The European market potential for dried garlic

Europe needs more dried garlic every year, while local output is falling. China still leads in supplies from developing countries, but exporters from Egypt, India and other countries of origin are winning new contracts as buyers spread their risk. The United Kingdom and Germany buy the most, with the Netherlands as a trading hub. Modest European Union (EU) Gross Domestic Product (GDP) growth of 1–1.5% should still boost dried garlic imports by about 2–2.5% in both 2025 and 2026, also because dried garlic is used to cut salt and boost flavour in ready meals and snacks.

Contents of this page

1. Product description: dried garlic

This study focuses on dried garlic, also commonly known in trade as dehydrated garlic. It does not include fresh garlic, such as garlic bulbs with a dry outer skin.

Although dried garlic is technically a dried vegetable, European buyers consider it a spice.

The botanical name of garlic is Allium sativum. This species has two main subspecies, and each one includes many different varieties:

- Allium sativum var. ophioscorodon: Also called hard-neck garlic, typically grown in cooler climates. It produces large cloves and includes Porcelain, Rocambole and Purple Stripe varieties.

- Allium sativum var. sativum: Also called soft-neck garlic, usually grown in warmer climates near the equator. It produces smaller, tightly packed cloves. Varieties include Artichoke, Silverskin and Creole.

Virtually all dried garlic is made of white garlic.

Figure 1: Garlic granules in a Dutch webshop

Source: Globally Cool (May 2025)

In Europe, dried garlic is used in several forms: whole, flakes, granules of different sizes and powder. To ensure consistent drying and moisture levels, garlic is usually sliced before drying. As a result, flakes, granules and powder are the most traded forms in Europe. Dried garlic is valued for its long shelf life, strong aroma, and ease of storage and transport.

The international trade code, or HS code, for dried garlic is 0712909010. However, trade data at this specific level is often grouped with other dried vegetables (e.g. olives) under HS code 07129090. As dried garlic is the main product in this group, the trade data provided in this study are a reliable indicator for the dried garlic market.

Where ‘Europe’ is referred to in this study, it covers the countries of the European Union, plus the United Kingdom and the EFTA countries Norway, Switzerland, Iceland and Liechtenstein. The statistics in this study also cover all of these countries.

2. What makes Europe an interesting market for dried garlic?

European imports of dried garlic are rising (+3.1% per year) while local supply is contracting, a combination that favours supply from developing countries. Imports from developing countries went up from 60,600 tonnes in 2020 to 78,800 tonnes in 2024, a healthy 6.8% CAGR. Buyers are widening their supplier base beyond China by buying larger volumes from countries like Egypt and India.

* Developing countries following the OECD-DAC list of ODA recipients, ‘Rest of the world’ refers to all other countries.

Source: Eurostat Comext and ITC Trade Map (June 2025)

Chinese customs figures for 2024 show exports of dehydrated garlic reaching 240,000 tonnes, up every year by 15%. If 20% is applied locally, Chinese production will increase to 300,000 tonnes. Other sources mention that China is good for 85% of the global volume, which would bring the global production estimate to about 350,000 tonnes.

Forecast: 2.0-2.5% growth in 2025-2026

The EU’s Spring 2025 forecast puts real GDP growth at 1.1% for 2025 and 1.5% for 2026. Despite this low growth, market reports, the summaries of which are shared on LinkedIn, still foresee a 6-7% growth for dried garlic sales in Europe. Linking industry, consumer and food service demand to GDP and lowering the forecasts of market reports reflecting slower consumer spending, we project volumes to go up by 2.0-2.5% in the years 2025 and 2026.

Tip:

- Read more about general developments in the spices and herbs market in our study What is the demand for spices and herbs on the European market?

3. Which European countries offer the most opportunities for dried garlic?

The United Kingdom and Germany are the largest importers of dried garlic in Europe. They control most of the trade with producing countries outside Europe. The Netherlands takes a third position, ahead of France, Spain and Poland.

