most issues with filling vacancies for ICT specialists (72.4% in 2024). This is also true for AI talent. According to Bain & Company, Germany had an AI talent gap of 78% in 2024. There were 32,000 AI professionals available versus a demand for 146,000. This gap is expected to stay high in the coming years. In 2027, an estimated 62,000 AI professionals will be available when 190,000–219,000 job openings need to be filled. This represents a gap of 67–72%.

Source: Bain & Company

German companies are less open to offshore outsourcing than companies in the UK and the Netherlands, for example. However, as German businesses continue to face skills shortages and become more experienced in offshoring, their attitude towards it is improving.

German companies generally prefer to work and collaborate in German. Generally, you will need an intermediary in Germany to communicate with current and potential clients. Alternatively, someone within your company should be fluent in German.

Tip:

- For more information on Germany’s AI sector, visit the website of the German AI association KI Bundesverband. This is Germany’s largest AI network, with over 400 innovative AI and deep tech companies. Also check out their member list.

The Netherlands: Technical AI talent requested

In 2024, 23.1% of Dutch companies used AI technologies, an increase of 9.7% compared to 2023. The two AI technologies that are used most are text mining and natural language generation. The CBS AI monitor 2024 points out that the use of text mining increased from 5.3% in 2023 to 13.5% in 2024. The use of natural language generation increased from 4.2% in 2023 to 12.3% in 2024. AI technologies were mainly used for marketing and sales, administrative processes and management tasks.

Companies most often acquire AI technology through commercial software (55.6%). 27.6% of companies hire third-party vendors to customise or develop software, especially in the financial services sector and in industry.

The sectors that used AI most in 2024 are information and communication (58%), specialist business services (39.8%) and financial services (37.4%). According to a 2024 survey, AI companies mainly serve the ICT (61%) sector, as well as the life sciences and health (37%), high-tech systems (28%) and creative (25%) sectors.

In 2024, the Netherlands had around 750 AI companies. Most of the AI talent is Dutch in these companies. 78% of AI companies have employees from the Netherlands, followed by 35% from Eastern Europe, 32% from Western Europe and 21% from the rest of the world.

Like German companies, Dutch companies face issues with filling vacancies for ICT specialists (63.1% in 2024). AI companies also have problems attracting talent. The main reasons for these problems are difficulty with finding employees with technical talent (48%), followed by researchers, such as data and AI/ML scientists (23%).

Tips:

- For an overview of the Dutch AI ecosystem, support organisations and the key challenges faced by Dutch AI companies, see techleap’s report on AI Scaling Challenges for Dutch founders;

- Check out the AIC4NL, the largest AI community in the Netherlands, created by the Nederlandse AI Coalitie and AiNed. It has 486 participants from various sectors and backgrounds;

- See TNO innovation for life if you want to know more about AI innovations in the Netherlands. TNO focuses on AI applications in five different sectors: healthcare, mobility, cyber security, robotics and energy.

France: Aiming to become an AI powerhouse

France is recognised as a leading hub for Gen AI in Europe. Among European countries, France had the fourth best AI startup ecosystem in 2024. Paris is Europe’s second top AI startup city, after London. Since 2021, the number of AI-focused startups has doubled, reaching more than 1,000 in April 2025. It includes companies like Mistral AI and applications like Pigment and Doctolib.

Among European countries, France has the highest score on the Government AI Readiness Index. Its AI policy focuses on innovation and attractiveness. Since the development of its National AI Strategy in 2018, France has invested more than €2.5 billion in research and technology. It includes several phases:

- Phase 1: The creation of four AI institutes, the Health Data Hub and the construction of the Jean Zay supercomputer;

- Phase 2: The creation of nine AI excellence training hubs, and;

- Phase 3: The creation of the first European Institute for AI Evaluation and Security (INESIA), and acceleration of AI deployment in businesses and public services, among other initiatives.

Although the French government is very AI-focused, French companies are not that fast in taking up AI technologies. They are falling behind other European countries. Only 9.9% of French companies used AI technologies, compared to 27.6% of Danish companies.

To provide AI software development services to French companies, it helps if you are fluent in French. If you are a service provider from a French-speaking country, you have an advantage over service providers that do not speak French.

Tips:

- For more information on the French government’s AI strategy, read the Make France an AI powerhouse report;

- Check out France’s AI association Hub France IA, which has over 800 members and partners to accelerate the adoption of AI in organisations.

Estonia: Government helps global entrepreneurs get access

Estonia is Europe’s second best country for AI startups and ranks sixth in the world. This is higher than Germany and France. Estonia has the most tech unicorns per capita in Europe. These are startup companies valued at over $1 billion (USD) not listed on the stock market. Tallinn is the top city for AI startups in Estonia.

The government is focused on growing the startup and technology sector. To achieve this, it has introduced several programmes, engaging a significant portion of its workforce in entrepreneurial ventures. The government also helps global entrepreneurs access the Estonian market. Examples of programmes are:

- E-residency: A government-issued digital identity that gives global entrepreneurs remote access to Estonia. It allows you to start a 100% online company from anywhere in the world. However, you do have to pick up your digital ID in person. For Africa, they have a pickup location in Egypt;

- Startup visas: If your business can be qualified as a startup, you can get a startup visa. It helps non-EU founders grow their startup in Estonia.