Source: Eurostat Comext and ITC Trade Map (June 2025)

United Kingdom: robust food processing industry

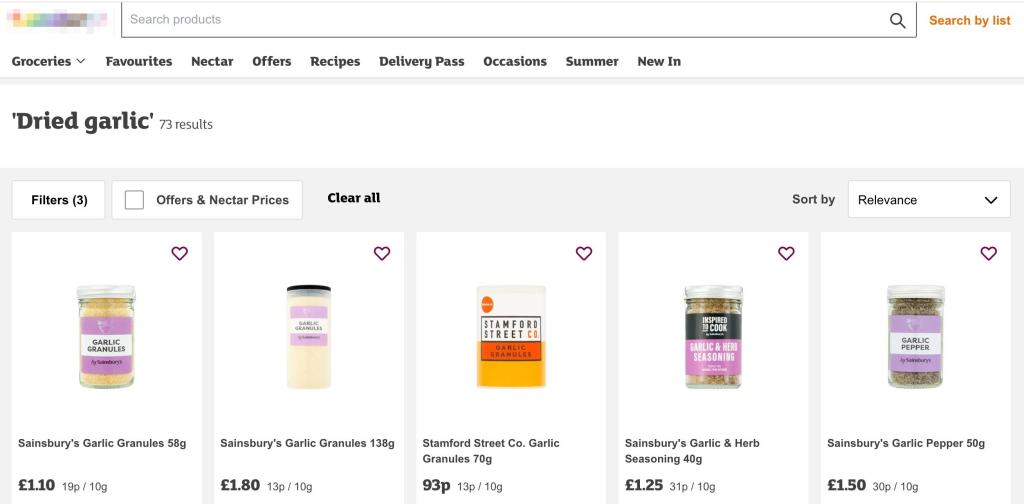

The United Kingdom (UK) presents significant opportunities for dried garlic suppliers driven by evolving consumer preferences, a strong food processing sector, and increasing demand for convenient and health-oriented food products. Most dried garlic in supermarkets is sold under private labels, as the United Kingdom is among the markets with the highest share of private labels in retail.

The UK is a fast-growing dried garlic market. In 2024 the country imported 22,680 tonnes, of which developing countries supplied 20,330 tonnes (CAGR 14%). Supply from developing countries is now 90% of the total import volume, underscoring the dominance of non-European sources. Net imports per capita are at 0.34 kg per person and rising, as retail and food service recover post-pandemic and post-Brexit.

China leads with 16,500 tonnes of volume in 2024, growing at 14% per year. China is followed by India (1,800 tonnes), Serbia (640 tonnes) and Egypt (590 tonnes). Supply from India, Serbia and Egypt grew by more than 20% annually. This shows that buyers want alternatives to China, so consistent quality and traceability open doors for exporters from other countries. There is competition from European origins too: Poland and Spain’s exports grew by 40% and 27% respectively.

Looking ahead, the IMF projects the United Kingdom’s GDP to grow by around 1.2% in 2025 and 1.4% in 2026, a modest but steady recovery. If growth feeds through household spending and food service, dried garlic imports are likely to grow by 2-4% per year on average.

Figure 4: Dried garlic in Waitrose – 5 private-label products on offer versus one branded product (not shown)

Source: Globally Cool (June 2025)

Germany: large market plus hub

Germany has a population of more than 84 million people. This makes Germany the largest market in Europe. Apart from that, Germany is a major re-exporter of food ingredients and processed foods. Many dried garlic importers and food manufacturers in Germany supply their products throughout all of Europe, making Germany Europe’s second-largest dried garlic exporter/hub, behind Belgium and ahead of the Netherlands. The unit price of German dried garlic exports is relatively high, showing that German exporters do a lot of value-adding, such as repacking in small units.

Germany is a moderately expanding dried garlic market. In 2024, Germany imported 29,060 tonnes, of which developing countries supplied 17,320 tonnes (CAGR 2.2%). A relatively stable 60% of the supply comes from developing countries. Net imports reached 29,060 tonnes, equal to 0.34 kg per person, and rose as home cooking, snacks and supplement production began using more dehydrated garlic.

China dominates the supplier list with 13,200 tonnes, followed by Poland (4,100 tonnes), Egypt (2,180 tonnes) and Kosovo (1,800 tonnes). Also, Uzbekistan (690 tonnes), India (560 tonnes) and Peru (340 tonnes) export substantial and consistent volumes. This variety of origins shows that exporters can become long-term suppliers to German companies if they offer reliable quality.

The concentration of the dried garlic trade in Germany has enabled many German players to source large volumes at low prices for the low-end segment. Suppliers that cannot differentiate their quality from that of the cheapest producing countries will find it particularly hard to compete on the German market.

Germany has a very large food industry that uses big amounts of different spices, including dried garlic. The food industry produces convenient processed foods, including sauces and marinades, ready-to-eat meals and processed meat products.

Spice companies in Germany are organised in the German Spice Association, which has 92 member companies. These spice companies supply retailers and food service providers and are also important suppliers for food manufacturers. While large manufacturers source their main spice needs themselves, they often rely on spice traders when their own sources cannot fulfil their needs or when they need small volumes. Small manufacturers usually rely even more on spice traders, as many of them do not consider sourcing of raw materials their core business and prefer to outsource it.

Value for money is important in the German retail market. This is also reflected in its large share of discounters. The leading spice manufacturer, Fuchs, dominates the market for low-end spices. The brands Fuchs, Ostmann, Ubena and BioWagner are all owned by Fuchs, which has a 75% market share. In addition to its own brands, Fuchs also packages dried garlic and other spices for several German private labels. The main private labels in Germany are Kania (of discounter chain Lidl), Le Gusto (by ALDI SÜD and ALDI Nord), Gut & Günstig (by EDEKA) and REWE Beste Wahl (by REWE).

Several supermarkets nowadays offer organic-certified dried garlic under private labels. For example, REWE sells organic dried garlic under REWE Bio, and Lidl under Kania Bio. The share of organic is estimated to be a maximum of 2% of total imports.

Figure 5: Garlic granules by Le Gusto in German supermarket chain ALDI Nord

Source: Globally Cool (February 2025)

The Netherlands: a trade hub for spices

The Netherlands is a major European trade hub for spices. While the country’s population and domestic consumption are small, importing wholesalers in the Netherlands play a large role in processing and particularly re-exporting dried garlic and other spices to other European countries.

Since 2022, the country has had a stable export volume of about 12,000 tonnes. The unit value of exports is relatively low and has even begun moving towards the lowest in Europe since 2023, showing that most are bulk trade, and Dutch importers predominantly buy powder and low-end products.

The Netherlands is a stable dried garlic market. In 2024, imports reached 15,190 tonnes, 7,380 tonnes (CAGR 3.4%) of which was supplied by developing countries. With that volume, developing countries hold almost 50% of imports, with the other 50% coming from European sources, reflecting the country’s two-way trading role. Net imports reached 15,190 tonnes, which translates to a high 0.85 kg per person, thanks to its large spice and food-processing industry.

China dominates, with Belgium (4,180 tonnes) and Germany (1,210 tonnes) next. Supply from European sources shows a remarkable drop from 20,000 tonnes in 2021 to 7,800 tonnes in 2022 and beyond. Both Germany and Spain saw their volume in the Netherlands drop sharply that year, because it was redirected directly to destination markets instead of going through the Netherlands. Egypt’s exports to the Netherlands grew by a modest 3.7% per year to 350 tonnes in 2024. There are small, but stable or declining positions for Kosovo, Türkiye and Colombia.

The Dutch Spice Association in the Netherlands strongly supports the sustainable sourcing of spices. The association is committed to Corporate Social Responsibility; a leading group of spices importers in the Netherlands set up the international Sustainable Spices Initiative with members from the Netherlands and other countries. This initiative provides opportunities for suppliers to take the lead in raising the bar for Corporate Social Responsibility. They have a competitive advantage in trade with members of the Sustainable Spices Initiative and can work together with that initiative to further improve the sustainability of their business.

Major retail chains like Albert Heijn (AH label), Lidl (Kania), Jumbo and ALDI (De Kruidencompany label) control much of dried garlic retail sales in the Netherlands. The leading independent brands of garlic in the Netherlands are Verstegen and Euroma.

Figure 6: High-end, freeze-dried garlic by one of the leading Dutch brands

Source: Globally Cool (February 2025)

France: major user of dried garlic for its Mediterranean cuisine

With 65 million inhabitants, France has the second-largest population in the EU. The French traditionally use garlic in cooking, so they consume a lot of garlic per person. Additionally, France houses the port of Marseille, Europe’s fourth-largest seaport. The port of Marseille contributes to France’s role as a hub, although its role in European dried garlic is much smaller than that of Germany and the Netherlands.