Central and Eastern European (CEE) countries like Estonia used to mainly be competitors for IT outsourcing providers from developing countries. Nowadays, however, they also offer you interesting partnership opportunities because of labour shortages.

Tips:

- To find Estonian startups and startup support organisations, read the startup Estonia ecosystem database. It allows you to apply filters, such as by technology type and industry;

- For an overview of important AI organisations in the European market, see the member list of the European Association for AI (EurAI).

4. Which trends offer opportunities or pose threats in the European AI software development market?

With the rapid development of AI, creating trustworthy and sustainable AI is becoming more important. You should expect strict regulation, as the EU has created the first legal framework for AI. In addition, there will be a trend towards developing energy-efficient AI technologies, expanding AI applications across various sectors and advancing to the next generation of Gen AI.

The importance of AI ethics and European regulations

The rapid deployment of AI technologies has raised concerns about biases, privacy violations and the potential for AI to be used in harmful ways. The EU’s proactive approach to regulation comes from a desire to ensure safety and fundamental rights, and support human-centric AI.

On 1 August 2024, the EU Artificial Intelligence Act (AI Act) came into effect. This is the first legal framework for AI in the world. It sets out uniform rules on AI to promote trustworthy AI in the EU. Most of the requirements will become applicable on 2 August 2026.

For AI software developers, these regulations present both opportunities and challenges. On the one hand, the AI Act shapes responsible AI development, ensuring transparency and trust. However, the complexity of compliance and the cost of meeting regulatory requirements may pose barriers to entry for smaller players.

Tip:

- For more information on the AI Act and other regulatory requirements, see our study on What requirements must outsourcing providers meet to be allowed on the European market.

Sustainability increasingly important in Europe

Doing business with eco-conscious ‘green’ suppliers is becoming more important to European buyers. AI software generally uses a lot of energy. Technical developments usually mean better-functioning software but also higher energy use. The rapid developments in AI raise concerns about long-term sustainability and the pressure it puts on energy grids.

For example, researchers trained an AI model to classify flowers using a small, publicly available dataset of iris flowers. The AI model achieved an accuracy of 96.17% in classifying the flowers’ different species with only 964 joules of energy. But to achieve higher accuracy, the system consumed significantly more energy. To gain a 1.74% increase in accuracy, energy consumption increased about three times to 2,815 joules. Further increases in accuracy demanded even greater increases in energy consumption. This is known as Red AI. Red AI mainly focuses on performance and accuracy, thereby ignoring aspects like sustainability. The opposite is known as Green AI.

With energy use becoming a critical factor, there is a trend towards making energy-efficient AI. As a result, the next wave of AI will focus on smaller, faster and more specialised models that run efficiently on local devices. For example, TinyML is a form of ML that enables models to run on smaller, less powerful devices. In 2025, more innovation is expected in low-power chips, eco-friendly data centres and AI models designed to do more with less.

Tips:

- Be aware of energy consumption and consider producing energy-efficient software. This will give you a competitive advantage;

- For more information on environmental and social sustainability, see our 7 tips on how to go green in the outsourcing sector and 7 tips on how to become more socially responsible in the outsourcing sector.

Fast-growing possibilities of the AI software development market

The AI software development market is changing fast. Current trends in the market include AI integration, multimodal AI, AI agents and Autonomous Systems, and AI in robotics. There are also opportunities for AI technologies in a broad range of sectors. For an overview of the sectors and AI technologies that offer opportunities, see the chapter on what makes Europe an interesting market. It is important to note that there are multiple European cities that have become major hubs for AI innovation, each with its own area of expertise. For example:

- Paris (France) is an AI hub specialised in autonomous systems, robotics and healthcare AI;

- Berlin (Germany) is central to Industry 4.0 (smart manufacturing). The country is known for its strong industry base and automotive sector. Innovations are focused on robotics and manufacturing processes;

- Amsterdam (the Netherlands) is an AI hub with a focus on healthcare AI, energy efficiency and ethical AI and data-sharing policies; and

- Stockholm (Sweden) is an AI hub in the field of autonomous vehicles, fintech and clean tech.

Next-generation Gen AI models: Multimodal AI

Gen AI is evolving from text-only (GPT-4) or image-only (DALL-E) models to multimodal AI, which can process text, images, audio and video simultaneously. There are several multimodal AIs, such as GPT-4o, Gemini 1.5 and Mistral models that can process and generate multiple forms of content. The drive towards more integrated and holistic AI systems comes from the desire to create AI that better mirrors human cognitive abilities, enabling machines to understand and respond to the world in a more natural way.

Tips:

- The AI market is evolving extremely fast. European buyers will expect you to be informed of the latest developments and have staff ready to tackle challenges in this extremely fast-changing sector;

- For more information on trends, see our study on trends in the European outsourcing market.

Kenya’s Impact Outsourcing believes in youth and women empowerment through acquiring digital skills, to reduce poverty and guarantee sustainable growth. They recruit talent from vulnerable and disadvantaged backgrounds across the East African region and provide them with remote work opportunities and free skills training, including financial literacy courses.

The company specialises in services in the AI/ML industry, including NLP, and works ‘in the spirit of Ethical AI’. They use techniques such as deep learning, machine learning and neural networks to build their models. The company is ISO 27001 certified to ensure the data privacy and security they promise.

Globally Cool carried out this study in partnership with Laszlo Klucs on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research