While France produces some of its dried garlic domestically and many consumers strongly prefer local produce, France remains heavily dependent on imports. In 2024, imports of dried garlic totalled 12,110 tonnes, 5,620 tonnes (CAGR 4.1%) of which was supplied by developing countries, showing potential to grow.

Net imports reached 12,110 tonnes, equal to 0.18 kg per person, showing the French preference for fresh and other alternatives to dried garlic. China leads French imports (4,820 tonnes in 2024), followed by Germany (2,360 tonnes) and Spain (1,310 tonnes). Behind Spain, Belgium and the Netherlands follow; then comes Egypt with 430 tonnes. Smaller volumes come from India, Kosovo and Albania.

France ranks 7th in Europe in export volume (3,420 tonnes). However, their unit price is relatively high, showing high added value, most likely by companies/brands such as Arcadie/Cook. Like many northern and western European markets, the retail market in France is highly concentrated. France houses a number of large retail chains like Carrefour, Delhaize and Intermarché, which all account for a large part of domestic garlic sales.

France has significant fresh garlic production, which includes several special varieties. Some of these have even received a Geographic Indication in recognition of their distinctive characteristics. This makes French consumers more aware of the differences between garlic varieties, offering suppliers opportunities to differentiate on quality by using unique varieties.

Poland: big market for dried garlic

Garlic is a staple in Poland’s national cuisine. It plays a dominant role in a wide variety of traditional dishes. This makes Poland one of the main importers of dried garlic in Europe. Although there is some local vegetable-drying capacity that also turns local fresh garlic into dried garlic, local production does not meet total market demands. In 2024, Poland imported 9,780 tonnes, of which developing countries supplied 53% or 5,160 tonnes (CAGR 3.2%).

Net imports reached 9,780 tonnes following a 4.4% average growth per year. As Polish processed-food output has been growing since 2020, apparent consumption per capita has been going up as well, to a weight of 0.26 kg per person.

China tops the supplier list with 3,480 tonnes, with Germany (2,930 tonnes) and Egypt (930 tonnes) in 2nd and 3rd place. The star performer on the list was India, with volume growing by 38% per year to 640 tonnes. Small volumes come from Uzbekistan, but these have been under pressure since 2022 due to the war in Ukraine and rising transportation costs. The average unit price of dried garlic imports used to be on the low end; however, it has gone up and moved towards the European average since 2022.

One of the main importers in Poland is Falcon. Despite its proximity to leading re‑exporter Germany, Poland imports much of its dried garlic directly from countries of origin. This provides opportunities for suppliers from these origins.

In Poland, major retail chains such as Biedronka, ABC and Zabka dominate the market, operating approximately 18,000 stores nationwide. These retailers play a crucial role in the distribution and availability of dried garlic products to and for consumers. The leading Polish spices and herbs brand is Prymat, offering mostly conventional spices and herbs, as local organic demand is limited.

Spain: exporter of fresh garlic and importer of dried garlic

Spain is Europe’s leading supplier of fresh garlic. Spanish garlic suppliers are organised in the Spanish National Producers and Traders of Garlic Association (ANPCA). Annual production was 240,000 tonnes in 2024.

Spain is a fast-growing dried garlic market with an 11% growth per year. In 2024, Spain imported 8,210 tonnes, of which developing countries supplied 5,360 tonnes (CAGR 12% and good for 65% of total imports). Net imports reached 8,210 tonnes, equal to 0.17 kg per person, and steadily rose due to growing applications in food and snack production and export packing. China dominates with 4,580 tonnes, with Germany (790 tonnes) and Portugal (620 tonnes) next. India is in 4th position with 460 tonnes following a 20% annual growth, showing the interest of Spanish importers in alternative origins to China.

Local added-value production exists in the garlic value chain; however, it is mostly oriented towards fresh and frozen convenience products. For dried garlic, imports dominate the Spanish supply. The Spanish Spice Association (AEC) represents the Spanish spice sector and currently includes 20 member companies.

Dried garlic, called ‘ajo deshidratado’ or ‘ajo granulado’, is a common shelf item in leading supermarkets such as Mercadona (Hacendado brand), Consum, Alcampo and El Corte Inglés. These retailers source dried garlic from Spanish packers such as Jesús Navarro (Carmencita), Artemis Bio, López Matencio and Salomón Spices. Ducros, owned by McCormick, also lists conventional and certified-organic dried garlic, making it one of the largest branded options on the market. Although organic volumes remain modest, demand keeps rising as Spanish shoppers seek clean-label, pesticide-free seasonings.

Tips:

- Focus on traders in Germany, the Netherlands and Belgium to enter the European market. This is especially useful if you have limited sales and marketing capacity to approach food manufacturers.

- See the list of members of the German Spice Association for the contacts of German dried garlic traders.

- Explore members' lists of national associations for contacts of other leading dried garlic exporters. For example: the Dutch Spices Association (the Netherlands) and the National Union of Processors of Pepper, Spices, Herbs and Vanilla (France). For information about Polish companies, contact the Polish Chamber of Commerce.

4. Which trends offer opportunities or pose threats in the European dried garlic market?

Consumers increasingly want responsibly sourced products with clear supply chains. Health trends boost dried garlic’s popularity because people use it as an alternative to salt. Busy lifestyles increase demand for convenient, ready-made meals, where garlic adds flavour. The organic market is growing slowly, and suppliers who offer traceability, convenience and certified organic garlic have good chances in this market.

Socially responsible sourcing remains high on the agenda of food manufacturers

Socially responsible sourcing is key in Europe. Consumers are becoming more aware of the impact of their purchases on people. They have growing concerns about social conditions in supply chains and expect suppliers to take more Corporate Social Responsibility (CSR). Non-governmental organisations (NGOs) have often taken the lead in stimulating companies to improve their CSR and source responsibly. Together with leading brands and manufacturers, they originally focused on commodities that allowed them to maximise impact.

A good example of an initiative from NGOs and leading companies in the spices sector is the Sustainable Spices Initiative (SSI). Some of the main social sustainability issues in the spices sector that SSI recognises are:

- Farmers often face poverty and food insecurity;

- Concerns around spice production, especially regarding long-term supply, food safety and traceability, due to poor agricultural practices, lack of adequate processing facilities, and growers switching to high-value crops or jobs.

One of the major sustainability concerns in the dried garlic market is the lack of transparency in supply chains. For some buyers, transparency is a major added value and a decisive factor in selecting suppliers. Addressing sustainability issues becomes particularly important for companies aiming to brand their dried garlic. Brands can gain trust from customers by showing their CSR. This applies to leading spice brands like McCormick, which embed CSR into their strategy and report about their achievements in sustainability reports, as well as to smaller brands in the high-end segment.

Companies in developing countries can respond to this trend by offering more transparency and showing their commitment to good practices through international certifications. One example is the Egyptian company Global Veg Egy, which exports dried garlic to Europe. The company is certified with GlobalG.A.P. and GRASP, and has completed a SMETA audit. These certifications show that the company follows responsible farming and labour practices. This helps build trust with buyers who care about social and environmental standards.

Olam Spices aims for sustainable sourcing

Olam Spices is a founding member of the Sustainable Spices Initiative (SSI), which aims for 25% sustainable sourcing by 2025 and 50% by 2030. Olam sources garlic directly from farms in Jinxian, China, and use Terrascope, their carbon management platform, to measure and report greenhouse gas (GHG) emissions across the supply chain. Olam has set science-based targets to cut Scope 1 (direct) and 2 (indirect) emissions by 50% by 2030 and reach net-zero by 2050.

Olam audits farms to SMETA standards and offers organic-certified garlic granules, giving buyers full traceability back to the field. By proving clear supply chains, cutting carbon and adding an organic line, Olam helps European food makers meet demand for responsible, healthy, salt-reduced solutions in ready meals and sauces.

Tips:

- Promote sustainable and ethical aspects of your production process and supply chain transparency. This means you should be able to prove and communicate a traceable chain back to the raw materials.

- Look for potential partners to improve sustainability. You can use available programmes and subsidies from governmental or non-governmental organisations for investments in sustainability. For more information, visit websites of the Sustainable Spice Initiative, the Netherlands Enterprise Agency or the German Ministry for Economic Cooperation and Development.

- See our study on trends for spices and herbs to learn more about current trends in the European market.

European buyers search for healthier ingredients

European consumers are searching for healthy ingredients. This is one of the most important trends in the European food and beverages market. Consumers perceive food ingredients like salt, sugar and synthetic additives as unhealthy. Other products that also add flavour, such as spices and herbs, are increasingly replacing these products.

The perceived health benefits of dried garlic are described, for example, in blogs, vlogs, health magazines and scientific articles like Allicin: chemistry and biological properties and Potential Health Benefits of Garlic Based on Human Intervention Studies: A Brief Overview. These publications often mention that garlic consumption helps lower cholesterol, blood pressure and glucose levels, and that it has antibacterial and anti-hypertensive properties, among other health-promoting and disease-preventing effects. One of the world’s largest dried garlic manufacturers, Olam, invested considerably in research to identify garlic varieties with the highest levels of active substances.

Figure 7: Dried garlic slices in a health food store in the Netherlands

Source: Globally Cool (May 2025)

Due to its perceived health benefits, dried garlic is also increasingly used as a food supplement. EU legislation allows the promotion of certain products on a positive list to be marketed as food supplements. Individual countries within the EU establish these positive lists for their own markets, and the harmonised list of food supplements for Belgium, France and Italy includes the bulb and essential oil of Allium sativum L. An example of a food supplement with garlic are tablets with garlic powder from Kwai Heartcare. The active substance in food supplements is allicin.

Despite the significant amount of research on the health benefits of garlic, its listing on the harmonised list of food supplements and in European pharmacopoeia, the EU does not allow food manufacturers to make any official health claims for garlic. The EU register for health claims does not contain any claim for garlic, which means that you cannot put a health claim on the label of your dried garlic to promote these potential health benefits. If you do, national food safety authorities will force you to take your products off the market.

Tips:

- Show buyers the research done on health properties of garlic to convince them that garlic is a healthy ingredient with many potential benefits.

- Do not make health claims, as EU legislation does not allow it.

- One of garlic's widely recognised health benefits is its positive contribution to the immune system. Read more about the potential for immune-boosting ingredients in the CBI article Increase in demand for immunity-boosting spices.

Consumers look for convenience

Due to their busy urban lifestyles, a growing number of European consumers buy ready-to-eat or easy-to-prepare meals from supermarkets. These meals can usually be reheated or eaten fresh. Europe is the largest consumer market for ready meals in the world, with around one-third of this market. Many of these meals use dried garlic as an ingredient. Dried garlic is a particularly important ingredient for many dishes from the Mediterranean region, including Spain, France and Italy, as well as in Asian dishes, such as Chinese and Indian foods.

Manufacturers use dried garlic in sauces, soups, meat products, bakery products, and many other prepared foods. They also use dried garlic in premixes for easy-to-prepare meals, such as this Chicken Tandoori mix.

A negative perception of the healthiness of ready-to-eat meals has slowed down growth of this product category. One of the reasons for this negative perception is the high amount of salt in many of these meals, added for flavouring and conservation purposes. Health authorities in several European countries have warned consumers about the negative effects of consuming large amounts of salt on their health.

This has led to whole food industries in several countries committed to reducing salt in their products. This requires reformulation of foods, and the challenge for food manufacturers is to maintain taste with smaller amounts of salt. Spices, with an important role for strong taste enhancers like dried garlic, are part of the solution, as they can provide flavour and prevent foods with less salt from tasting bland.

The organic market keeps growing

Demand for organic spices, including dried garlic, is growing slowly. Organic certification strengthens the perception of natural and healthy characteristics of your product. While demand for organic products in other categories, such as fresh fruit and vegetables, dairy products and meat products, is stronger, the spices market follows a slower growth path.

Figure 8: Organic garlic in German supermarket chain Lidl

Source: Globally Cool (May 2025)

Certification bodies are becoming stricter towards the use of non-certified ingredients in organic-certified food products, and this affects spices. Their argument is that the availability of organic spices is improving, and that the exception rule is no longer needed. Availability of organic dried garlic is indeed increasing. This has supported the growth of organic garlic imports to reach 2% of the total import value for fresh garlic. For dried garlic, this is estimated to be about the same.

Tips:

- Invest in research and development to find or develop product formulations showing food manufacturers how to use dried garlic to mask salt reduction. Then share the formulations with food manufacturers or let them taste the products at trade fairs or during meetings.

- Realise that certification against international sustainability standards, such as organic, does not necessarily say anything about the quality of your dried garlic. Invest in research and product development if you want to export high-quality dried garlic to the European market.

- Carefully assess your capacity to apply organic farming before converting to organic garlic production.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research